This Question 6 pts 39 of 39 6 completeThis Test 300 pts pos

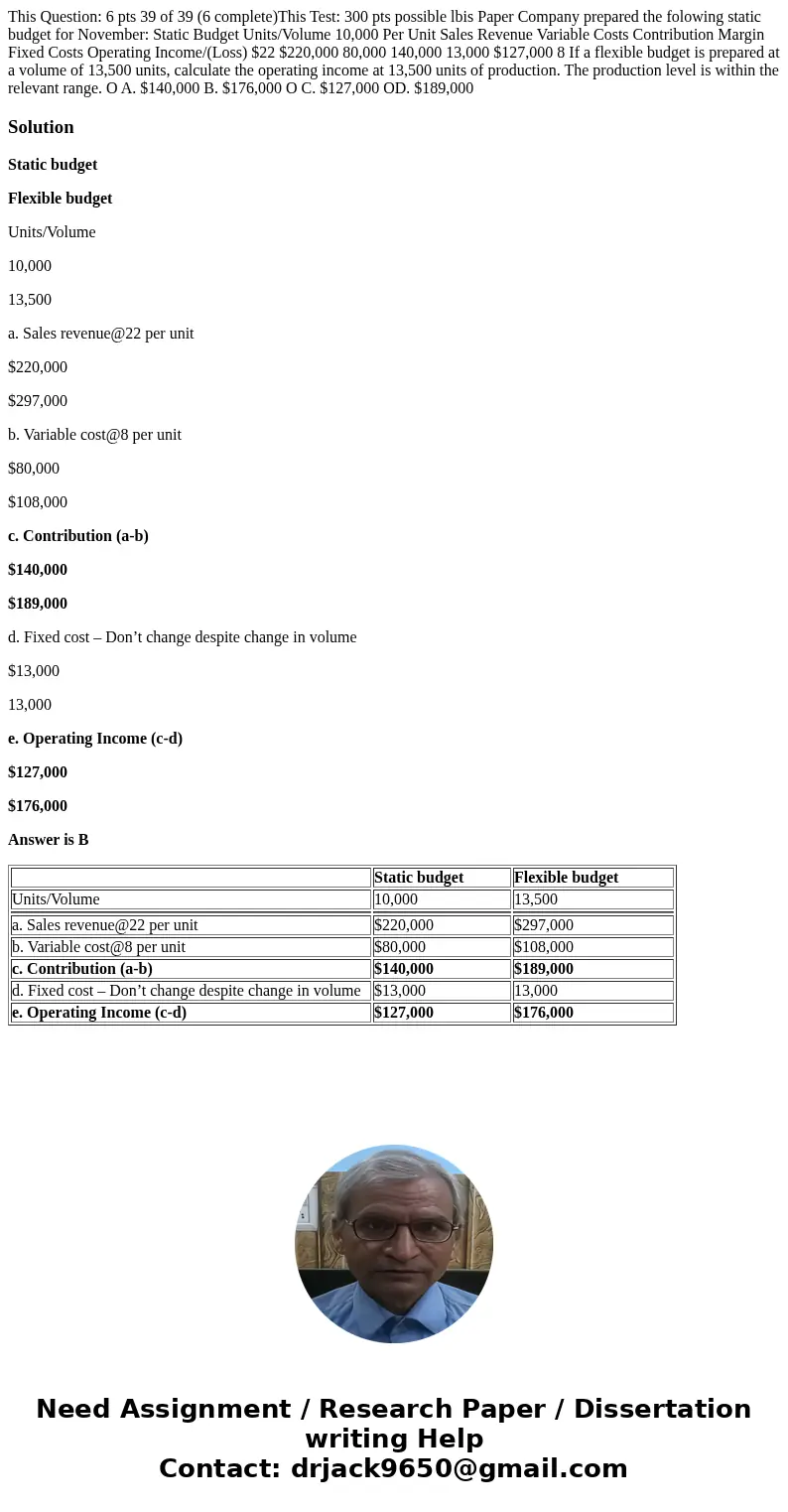

This Question: 6 pts 39 of 39 (6 complete)This Test: 300 pts possible lbis Paper Company prepared the folowing static budget for November: Static Budget Units/Volume 10,000 Per Unit Sales Revenue Variable Costs Contribution Margin Fixed Costs Operating Income/(Loss) $22 $220,000 80,000 140,000 13,000 $127,000 8 If a flexible budget is prepared at a volume of 13,500 units, calculate the operating income at 13,500 units of production. The production level is within the relevant range. O A. $140,000 B. $176,000 O C. $127,000 OD. $189,000

Solution

Static budget

Flexible budget

Units/Volume

10,000

13,500

a. Sales revenue@22 per unit

$220,000

$297,000

b. Variable cost@8 per unit

$80,000

$108,000

c. Contribution (a-b)

$140,000

$189,000

d. Fixed cost – Don’t change despite change in volume

$13,000

13,000

e. Operating Income (c-d)

$127,000

$176,000

Answer is B

| Static budget | Flexible budget | |

| Units/Volume | 10,000 | 13,500 |

| a. Sales revenue@22 per unit | $220,000 | $297,000 |

| b. Variable cost@8 per unit | $80,000 | $108,000 |

| c. Contribution (a-b) | $140,000 | $189,000 |

| d. Fixed cost – Don’t change despite change in volume | $13,000 | 13,000 |

| e. Operating Income (c-d) | $127,000 | $176,000 |

Homework Sourse

Homework Sourse