During 2018 Finch Corporation reported aftertax net income o

Solution

after tax net income

3615000

less preferred dividend

(9660*100)*10%

96600

net income available to common stockholders

3518400

no of common stock

400000

earning per share

3518400/40000

8.80

Book value per share of common stock

total stockholder equity

20000000

less book value of preferred stock

966000

book value of common stock

19034000

no of common stock

400000

Book value per share of common stock

47.59

Price earning ratio = market price/eps

51/8.796

5.80

dividend yield = dividend paid/current market price

5/51

9.80%

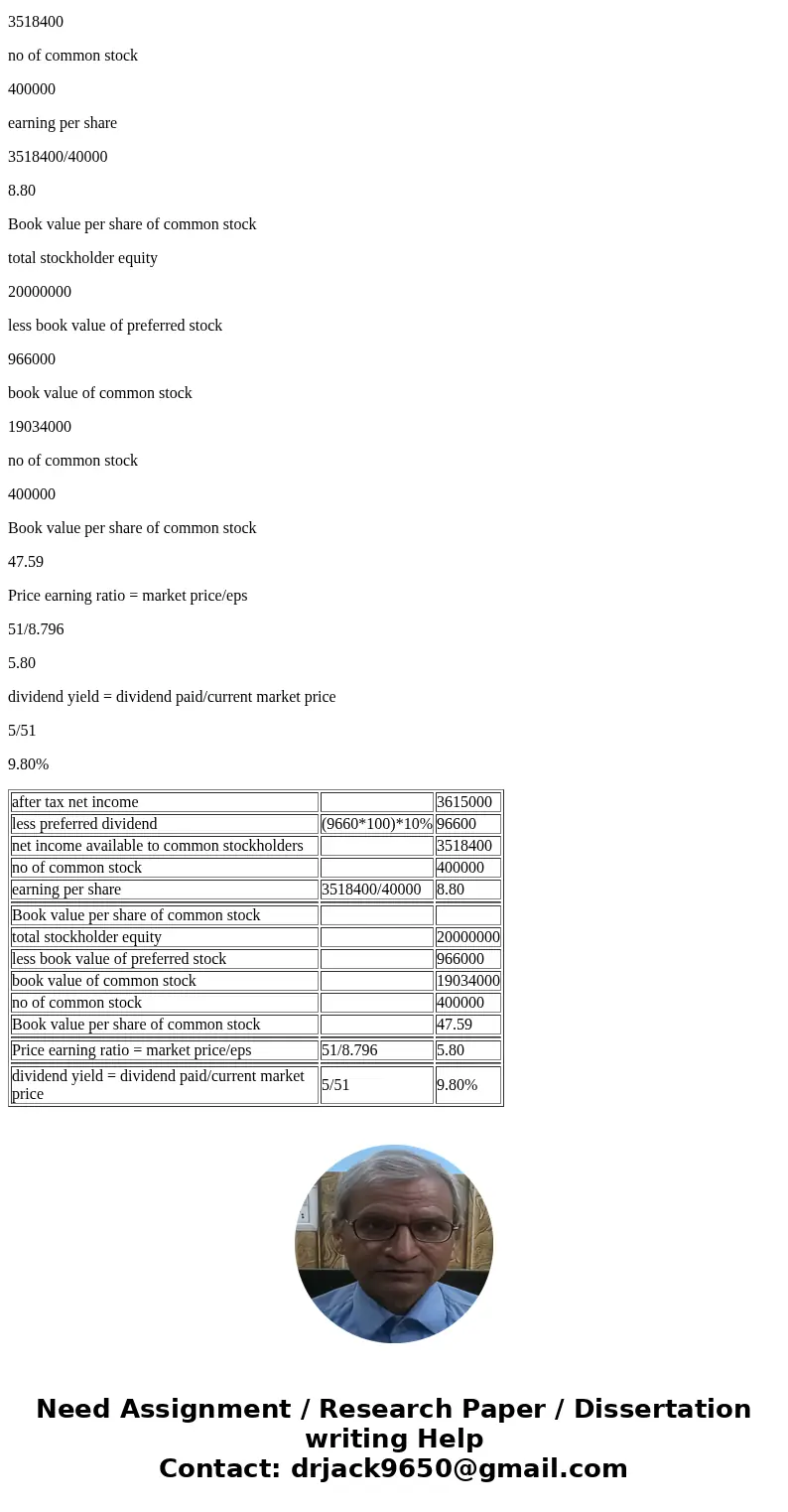

| after tax net income | 3615000 | |

| less preferred dividend | (9660*100)*10% | 96600 |

| net income available to common stockholders | 3518400 | |

| no of common stock | 400000 | |

| earning per share | 3518400/40000 | 8.80 |

| Book value per share of common stock | ||

| total stockholder equity | 20000000 | |

| less book value of preferred stock | 966000 | |

| book value of common stock | 19034000 | |

| no of common stock | 400000 | |

| Book value per share of common stock | 47.59 | |

| Price earning ratio = market price/eps | 51/8.796 | 5.80 |

| dividend yield = dividend paid/current market price | 5/51 | 9.80% |

Homework Sourse

Homework Sourse