QUESTION 20 Julia is a cash basis veterinarian in a rural mi

QUESTION 20 Julia is a cash basis veterinarian in a rural midwest town. During 2018, she was paid the following for services rendered in 2018 Cash of $400 that she has not yet deposited in the bank - A well-used motorcycle with a market value of $250 that was not working when Julia received it. She spent an additional $300 on repairs and now rides the bike from time to time. Tickets to Midwest University\'s homecoming football game worth $50 with a face value (cost) of $70. Checks worth $700 that Julia has not cashed yet. - A check from one customer for $150 (not included in the $700 above) that was post-dated into next year. Julie did not notice the date and cashed it anyway with no issues. - Chickens worth $400 An accounts receivable\" at year end of $4,300 from a giant agriculture corporation that Julia agreed to bill every three months because they are such a large customer. At year-end, Julia was fairly certain she\'d collect but the corporation actually went bankrupt in 2019 and Julia never collected. How much gross inome from these items must Julia recognize in 2018? $1,950 $2.250 s6100 $6.250 None of the choices are correct

Solution

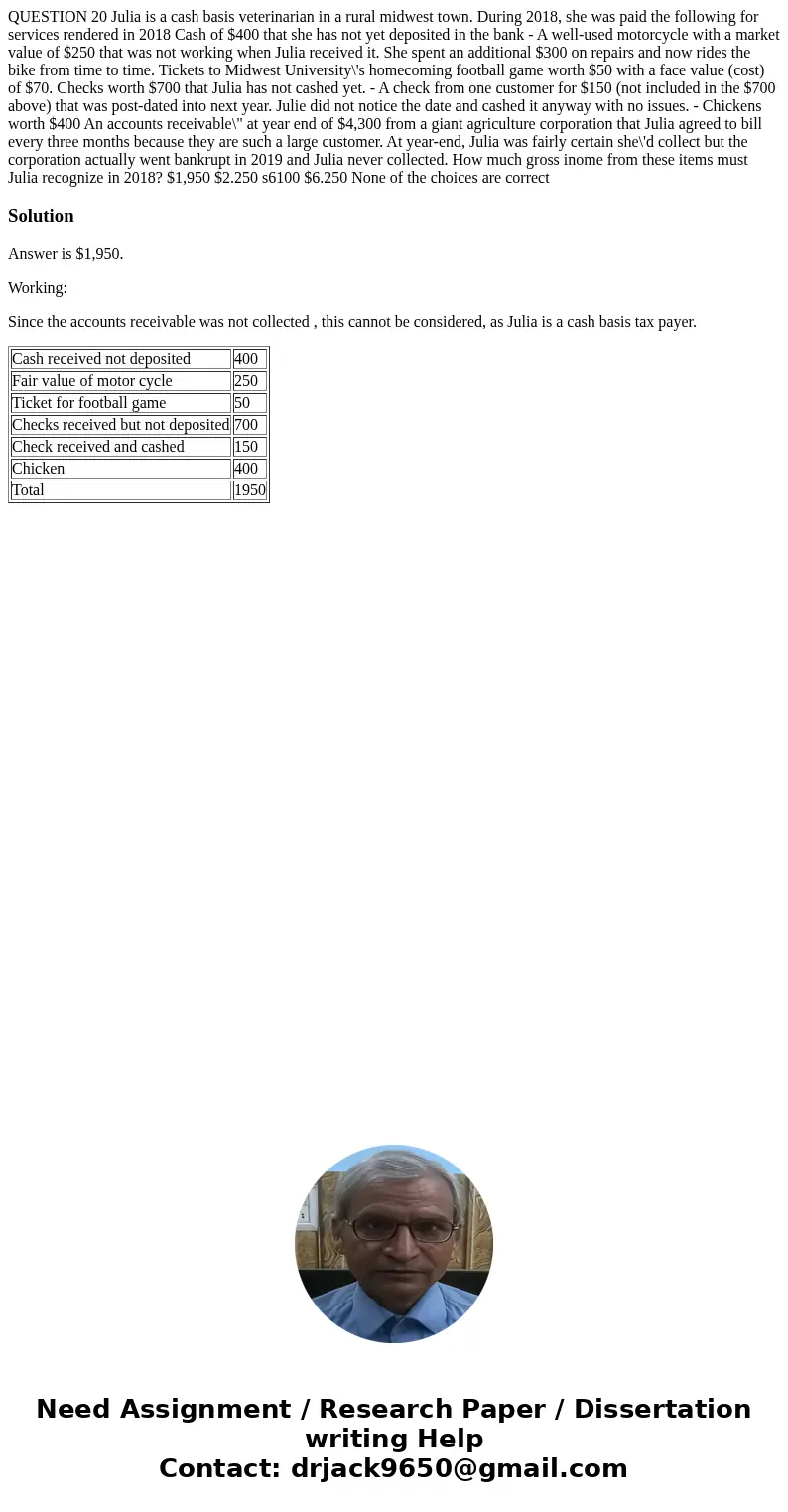

Answer is $1,950.

Working:

Since the accounts receivable was not collected , this cannot be considered, as Julia is a cash basis tax payer.

| Cash received not deposited | 400 |

| Fair value of motor cycle | 250 |

| Ticket for football game | 50 |

| Checks received but not deposited | 700 |

| Check received and cashed | 150 |

| Chicken | 400 |

| Total | 1950 |

Homework Sourse

Homework Sourse