Question 27 A partial trial balance of Sheffield Corporation

Question 27 A partial trial balance of Sheffield Corporation is as follows on December 31, 2018. Dr Cr. Supplies Salaries and wages payable nterest Receivable Prepaid Insurance Unearned Rent Interest Payable $2,500 $1,500 5,100 95,100 15,400 Additional adjusting data: 1. A physical count of supplies on hand on December 31, 2018, totaled $1,000 2. Through oversight, the Salaries and Wages Payable account was not changed during 2018. Accrued salaries and wages on December 31, 2018, amounted to $4,300 3. The Interest Receivable account was also left unchanged during 2018. Accrued interest on investments amounts to $4,100 on December 31, 2018 4. The unexpired portions of the insurance policies totaled $70,900 as of December 31, 2018. 5. $28,600 was received on January 1, 2018, for the rent of a building for both 2018 and 2019. The entire amount was credited to rent revenue. 6. Depreciation on equipment for the year was erroneously recorded as $5,200 rather than the correct figure of $52,000 7. A further review of depreciation calculations of prior years revealed that equipment depreciation of $7,600 was not recorded. It was decided that this oversight should be corrected by a prior period adjustment.

Solution

SOLUTION

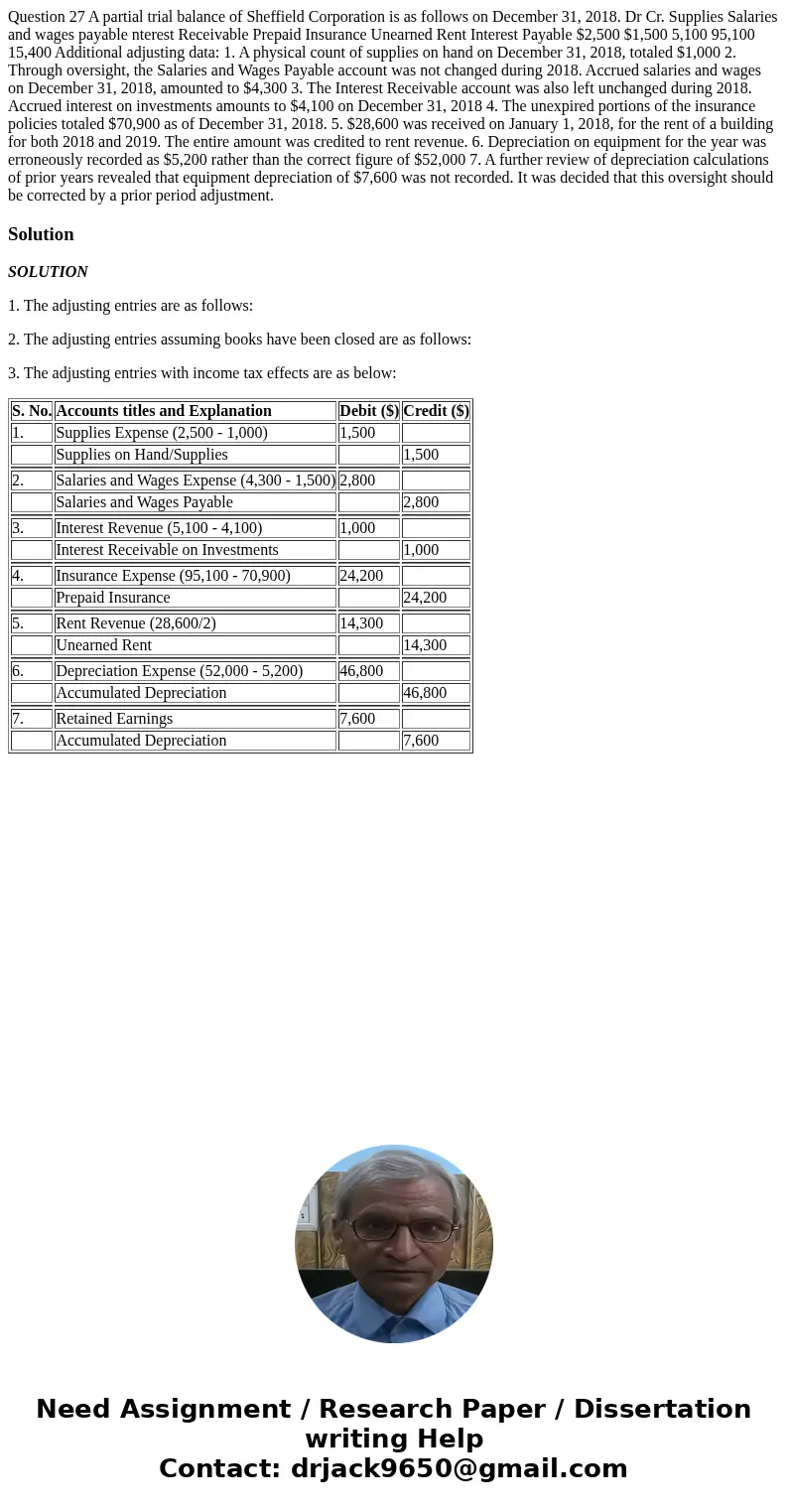

1. The adjusting entries are as follows:

2. The adjusting entries assuming books have been closed are as follows:

3. The adjusting entries with income tax effects are as below:

| S. No. | Accounts titles and Explanation | Debit ($) | Credit ($) |

| 1. | Supplies Expense (2,500 - 1,000) | 1,500 | |

| Supplies on Hand/Supplies | 1,500 | ||

| 2. | Salaries and Wages Expense (4,300 - 1,500) | 2,800 | |

| Salaries and Wages Payable | 2,800 | ||

| 3. | Interest Revenue (5,100 - 4,100) | 1,000 | |

| Interest Receivable on Investments | 1,000 | ||

| 4. | Insurance Expense (95,100 - 70,900) | 24,200 | |

| Prepaid Insurance | 24,200 | ||

| 5. | Rent Revenue (28,600/2) | 14,300 | |

| Unearned Rent | 14,300 | ||

| 6. | Depreciation Expense (52,000 - 5,200) | 46,800 | |

| Accumulated Depreciation | 46,800 | ||

| 7. | Retained Earnings | 7,600 | |

| Accumulated Depreciation | 7,600 |

Homework Sourse

Homework Sourse