Homework Chapter 14 more Score 004 of 1 pt CYU141 similar t

Homework: Chapter 14 more Score: 0.04 of 1 pt & CYU14-1 (similar to) 4 of 12 (4 completel HW Score: 35.53%, 33 of 15 California Coal Company has 12%, 10-year bonds payable that mavre on Ane 30,\" The bonds ssued on 30, 20t nd Calton a Cal pays inten each June 30 and December 31 Read the requirements Requirement t. vai the bonds be ssued at face vahe. ata premium, or at adscount ? the market nterest tate on he dat d sanoe 11%? lfthe market nterest rate is 147 the market \"terest rate is 11%, te bonds wil be issued at . premum Requirement 2. Calfornia Coal issued $500,000 o the bonds al 88. Round all calcuiations to the nearest delar a. Record issuaaroe ofthe bonds on June 30, 2018. (Record debits first, then credts Seea eelagios onme ????heoftw oral win Round your answers the nearest whole dolar (a) Jun. 30 lthe bonds be issued at face value, at a premium, or at a dacount he manet interest rae 2. Caifornia Coal issued $500,000 of the bonds at 88 Round all caloulations to the nearest dollay a. Record issuance or bonds on Jne 30, 2018. b. Record the payment of interest and amortization of the discount on December 31, 2018 Use the straight-line amortization method e. Compute the bonds carrying anount at December 31, 2018 d. Record the payment of interest and amortization of discount on June 30,2019 Print Done

Solution

Journal entries

date

explanation

debit

credit

30-Jun

cash

440000

discount on bonds payable

60000

bonds payable

500000

dec 31 2018

interest expense

33000

cash

30000

discount on bonds payable

3000

Bond carrying amount at dec 31 2018

carrying value at dec 31 2018+ discount amortized

440000+(3000)

