54000 Bru Capital Chou Capital 333 see to provide for futur

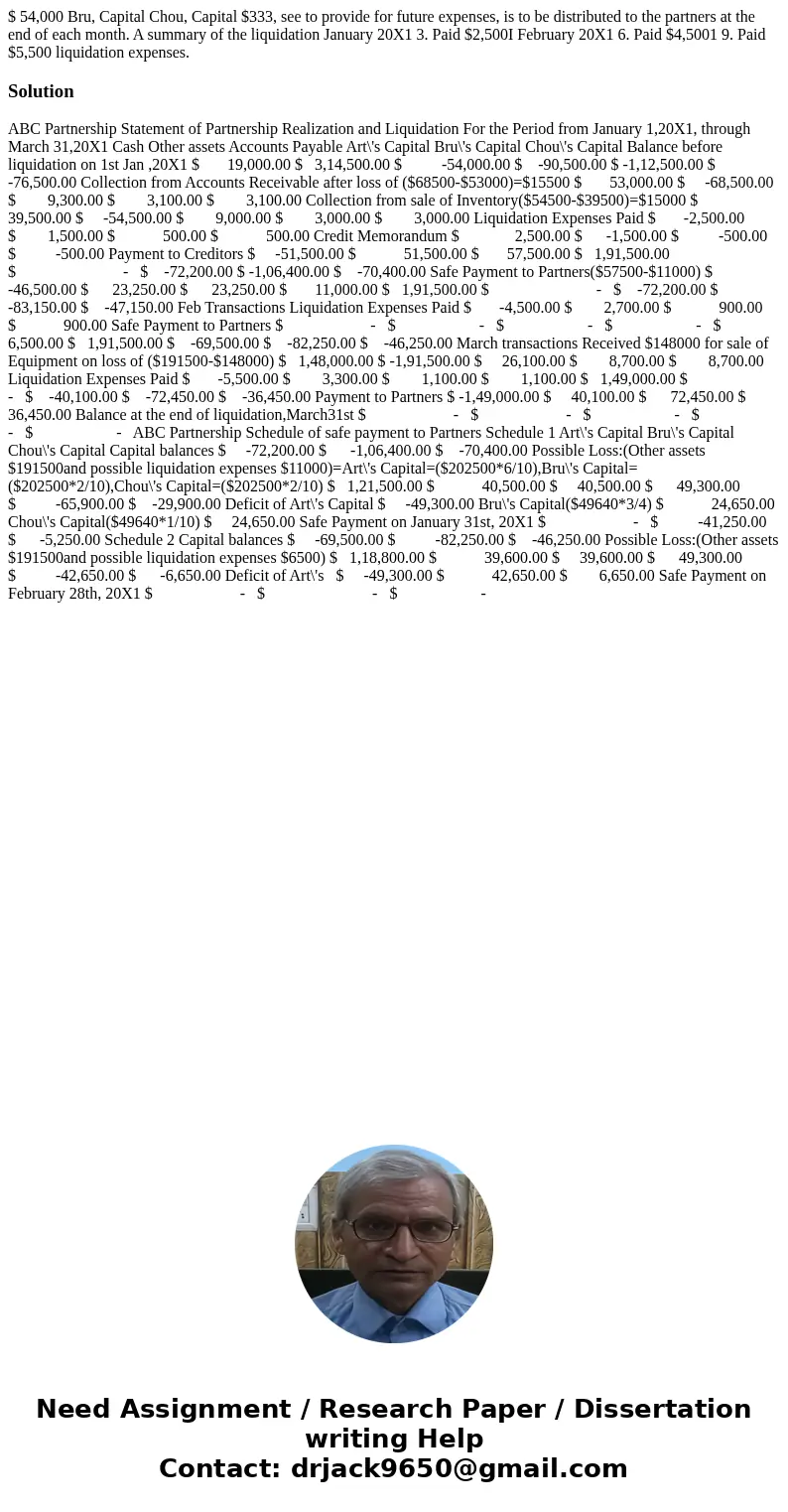

$ 54,000 Bru, Capital Chou, Capital $333, see to provide for future expenses, is to be distributed to the partners at the end of each month. A summary of the liquidation January 20X1 3. Paid $2,500I February 20X1 6. Paid $4,5001 9. Paid $5,500 liquidation expenses.

