r 5 Ho Oue Today at Noon PV OF CASH FLOW STREAM are guarant

Solution

There should be present value (PV) calculation for each contract (C). The contract having the highest PV should be recommended.

PV of C 1

Year

CF, $

5% discount factor (F) = 1/ (1 + 0.05) ^n [where n = years, 1, 2 ..]

CF × F ($)

1

3,500,000

0.952380

3,333,330

2

3,500,000

0.907029

3,174,601.50

3

3,500,000

0.863837

3,023,429.50

4

3,500,000

0.822702

2,879,457

PV

12,410,818

PV of C 2

Year

CF, $

5% discount factor (F) = 1/ (1 + 0.05) ^n [where n = years, 1, 2 ..]

CF × F ($)

1

2,500,000

0.952380

2,380,950

2

3,000,000

0.907029

2,721,087

3

4,500,000

0.863837

3,887,266.50

4

5,000,000

0.822702

4,113,510

PV

13,102,813.50

PV of C 3

Year

CF, $

5% discount factor (F) = 1/ (1 + 0.05) ^n [where n = years, 1, 2 ..]

CF × F ($)

1

6,000,000

0.952380

5,714,280

2

1,500,000

0.907029

1,360,543.50

3

1,500,000

0.863837

1,295,755.50

4

1,500,000

0.822702

1,234,053

PV

9,604,632

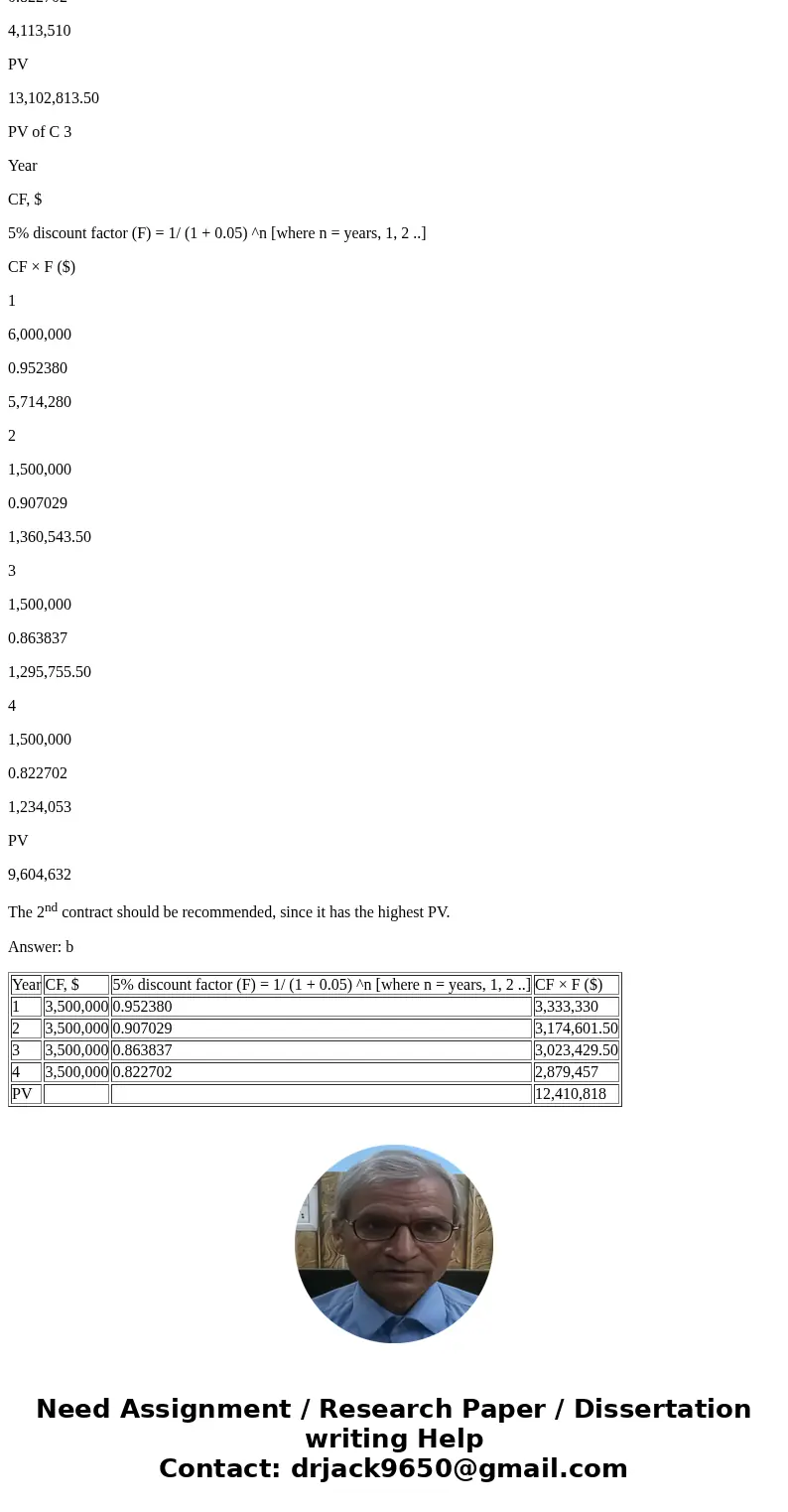

The 2nd contract should be recommended, since it has the highest PV.

Answer: b

| Year | CF, $ | 5% discount factor (F) = 1/ (1 + 0.05) ^n [where n = years, 1, 2 ..] | CF × F ($) |

| 1 | 3,500,000 | 0.952380 | 3,333,330 |

| 2 | 3,500,000 | 0.907029 | 3,174,601.50 |

| 3 | 3,500,000 | 0.863837 | 3,023,429.50 |

| 4 | 3,500,000 | 0.822702 | 2,879,457 |

| PV | 12,410,818 |

Homework Sourse

Homework Sourse