The Central Valley Company is a merchandising firm that sell

The Central Valley Company is a merchandising firm that sells a single product. The company\'s revenues and expenses for the last three months are given below:

April

May

June

Sales in units .................................

4,500

5,250

6,000

Sales revenue ...............................

$630,000

$735,000

$840,000

Less cost of goods sold ………..........

252,000

294,000

336,000

Gross Margin ................................

378,000

441,000

504,000

Less operating expenses:

Shipping expense ………..............

56,000

63,500

71,000

Advertising expense ………..........

70,000

70,000

70,000

Salaries and commissions ..........

143,000

161,750

180,500

Insurance expense ....................

9,000

9,000

9,000

Depreciation expense ...............

42,000

42,000

42,000

Total operating expenses ……..

320,000

346,250

372,500

Net income .......................

$58,000

$94,750

$131,500

Required:

Determine which expenses are mixed (show computations) and, by use of the high-low method, separate each mixed expense into its variable and fixed components. State the cost formula for each mixed expense.

Compute the company\'s total contribution margin (Sales – Variable Costs) for May.

| April | May | June | |||

| Sales in units ................................. | 4,500 | 5,250 | 6,000 | ||

| Sales revenue ............................... | $630,000 | $735,000 | $840,000 | ||

| Less cost of goods sold ……….......... | 252,000 | 294,000 | 336,000 | ||

| Gross Margin ................................ | 378,000 | 441,000 | 504,000 | ||

| Less operating expenses: | |||||

| Shipping expense ……….............. | 56,000 | 63,500 | 71,000 | ||

| Advertising expense ……….......... | 70,000 | 70,000 | 70,000 | ||

| Salaries and commissions .......... | 143,000 | 161,750 | 180,500 | ||

| Insurance expense .................... | 9,000 | 9,000 | 9,000 | ||

| Depreciation expense ............... | 42,000 | 42,000 | 42,000 | ||

| Total operating expenses …….. | 320,000 | 346,250 | 372,500 | ||

| Net income ....................... | $58,000 | $94,750 | $131,500 |

Solution

the expense which increases proportionately with increse in sales will be a variable expense.

the expense which remains fixed irrespective of units sold will be fixed expense.

the expense which increases but not in proportion with increase in sales units will be mixed expense.