Solution

ABC Partnership Statement of Partnership Realization and Liquidation For the Period from January 1,20X1, through March 31,20X1 Cash Other assets Accounts Payable Art\'s Capital Bru\'s Capital Chou\'s Capital Balance before liquidation on 1st Jan ,20X1 $ 19,000.00 $ 3,14,500.00 $ -54,000.00 $ -90,500.00 $ -1,12,500.00 $ -76,500.00 Collection from Accounts Receivable after loss of ($68500-$53000)=$15500 $ 53,000.00 $ -68,500.00 $ 9,300.00 $ 3,100.00 $ 3,100.00 Collection from sale of Inventory($54500-$39500)=$15000 $ 39,500.00 $ -54,500.00 $ 9,000.00 $ 3,000.00 $ 3,000.00 Liquidation Expenses Paid $ -2,500.00 $ 1,500.00 $ 500.00 $ 500.00 Credit Memorandum $ 2,500.00 $ -1,500.00 $ -500.00 $ -500.00 Payment to Creditors $ -51,500.00 $ 51,500.00 $ 57,500.00 $ 1,91,500.00 $ - $ -72,200.00 $ -1,06,400.00 $ -70,400.00 Safe Payment to Partners($57500-$11000) $ -46,500.00 $ 23,250.00 $ 23,250.00 $ 11,000.00 $ 1,91,500.00 $ - $ -72,200.00 $ -83,150.00 $ -47,150.00 Feb Transactions Liquidation Expenses Paid $ -4,500.00 $ 2,700.00 $ 900.00 $ 900.00 Safe Payment to Partners $ - $ - $ - $ - $ 6,500.00 $ 1,91,500.00 $ -69,500.00 $ -82,250.00 $ -46,250.00 March transactions Received $148000 for sale of Equipment on loss of ($191500-$148000) $ 1,48,000.00 $ -1,91,500.00 $ 26,100.00 $ 8,700.00 $ 8,700.00 Liquidation Expenses Paid $ -5,500.00 $ 3,300.00 $ 1,100.00 $ 1,100.00 $ 1,49,000.00 $ - $ -40,100.00 $ -72,450.00 $ -36,450.00 Payment to Partners $ -1,49,000.00 $ 40,100.00 $ 72,450.00 $ 36,450.00 Balance at the end of liquidation,March31st $ - $ - $ - $ - $ - ABC Partnership Schedule of safe payment to Partners Schedule 1 Art\'s Capital Bru\'s Capital Chou\'s Capital Capital balances $ -72,200.00 $ -1,06,400.00 $ -70,400.00 Possible Loss:(Other assets $191500and possible liquidation expenses $11000)=Art\'s Capital=($202500*6/10),Bru\'s Capital=($202500*2/10),Chou\'s Capital=($202500*2/10) $ 1,21,500.00 $ 40,500.00 $ 40,500.00 $ 49,300.00 $ -65,900.00 $ -29,900.00 Deficit of Art\'s Capital $ -49,300.00 Bru\'s Capital($49640*3/4) $ 24,650.00 Chou\'s Capital($49640*1/10) $ 24,650.00 Safe Payment on January 31st, 20X1 $ - $ -41,250.00 $ -5,250.00 Schedule 2 Capital balances $ -69,500.00 $ -82,250.00 $ -46,250.00 Possible Loss:(Other assets $191500and possible liquidation expenses $6500) $ 1,18,800.00 $ 39,600.00 $ 39,600.00 $ 49,300.00 $ -42,650.00 $ -6,650.00 Deficit of Art\'s $ -49,300.00 $ 42,650.00 $ 6,650.00 Safe Payment on February 28th, 20X1 $ - $ - $ -

Homework Sourse

Homework Sourse