Required information [The following information applies to the questions displayed below Diego Company manufactures one product that is sold for $77 per unit in two geographic regions-the East and West regions. The following information pertains to the company\'s first year of operations in which it prod ed 59,000 units and sold 54,000 units. Variable costs per unit: Manufacturing: Direct materials Direct labor Variable manufacturing overhead 27 10 Variable selling and administrative Fixed costs per year: $1,298, 000 Fixed manufacturing overhead Fixed selling and administrative expense662, 000 The company sold 41,000 units in the East region and 13,000 units in the West region. It determined that $330,000 of its fixed selling and administrative expense is traceable to the West region, $280,000 is traceable to the East region, and the remaining $52,000 is a common fixed expense. The company will continue to incur the total amount of its fixed manufacturing overhead costs as long as it continues to produce any amount of its only product 14. Diego is considering eliminating the West region because an internally generated report suggests the region\'s total gross margin in the first year of operations was $122,000 less than its traceable fixed selling and administrative expenses. Diego belleves that if it drops the West region, the East region\'s sales will grow by 5% in Year 2, Using the contribution approach for analyzing segment profitability and assuming all else remains constant in Year 2, what would be the profit impact of dropping the West region in Year 2? Prev 14 15 of 17Next>

Calculation of Variable cost per unit

Direct material = $27

Direct labor = $10

Variable manufacturing overhead = $2

Variable selling and administrative expense = $3

Hence, variable cost per unit = 27 + 10 + 2 + 3

= $42

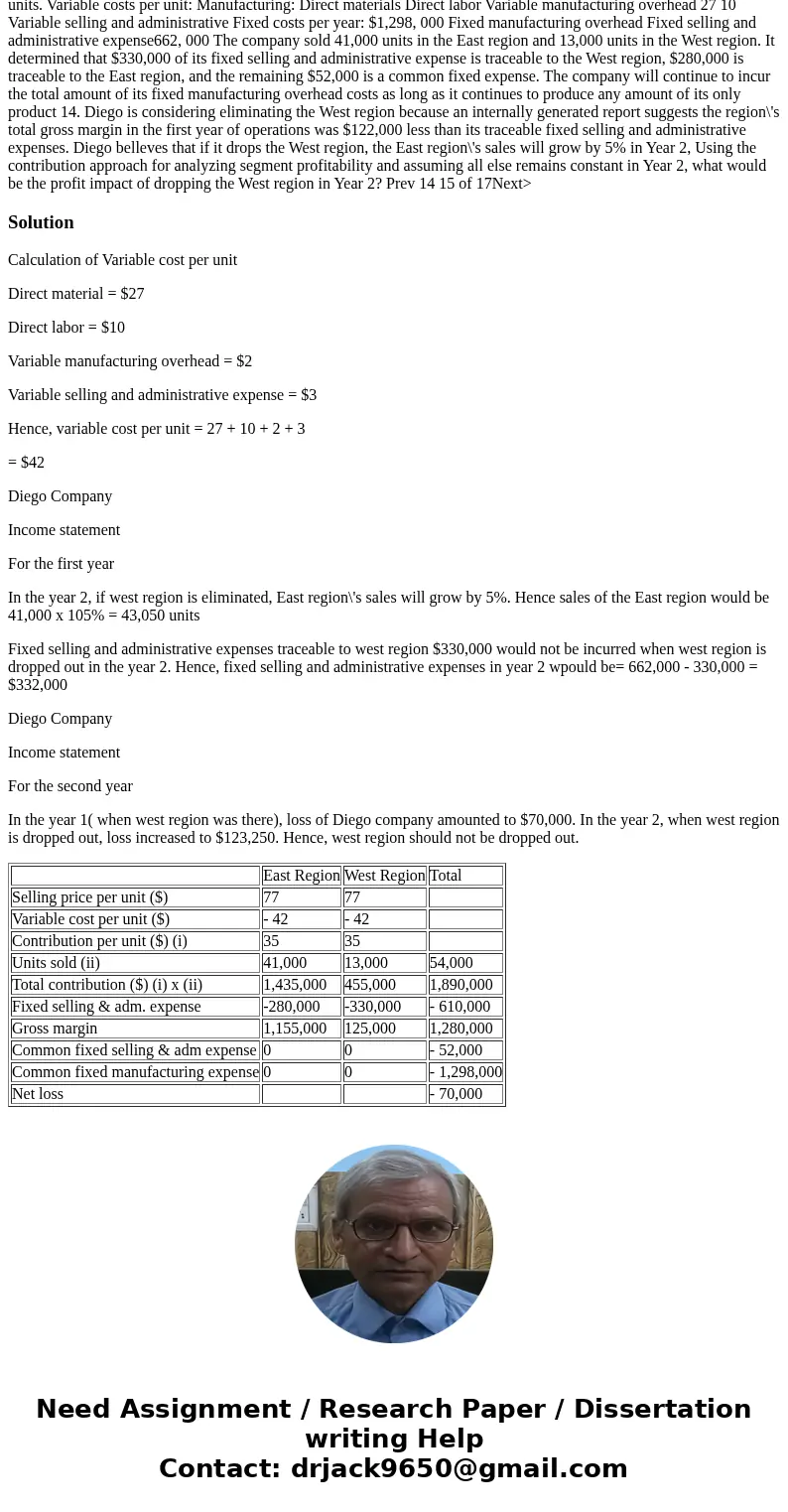

Diego Company

Income statement

For the first year

In the year 2, if west region is eliminated, East region\'s sales will grow by 5%. Hence sales of the East region would be 41,000 x 105% = 43,050 units

Fixed selling and administrative expenses traceable to west region $330,000 would not be incurred when west region is dropped out in the year 2. Hence, fixed selling and administrative expenses in year 2 wpould be= 662,000 - 330,000 = $332,000

Diego Company

Income statement

For the second year

In the year 1( when west region was there), loss of Diego company amounted to $70,000. In the year 2, when west region is dropped out, loss increased to $123,250. Hence, west region should not be dropped out.

| East Region | West Region | Total |

| Selling price per unit ($) | 77 | 77 | |

| Variable cost per unit ($) | - 42 | - 42 | |

| Contribution per unit ($) (i) | 35 | 35 | |

| Units sold (ii) | 41,000 | 13,000 | 54,000 |

| Total contribution ($) (i) x (ii) | 1,435,000 | 455,000 | 1,890,000 |

| Fixed selling & adm. expense | -280,000 | -330,000 | - 610,000 |

| Gross margin | 1,155,000 | 125,000 | 1,280,000 |

| Common fixed selling & adm expense | 0 | 0 | - 52,000 |

| Common fixed manufacturing expense | 0 | 0 | - 1,298,000 |

| Net loss | | | - 70,000 |

Homework Sourse

Homework Sourse