If I am required to record sales assuming that customers wil

If I am required to record sales assuming that customers will take the discount, what do I do if they don’t take the discount and I receive payment for the full price? How do I record it?

If I am required to record sales assuming that customers will take the discount, what do I do if they don’t take the discount and I receive payment for the full price? How do I record it?

Solution

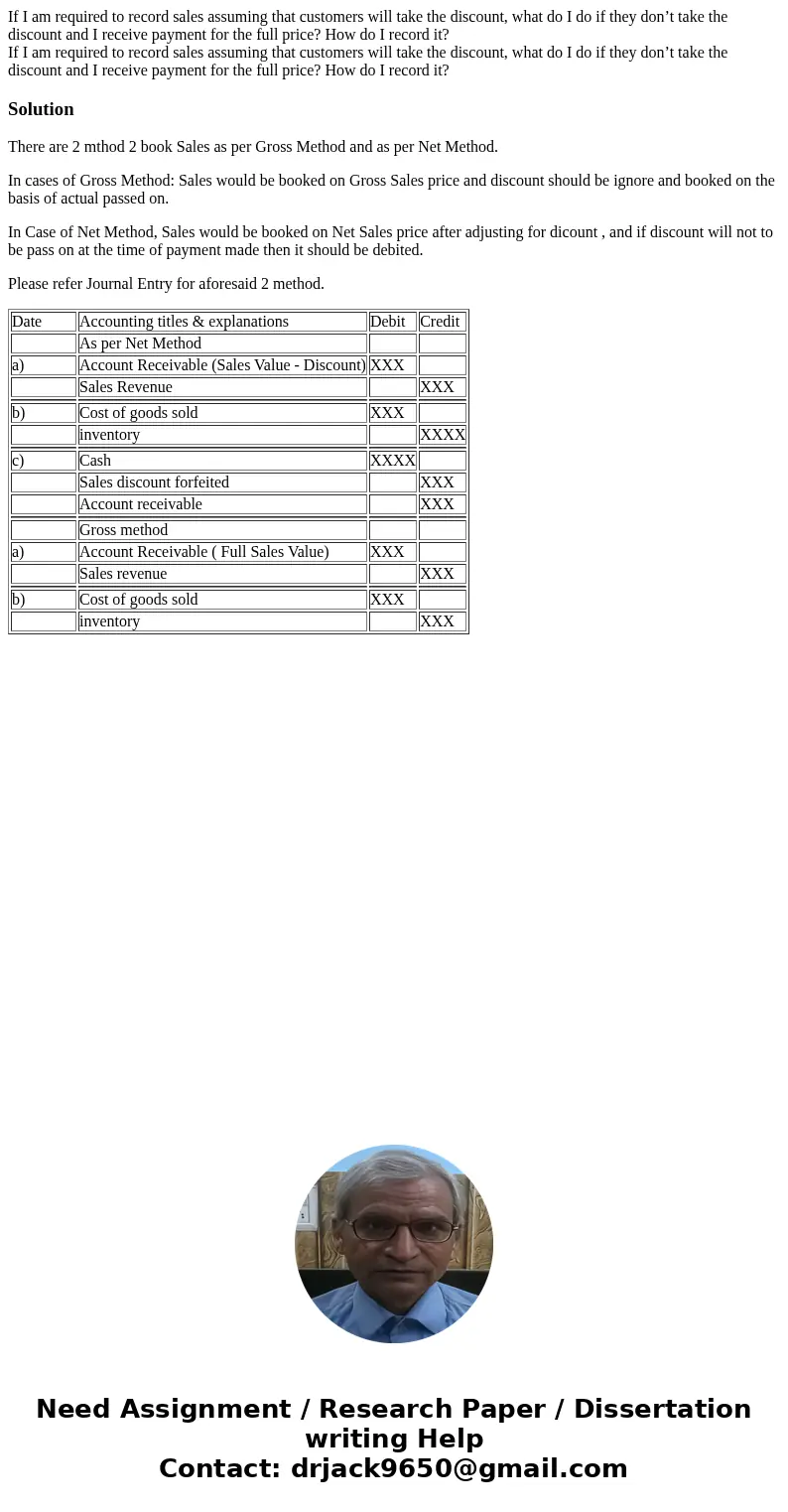

There are 2 mthod 2 book Sales as per Gross Method and as per Net Method.

In cases of Gross Method: Sales would be booked on Gross Sales price and discount should be ignore and booked on the basis of actual passed on.

In Case of Net Method, Sales would be booked on Net Sales price after adjusting for dicount , and if discount will not to be pass on at the time of payment made then it should be debited.

Please refer Journal Entry for aforesaid 2 method.

| Date | Accounting titles & explanations | Debit | Credit |

| As per Net Method | |||

| a) | Account Receivable (Sales Value - Discount) | XXX | |

| Sales Revenue | XXX | ||

| b) | Cost of goods sold | XXX | |

| inventory | XXXX | ||

| c) | Cash | XXXX | |

| Sales discount forfeited | XXX | ||

| Account receivable | XXX | ||

| Gross method | |||

| a) | Account Receivable ( Full Sales Value) | XXX | |

| Sales revenue | XXX | ||

| b) | Cost of goods sold | XXX | |

| inventory | XXX |

Homework Sourse

Homework Sourse