D Chapter 12 Investments x D AC 313 Summer Conect xAssume n

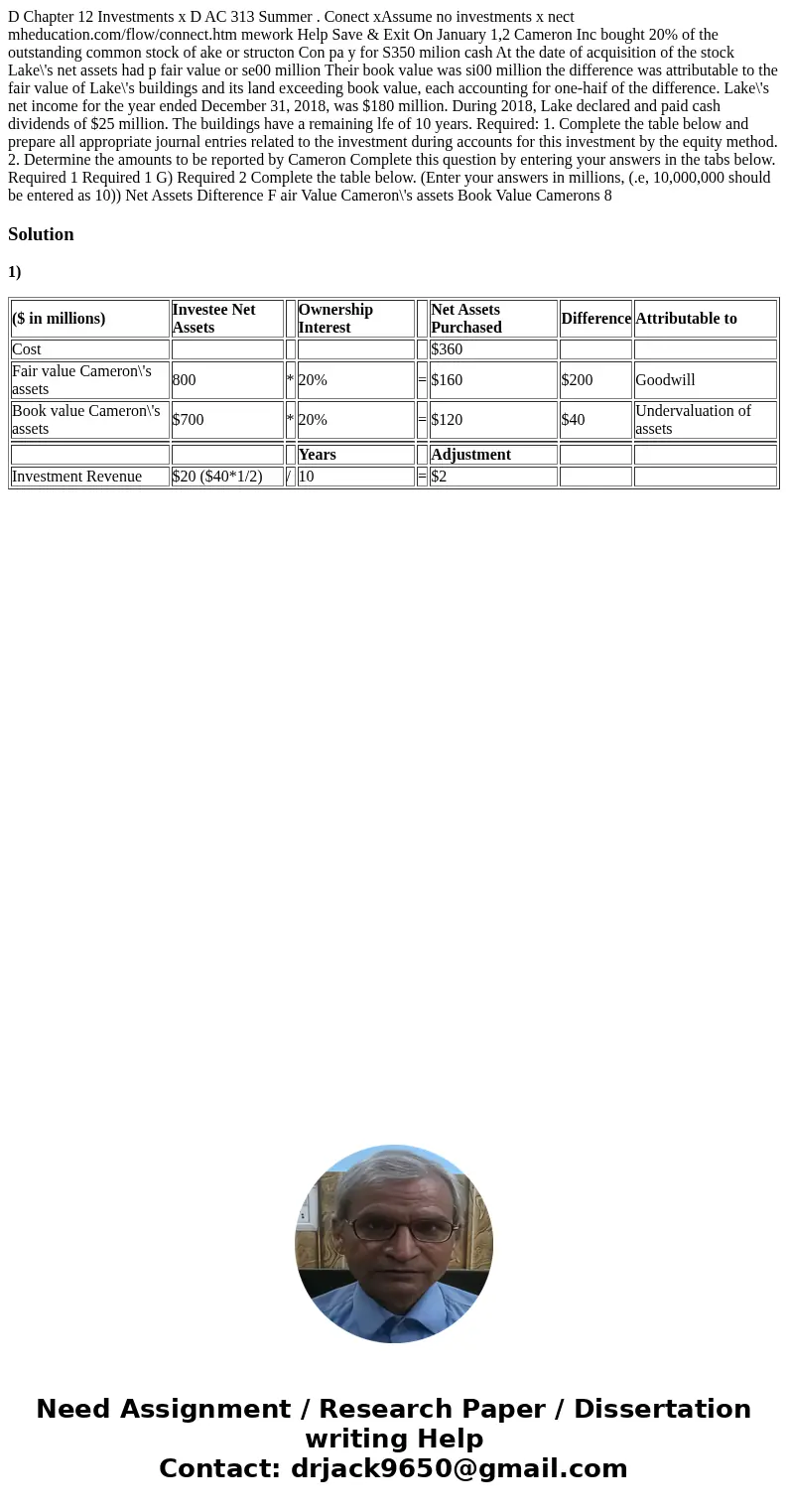

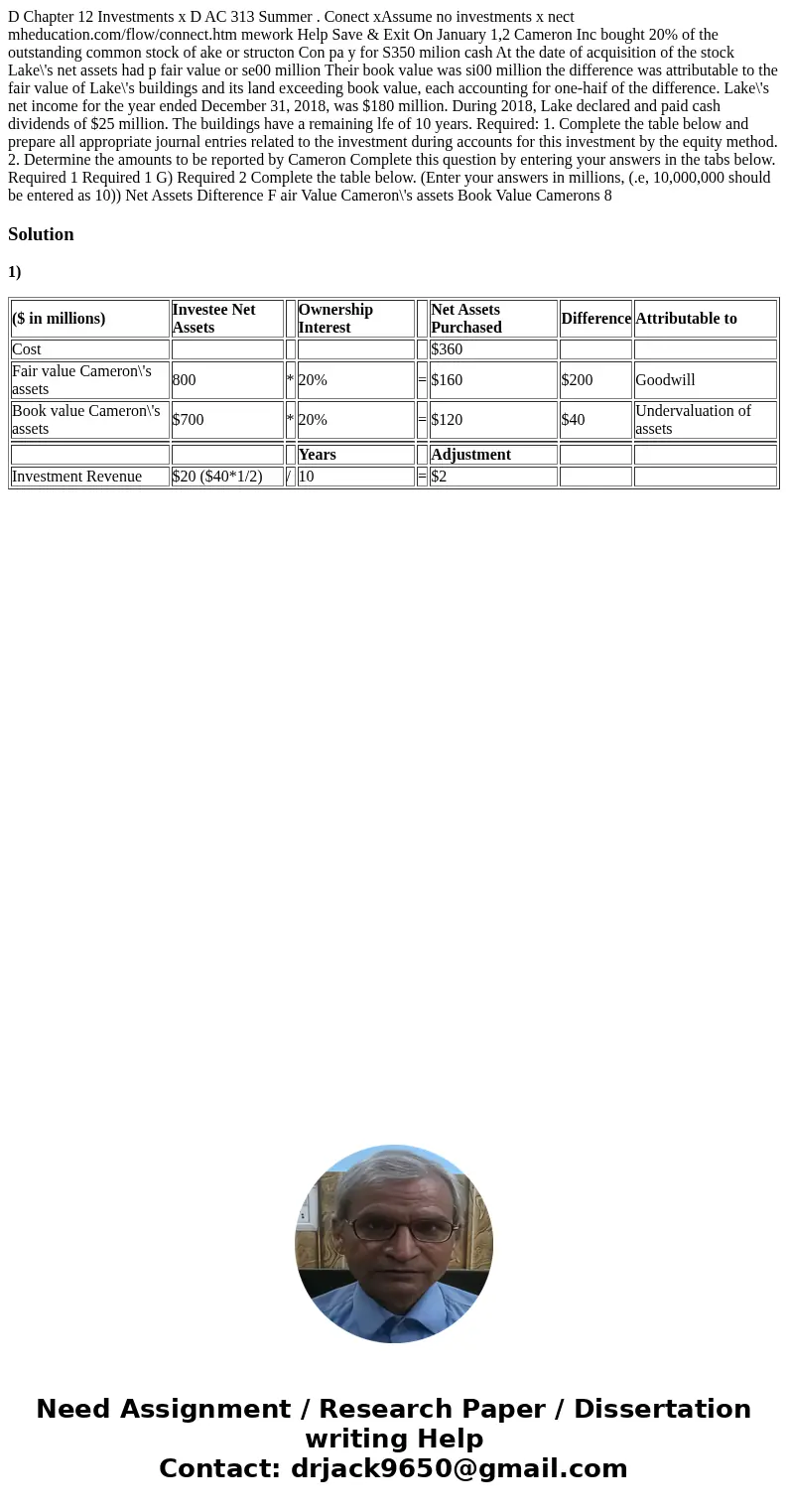

D Chapter 12 Investments x D AC 313 Summer . Conect xAssume no investments x nect mheducation.com/flow/connect.htm mework Help Save & Exit On January 1,2 Cameron Inc bought 20% of the outstanding common stock of ake or structon Con pa y for S350 milion cash At the date of acquisition of the stock Lake\'s net assets had p fair value or se00 million Their book value was si00 million the difference was attributable to the fair value of Lake\'s buildings and its land exceeding book value, each accounting for one-haif of the difference. Lake\'s net income for the year ended December 31, 2018, was $180 million. During 2018, Lake declared and paid cash dividends of $25 million. The buildings have a remaining lfe of 10 years. Required: 1. Complete the table below and prepare all appropriate journal entries related to the investment during accounts for this investment by the equity method. 2. Determine the amounts to be reported by Cameron Complete this question by entering your answers in the tabs below. Required 1 Required 1 G) Required 2 Complete the table below. (Enter your answers in millions, (.e, 10,000,000 should be entered as 10)) Net Assets Difterence F air Value Cameron\'s assets Book Value Camerons 8

Solution

1)

| ($ in millions) | Investee Net Assets | Ownership Interest | Net Assets Purchased | Difference | Attributable to | ||

| Cost | $360 | ||||||

| Fair value Cameron\'s assets | 800 | * | 20% | = | $160 | $200 | Goodwill |

| Book value Cameron\'s assets | $700 | * | 20% | = | $120 | $40 | Undervaluation of assets |

| Years | Adjustment | ||||||

| Investment Revenue | $20 ($40*1/2) | / | 10 | = | $2 |

Homework Sourse

Homework Sourse