The contribution format income statement for Huerra Company

The contribution format income statement for Huerra Company for last year is given below: Total Unit Sales Variable expenses Contribution margin Fixed expenses Net operating income Income taxes @ 40% Net income $ 1,002,000 400,800 76,000 $ 50.10 30.06 20.04 16.24 3.80 30,400 S 45,600 S 2.28 The company had average operating assets of $492,000 during the year.

Solution

Considering each question separately in comparison with original question

3.

Contribution Margin = 41.50%

Turnover = 1002000

ROI = 5.45%

4.

Contribution Margin = 40.00%

Turnover = 1002000

ROI = 4.13%

5.

Contribution Margin = 45.45%

Turnover = 1102200

ROI = 9.59%

6.

Contribution Margin = 40.00%

Turnover = 1002000

ROI = 5.75%

7. No effect on operating income

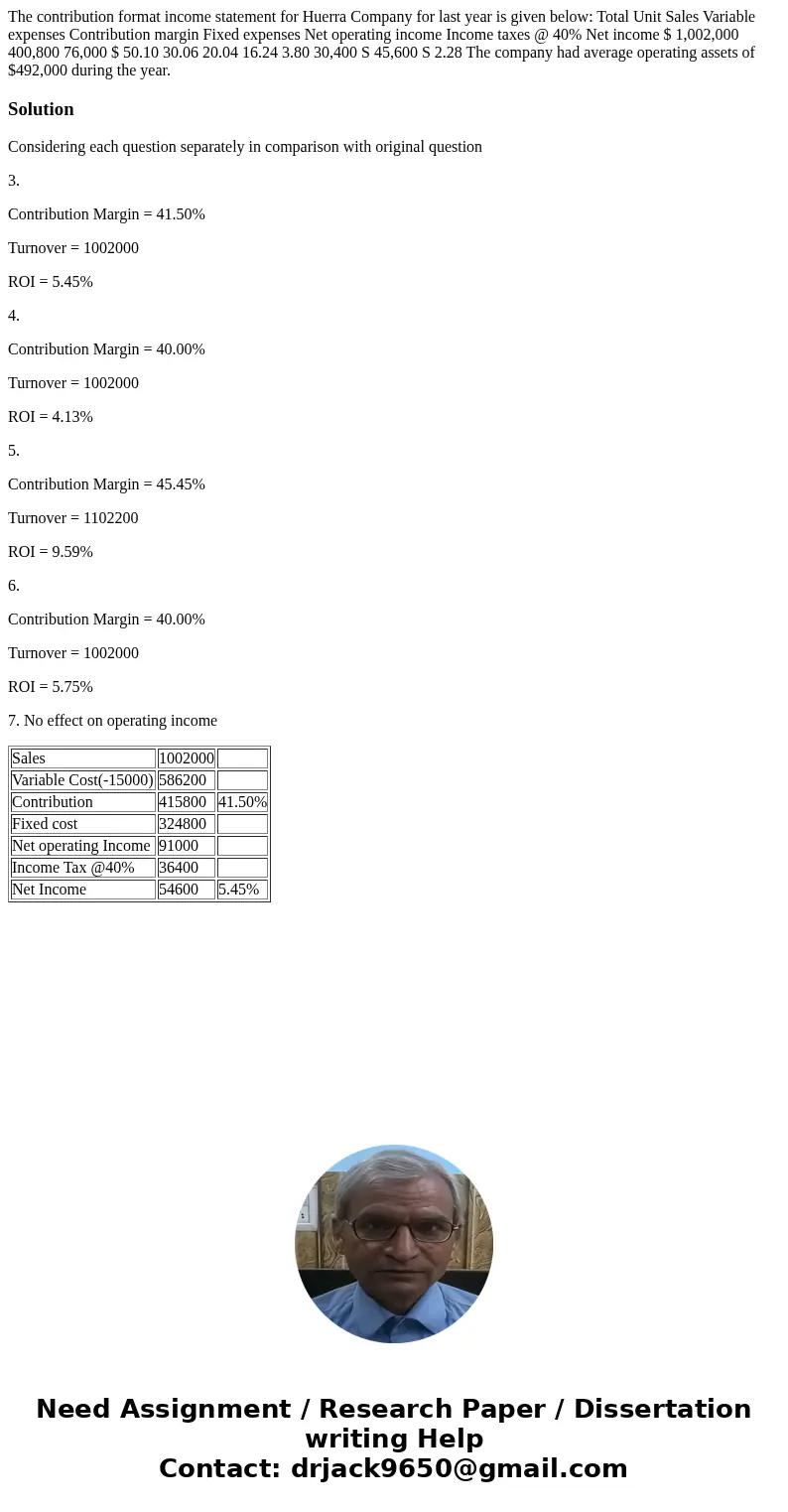

| Sales | 1002000 | |

| Variable Cost(-15000) | 586200 | |

| Contribution | 415800 | 41.50% |

| Fixed cost | 324800 | |

| Net operating Income | 91000 | |

| Income Tax @40% | 36400 | |

| Net Income | 54600 | 5.45% |

Homework Sourse

Homework Sourse