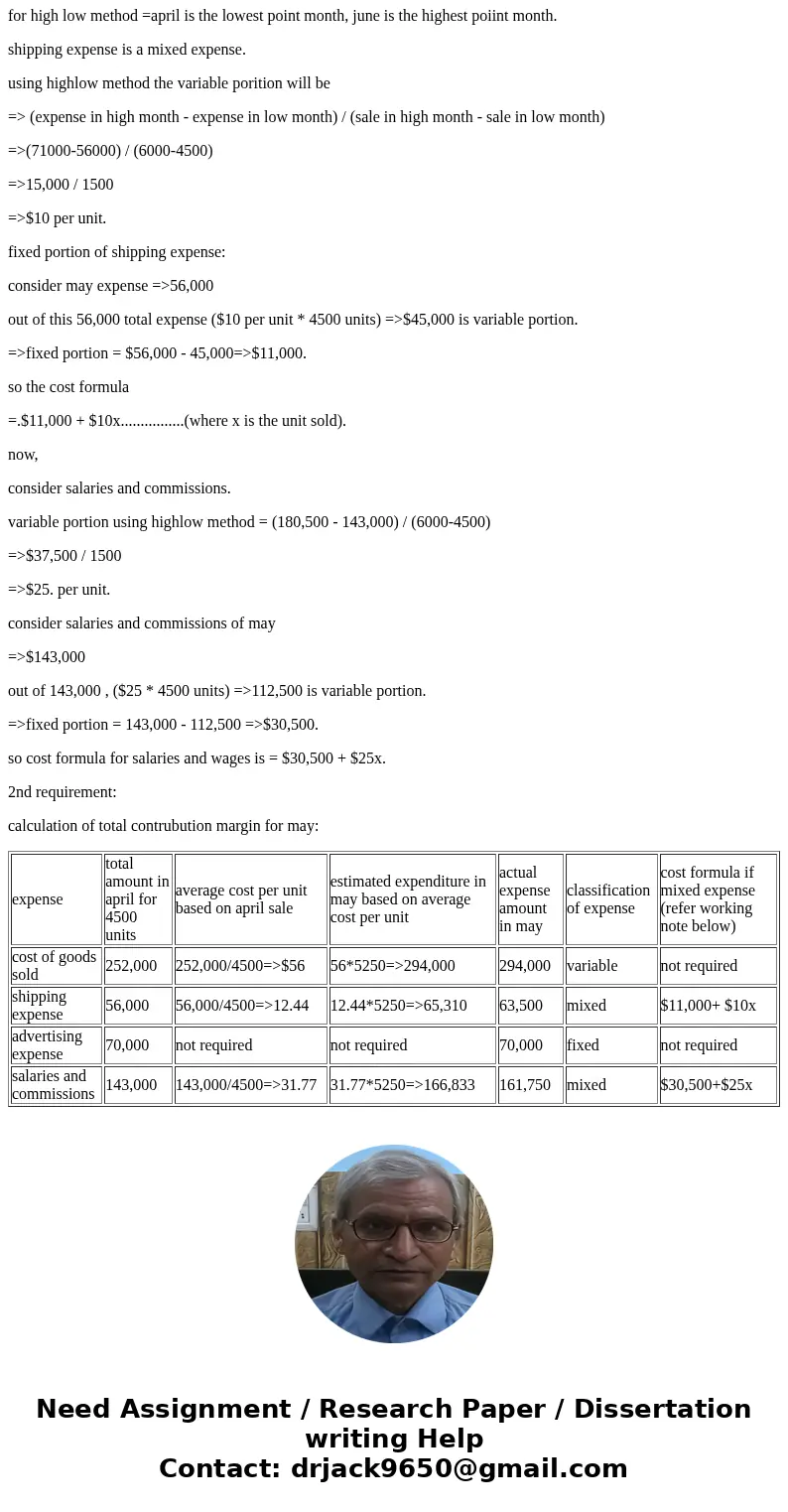

the following table shows the required classification:

note:

for high low method =april is the lowest point month, june is the highest poiint month.

shipping expense is a mixed expense.

using highlow method the variable porition will be

=> (expense in high month - expense in low month) / (sale in high month - sale in low month)

=>(71000-56000) / (6000-4500)

=>15,000 / 1500

=>$10 per unit.

fixed portion of shipping expense:

consider may expense =>56,000

out of this 56,000 total expense ($10 per unit * 4500 units) =>$45,000 is variable portion.

=>fixed portion = $56,000 - 45,000=>$11,000.

so the cost formula

=.$11,000 + $10x................(where x is the unit sold).

now,

consider salaries and commissions.

variable portion using highlow method = (180,500 - 143,000) / (6000-4500)

=>$37,500 / 1500

=>$25. per unit.

consider salaries and commissions of may

=>$143,000

out of 143,000 , ($25 * 4500 units) =>112,500 is variable portion.

=>fixed portion = 143,000 - 112,500 =>$30,500.

so cost formula for salaries and wages is = $30,500 + $25x.

2nd requirement:

calculation of total contrubution margin for may:

| expense | total amount in april for 4500 units | average cost per unit based on april sale | estimated expenditure in may based on average cost per unit | actual expense amount in may | classification of expense | cost formula if mixed expense (refer working note below) |

| cost of goods sold | 252,000 | 252,000/4500=>$56 | 56*5250=>294,000 | 294,000 | variable | not required |

| shipping expense | 56,000 | 56,000/4500=>12.44 | 12.44*5250=>65,310 | 63,500 | mixed | $11,000+ $10x |

| advertising expense | 70,000 | not required | not required | 70,000 | fixed | not required |

| salaries and commissions | 143,000 | 143,000/4500=>31.77 | 31.77*5250=>166,833 | 161,750 | mixed | $30,500+$25x |

Homework Sourse

Homework Sourse