C932 Partnership Income and Basis Adjustments Mark and Pamel

Solution

Answer:-

Particular

Amount($)

Sales

450,000

-Cost of goods sold

(210,000)

Sec 1245 gain

33,000

Depreciation

(27,000)

Guaranteed payment to Pamela

(30,000)

Meals & entertainment Exp.(11,600*2)

(5800)

Business Debt

(42,000)

Total partnership\'s ordinary income

168,200

Particular

Amount

Mark

Pamela

Dividend on corporate investment

15,000

7,500

7,500

Tax- Exempt interest income

4,000

2,000

2,000

Sec 1231 gain

18,000

9,000

9,000

Long term capital gain (12,000-10,000)

2,000

1,000

1,000

Short term capital loss

(9,000)

(4,500)

(4,500)

Stock Investment

(9,200)

(4,600)

(4,600)

Tax-exempt Bond s

(2,800)

(1,400)

(1,400)

Charitable contributions

(5,000)

(2,500)

(2,500)

Nondeductible expenses

(5,800)

(2,900)

(2,900)

Guaranteed payment

30,000

30000

Total

37,200

c. Compute Mark and Pamela’s ending basis in their partnership interests assuming their beginning balances are $150,000 each

Particular

Mark

Pamela

Partnership\'s ordinary income $168,200

84,100

84,100

Dividend on corporate investment

7,500

7,500

Tax- Exempt interest income

2,000

2,000

Sec 1231 gain

9,000

9,000

Long term capital gain

1,000

1,000

Short term capital loss

(4,500)

(4,500)

Stock Investment

(4,600)

(4,600)

Tax-exempt Bond s

(1,400)

(1,400)

Charitable contributions

(2,500)

(2,500)

Nondeductible expenses meals and entertainment

(2,900)

(2,900)

Reduction in Partnership liabilities

(7,000)

(7,000)

40,700

40,700

Beg Bal $150,000 each

150,000

150,000

Total Sharesof items

40,700

40,700

Ending Basis for each partner

190,700

190,700

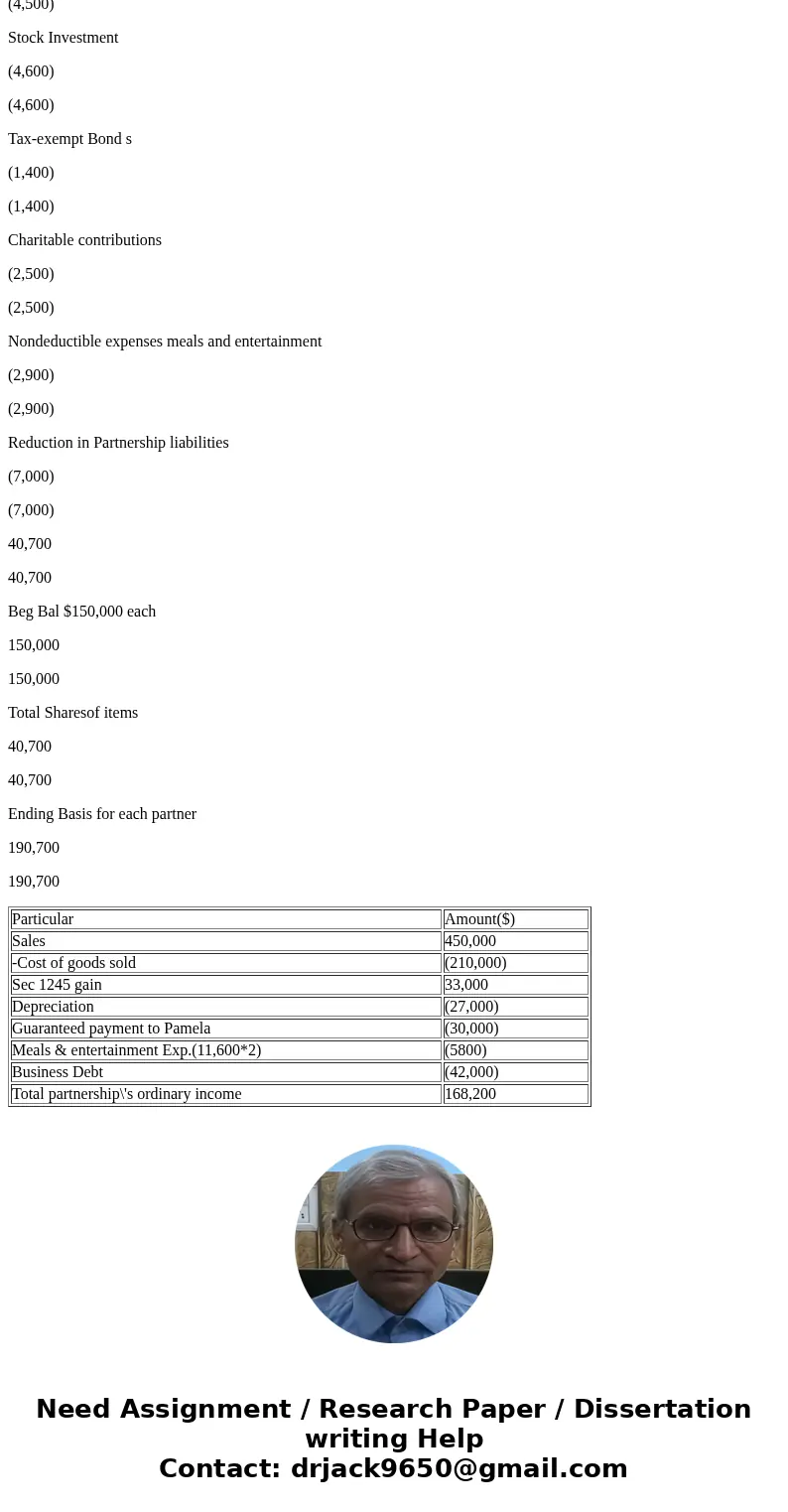

| Particular | Amount($) |

| Sales | 450,000 |

| -Cost of goods sold | (210,000) |

| Sec 1245 gain | 33,000 |

| Depreciation | (27,000) |

| Guaranteed payment to Pamela | (30,000) |

| Meals & entertainment Exp.(11,600*2) | (5800) |

| Business Debt | (42,000) |

| Total partnership\'s ordinary income | 168,200 |

Homework Sourse

Homework Sourse