Table Ouyang Inc Financial Information 33786 Which of the fo

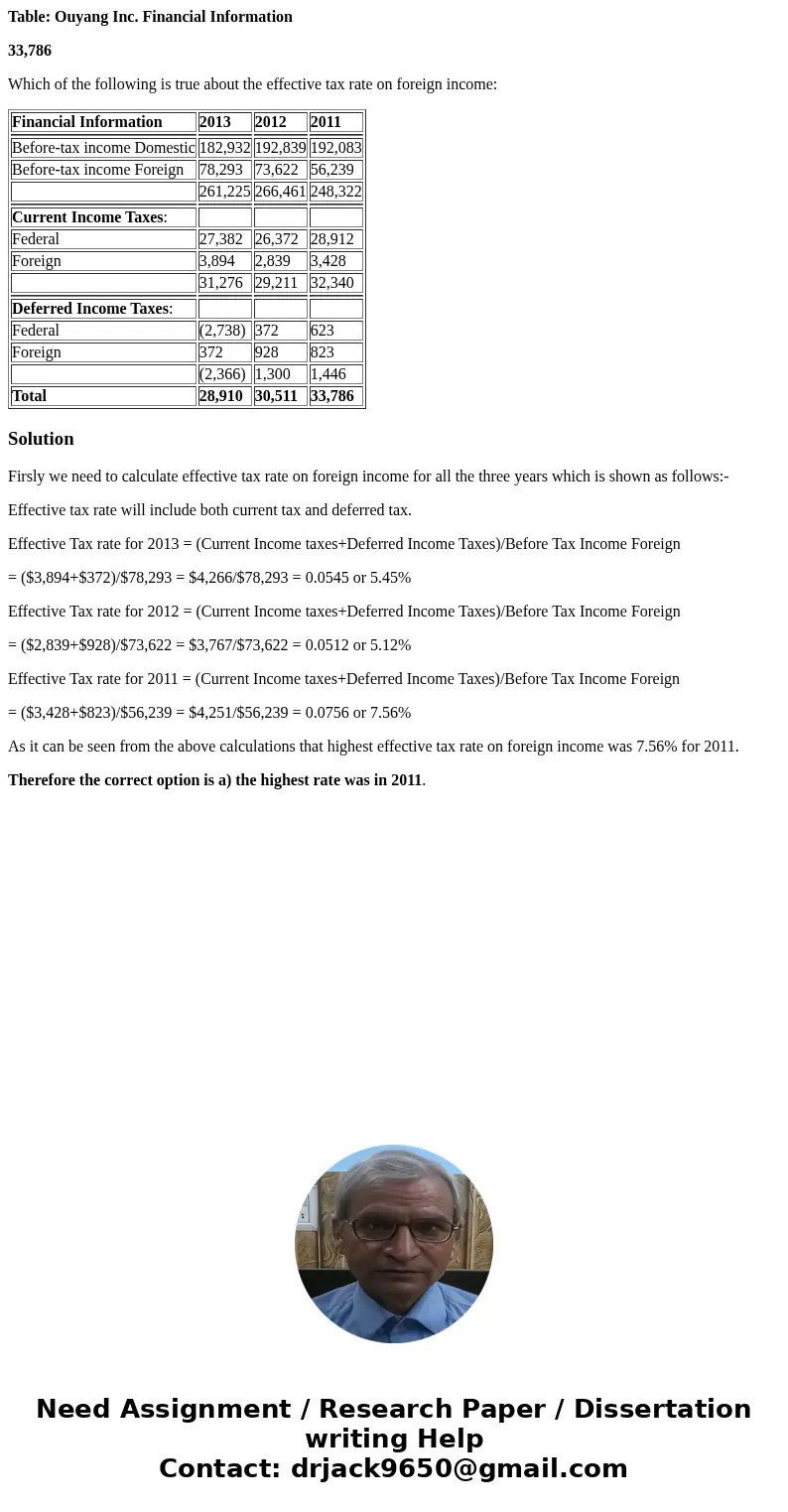

Table: Ouyang Inc. Financial Information

33,786

Which of the following is true about the effective tax rate on foreign income:

| Financial Information | 2013 | 2012 | 2011 |

| Before-tax income Domestic | 182,932 | 192,839 | 192,083 |

| Before-tax income Foreign | 78,293 | 73,622 | 56,239 |

| 261,225 | 266,461 | 248,322 | |

| Current Income Taxes: | |||

| Federal | 27,382 | 26,372 | 28,912 |

| Foreign | 3,894 | 2,839 | 3,428 |

| 31,276 | 29,211 | 32,340 | |

| Deferred Income Taxes: | |||

| Federal | (2,738) | 372 | 623 |

| Foreign | 372 | 928 | 823 |

| (2,366) | 1,300 | 1,446 | |

| Total | 28,910 | 30,511 | 33,786 |

Solution

Firsly we need to calculate effective tax rate on foreign income for all the three years which is shown as follows:-

Effective tax rate will include both current tax and deferred tax.

Effective Tax rate for 2013 = (Current Income taxes+Deferred Income Taxes)/Before Tax Income Foreign

= ($3,894+$372)/$78,293 = $4,266/$78,293 = 0.0545 or 5.45%

Effective Tax rate for 2012 = (Current Income taxes+Deferred Income Taxes)/Before Tax Income Foreign

= ($2,839+$928)/$73,622 = $3,767/$73,622 = 0.0512 or 5.12%

Effective Tax rate for 2011 = (Current Income taxes+Deferred Income Taxes)/Before Tax Income Foreign

= ($3,428+$823)/$56,239 = $4,251/$56,239 = 0.0756 or 7.56%

As it can be seen from the above calculations that highest effective tax rate on foreign income was 7.56% for 2011.

Therefore the correct option is a) the highest rate was in 2011.

Homework Sourse

Homework Sourse