Actuary and trustee reports indicate the following changes i

Solution

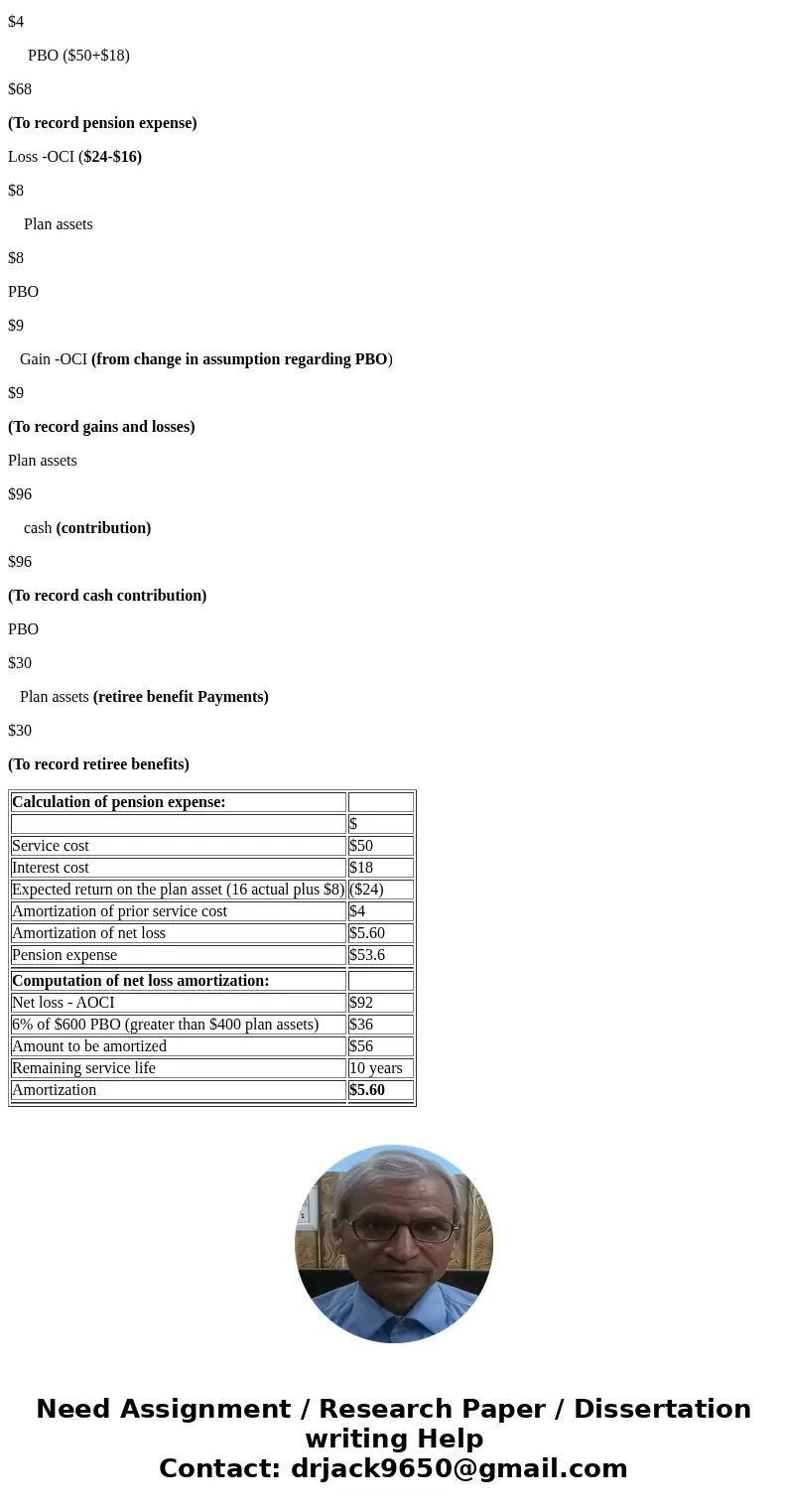

Calculation of pension expense:

$

Service cost

$50

Interest cost

$18

Expected return on the plan asset (16 actual plus $8)

($24)

Amortization of prior service cost

$4

Amortization of net loss

$5.60

Pension expense

$53.6

Computation of net loss amortization:

Net loss - AOCI

$92

6% of $600 PBO (greater than $400 plan assets)

$36

Amount to be amortized

$56

Remaining service life

10 years

Amortization

$5.60

General description

Debit

credit

Pension expense

$53.6

Plan assets (expected return on plan assets)

$24

Net assets - AOCI (current amortization)

$5.60

Prior service cost

$4

PBO ($50+$18)

$68

(To record pension expense)

Loss -OCI ($24-$16)

$8

Plan assets

$8

PBO

$9

Gain -OCI (from change in assumption regarding PBO)

$9

(To record gains and losses)

Plan assets

$96

cash (contribution)

$96

(To record cash contribution)

PBO

$30

Plan assets (retiree benefit Payments)

$30

(To record retiree benefits)

| Calculation of pension expense: | |

| $ | |

| Service cost | $50 |

| Interest cost | $18 |

| Expected return on the plan asset (16 actual plus $8) | ($24) |

| Amortization of prior service cost | $4 |

| Amortization of net loss | $5.60 |

| Pension expense | $53.6 |

| Computation of net loss amortization: | |

| Net loss - AOCI | $92 |

| 6% of $600 PBO (greater than $400 plan assets) | $36 |

| Amount to be amortized | $56 |

| Remaining service life | 10 years |

| Amortization | $5.60 |

Homework Sourse

Homework Sourse