443000

June 30 2019

interest expense

33000

cash

30000

discount on bonds payable

3000

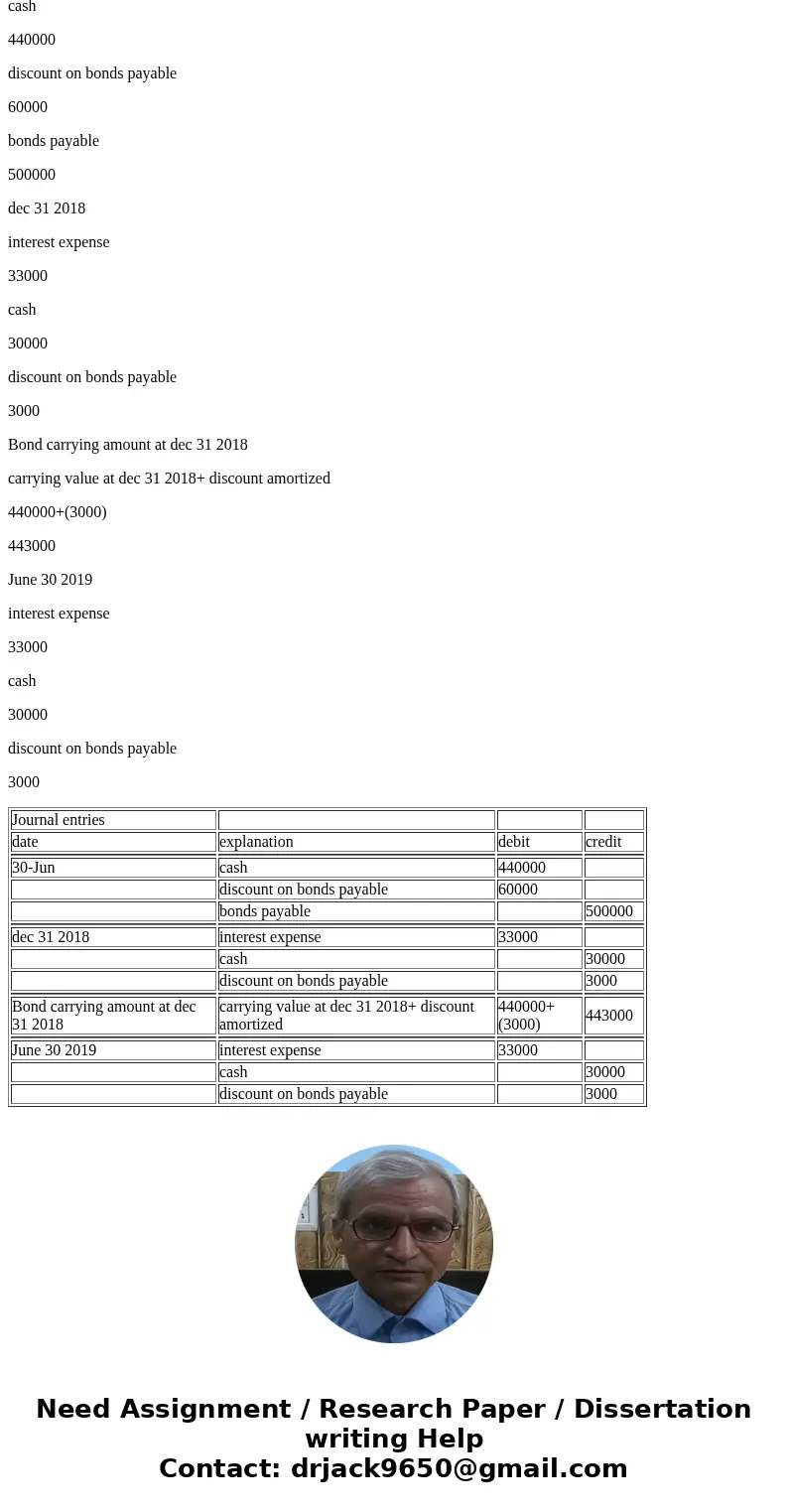

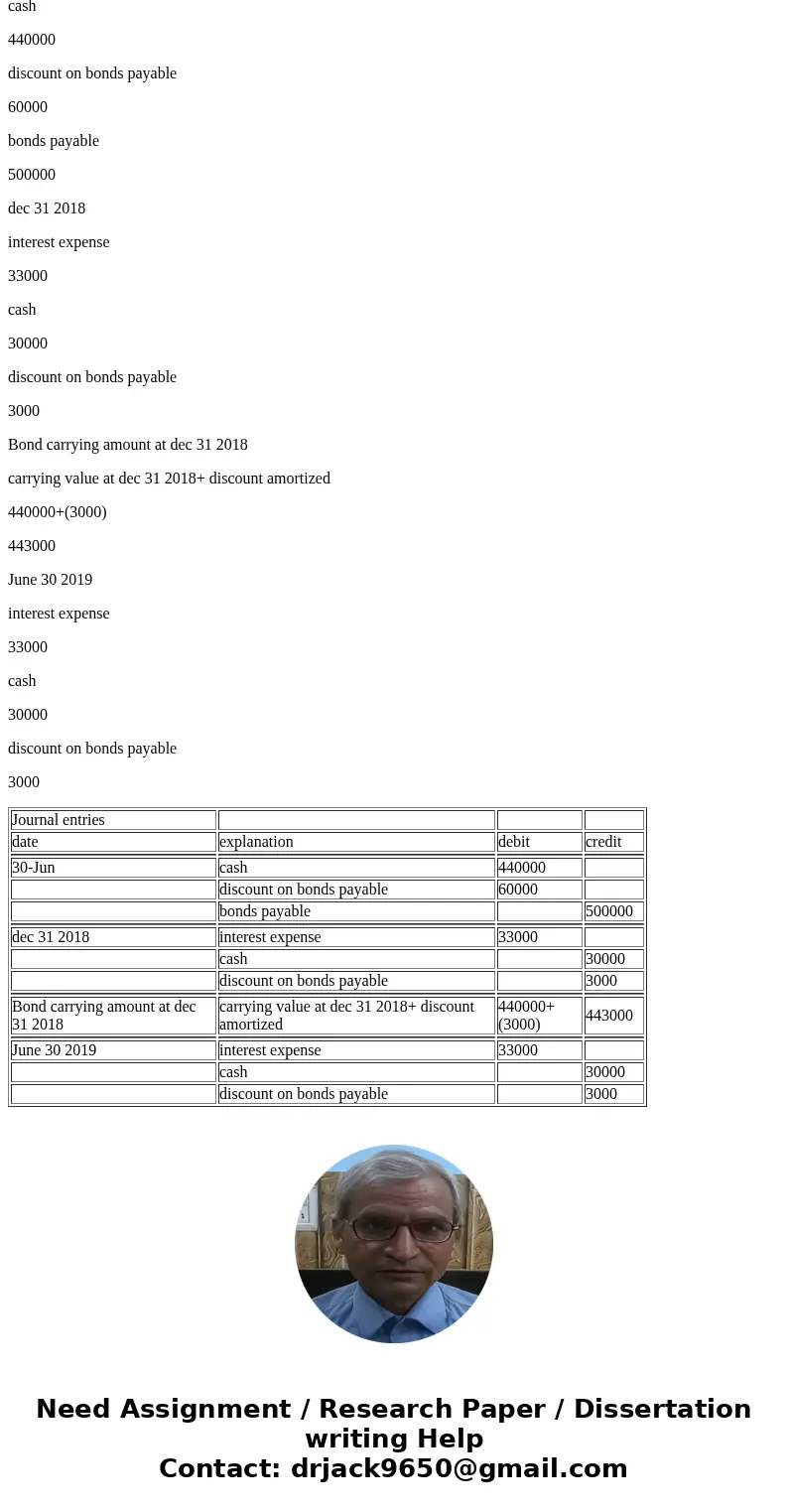

| Journal entries | |||

| date | explanation | debit | credit |

| 30-Jun | cash | 440000 | |

| discount on bonds payable | 60000 | ||

| bonds payable | 500000 | ||

| dec 31 2018 | interest expense | 33000 | |

| cash | 30000 | ||

| discount on bonds payable | 3000 | ||

| Bond carrying amount at dec 31 2018 | carrying value at dec 31 2018+ discount amortized | 440000+(3000) | 443000 |

| June 30 2019 | interest expense | 33000 | |

| cash | 30000 | ||

| discount on bonds payable | 3000 |

Homework Sourse

Homework Sourse