A partnership has the following account balances Cash 79000

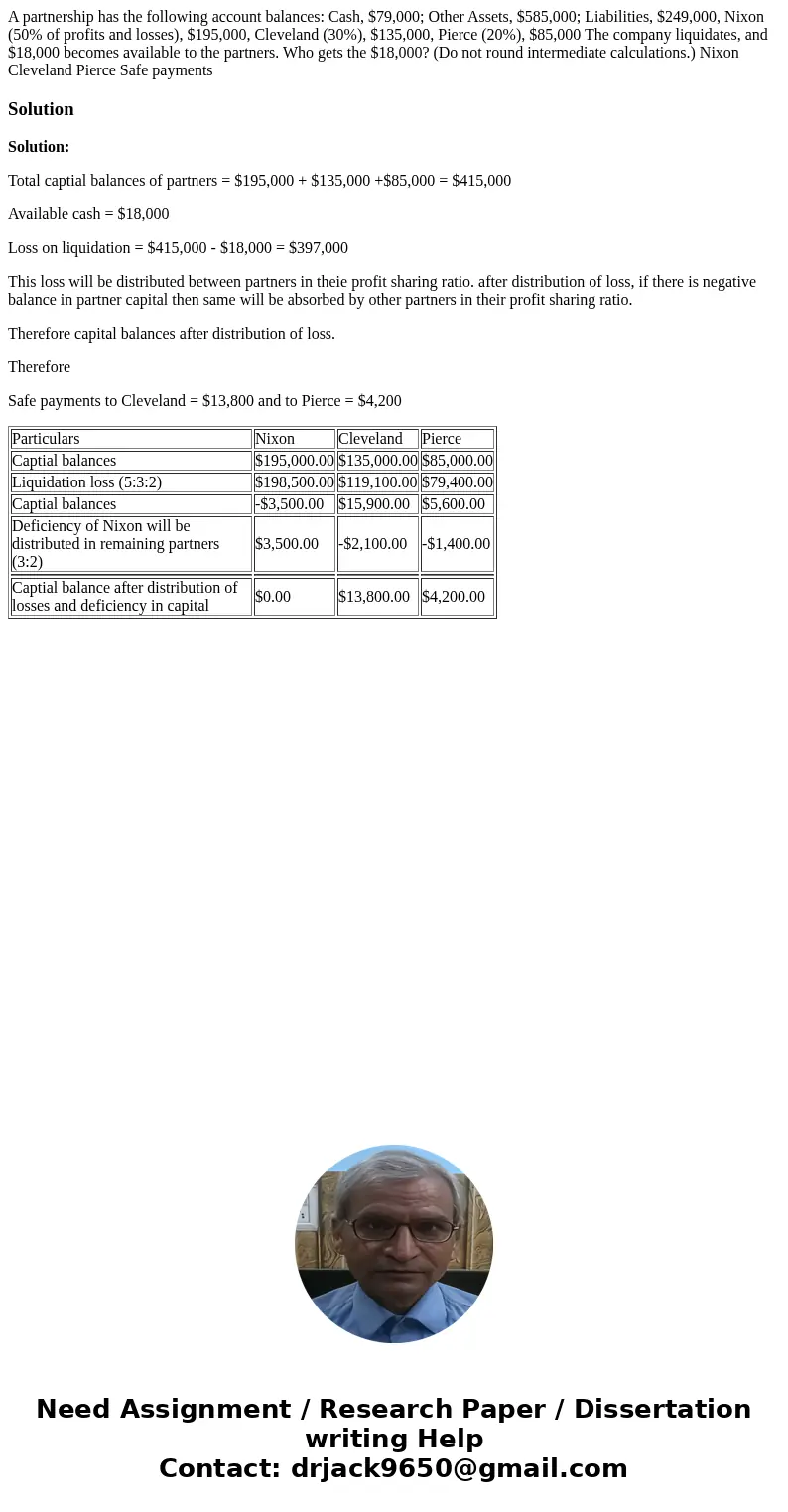

A partnership has the following account balances: Cash, $79,000; Other Assets, $585,000; Liabilities, $249,000, Nixon (50% of profits and losses), $195,000, Cleveland (30%), $135,000, Pierce (20%), $85,000 The company liquidates, and $18,000 becomes available to the partners. Who gets the $18,000? (Do not round intermediate calculations.) Nixon Cleveland Pierce Safe payments

Solution

Solution:

Total captial balances of partners = $195,000 + $135,000 +$85,000 = $415,000

Available cash = $18,000

Loss on liquidation = $415,000 - $18,000 = $397,000

This loss will be distributed between partners in theie profit sharing ratio. after distribution of loss, if there is negative balance in partner capital then same will be absorbed by other partners in their profit sharing ratio.

Therefore capital balances after distribution of loss.

Therefore

Safe payments to Cleveland = $13,800 and to Pierce = $4,200

| Particulars | Nixon | Cleveland | Pierce |

| Captial balances | $195,000.00 | $135,000.00 | $85,000.00 |

| Liquidation loss (5:3:2) | $198,500.00 | $119,100.00 | $79,400.00 |

| Captial balances | -$3,500.00 | $15,900.00 | $5,600.00 |

| Deficiency of Nixon will be distributed in remaining partners (3:2) | $3,500.00 | -$2,100.00 | -$1,400.00 |

| Captial balance after distribution of losses and deficiency in capital | $0.00 | $13,800.00 | $4,200.00 |

Homework Sourse

Homework Sourse