The Colson Company issued 362000 of 9 bonds on January 1 201

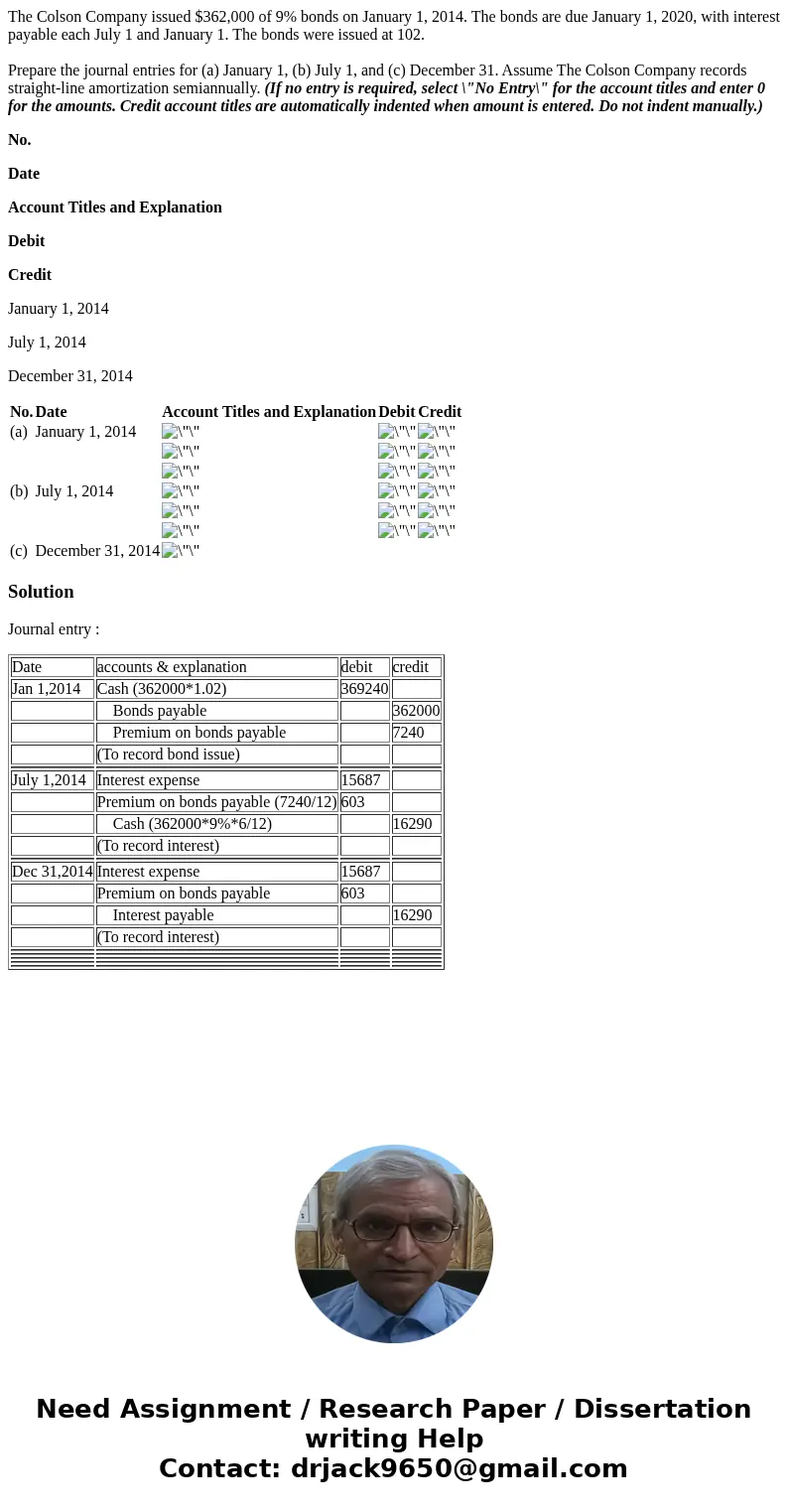

The Colson Company issued $362,000 of 9% bonds on January 1, 2014. The bonds are due January 1, 2020, with interest payable each July 1 and January 1. The bonds were issued at 102.

Prepare the journal entries for (a) January 1, (b) July 1, and (c) December 31. Assume The Colson Company records straight-line amortization semiannually. (If no entry is required, select \"No Entry\" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

No.

Date

Account Titles and Explanation

Debit

Credit

January 1, 2014

July 1, 2014

December 31, 2014

| No. | Date | Account Titles and Explanation | Debit | Credit |

| (a) | January 1, 2014 |

|

|

|

|

|

|

| ||

|

|

|

| ||

| (b) | July 1, 2014 |

|

|

|

|

|

|

| ||

|

|

|

| ||

| (c) | December 31, 2014 |

|

Solution

Journal entry :

| Date | accounts & explanation | debit | credit |

| Jan 1,2014 | Cash (362000*1.02) | 369240 | |

| Bonds payable | 362000 | ||

| Premium on bonds payable | 7240 | ||

| (To record bond issue) | |||

| July 1,2014 | Interest expense | 15687 | |

| Premium on bonds payable (7240/12) | 603 | ||

| Cash (362000*9%*6/12) | 16290 | ||

| (To record interest) | |||

| Dec 31,2014 | Interest expense | 15687 | |

| Premium on bonds payable | 603 | ||

| Interest payable | 16290 | ||

| (To record interest) | |||

Homework Sourse

Homework Sourse