A machine purchased three years ago for 720000 has a current

A machine purchased three years ago for $720,000 has a current book value using straight-line depreciation of $400,000; its operating expenses are $60,000 per year. A replacement machine would cost $480,000, have a useful life of nine years, and would require $26,000 per year in operating expenses. It has an expected salvage value of $130,000 after nine years. The current disposal value of the old machine is $170,000; if it is kept 9 more years, its residual value would be $20,000.

Required

Calculate the total costs in keeping the old machine and purchase a new machine. Should the old machine be replaced?

Solution

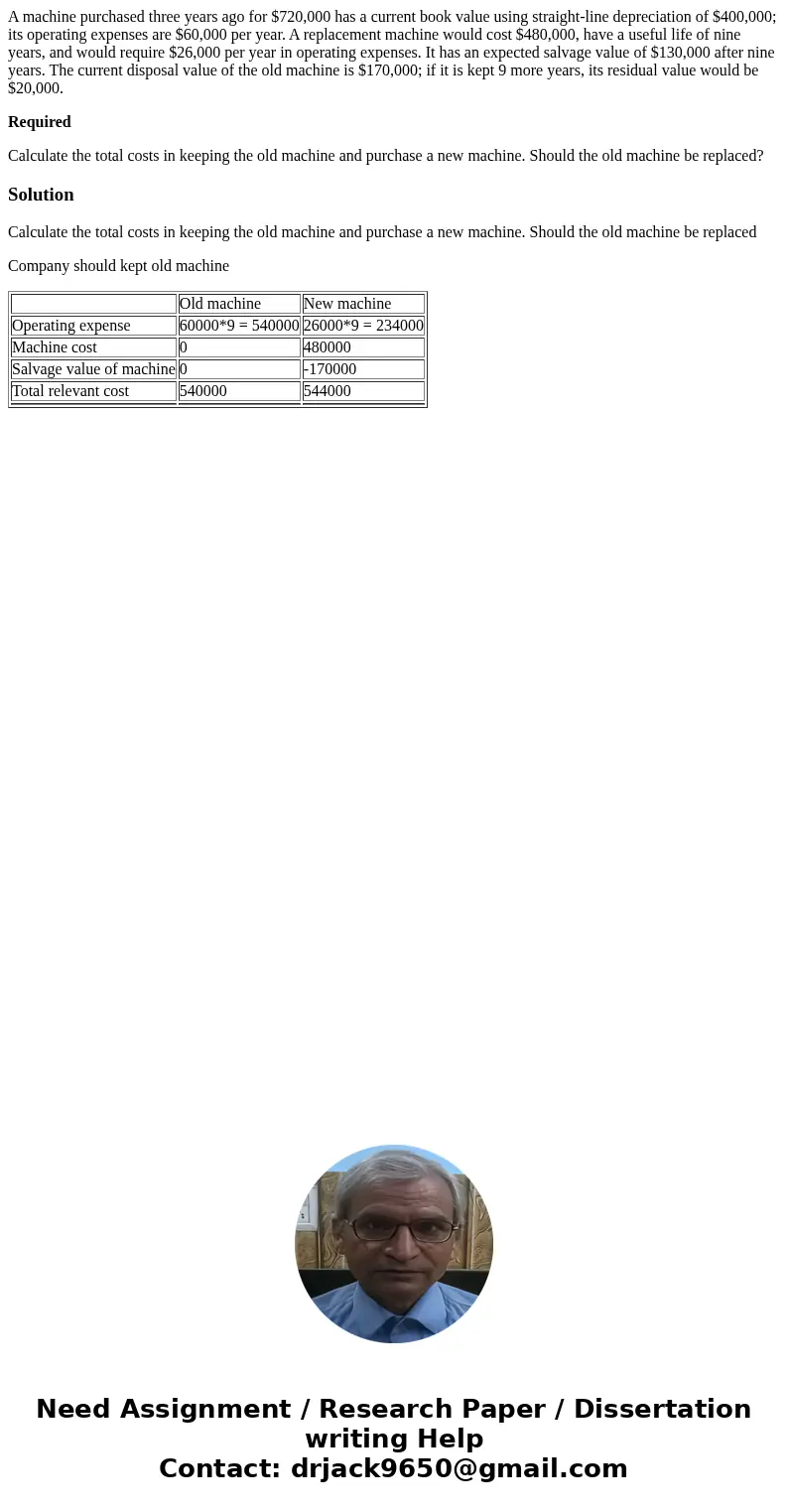

Calculate the total costs in keeping the old machine and purchase a new machine. Should the old machine be replaced

Company should kept old machine

| Old machine | New machine | |

| Operating expense | 60000*9 = 540000 | 26000*9 = 234000 |

| Machine cost | 0 | 480000 |

| Salvage value of machine | 0 | -170000 |

| Total relevant cost | 540000 | 544000 |

Homework Sourse

Homework Sourse