I WILL HELP RATE FULL ANSWERS 5 The Buy relationship in the

I WILL HELP RATE FULL ANSWERS!

5. The Buy relationship in the following E-R model is transformed into a relational model as follows. Is there any problem with this transformation? If so, discuss the problems) and make corrections. Phone Email Address Name Contact Ticket No Person Ticket Price Buy Date Buy Employee Customer Type DateOf Hire Salary EmHistory Member Password Login Name Customer ID Type Ticket No Buy Date Ticket Ticket No PriceSolution

Part A). Soution:- Calculation of conventional pay back period of Option A :-

Initial investment = $ 4500.

Conventional pay back period of Option A lies between Year 3 and Year 4. Thus, by interpolation, Conventional payback period of Option A is calculated as follows:-

Conventional pay back period = 3 + (4500 - 4400) / 1700

= 3 + 100 / 1700

= 3 + 0.06

= 3.06 Years (Rounded off to 3 Years.)

Part B). Soution:- Calculation of conventional pay back period of Option B :-

Initial investment = $ 3800.

Conventional pay back period of Option B lies between Year 3 and Year 4. Thus, by interpolation, Conventional payback period of Option B is calculated as follows:-

Conventional pay back period = 3 + (3800 - 2800) / 1700

= 3 + 1000 / 1700

= 3 + 0.59

= 3.59 Years

Conclusion:- As the conventional pay back period of Option A is less than that of Option B, accordingly, Option A will be selected on the basis of conventional pay back criterion.

Part C). Solution:- Calculation of present worth of Option A :-

Initial investment = $ 4500.

Present worth of Option A = 4571.44 - 4500 = $ 71.44

Part D). Solution:- Calculation of present worth of Option B :-

Initial investment = $ 3800.

Present worth of Option B = 3174.70 - 3800 = (-) 625.30

(On the basis of present worth criterion, Option A will be selected because the present worth of Option A is positive whereas the present worth of option B is in negative.)

Conclusion:- Option A will be selected on the basis of present worth criterion.

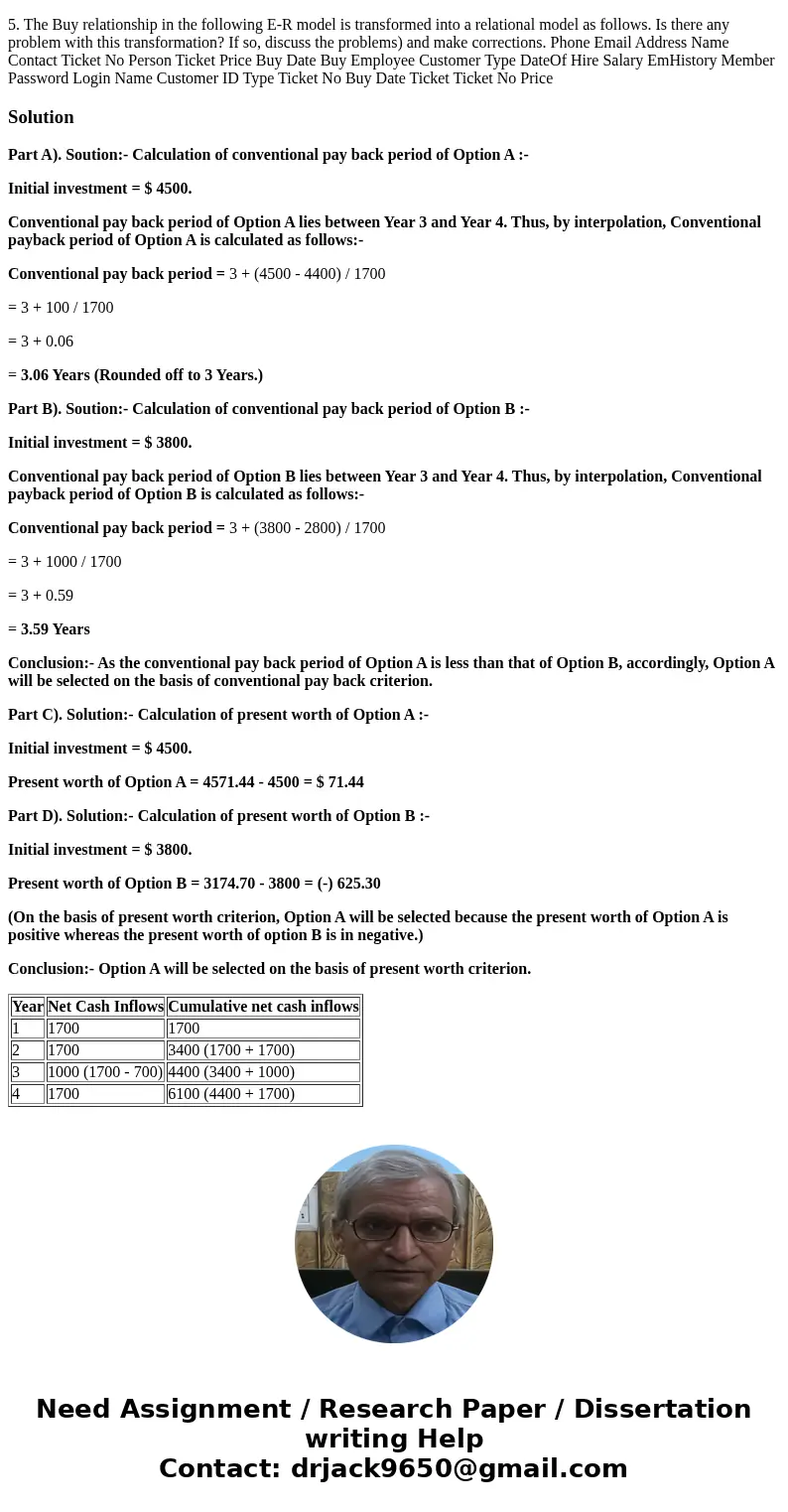

| Year | Net Cash Inflows | Cumulative net cash inflows |

| 1 | 1700 | 1700 |

| 2 | 1700 | 3400 (1700 + 1700) |

| 3 | 1000 (1700 - 700) | 4400 (3400 + 1000) |

| 4 | 1700 | 6100 (4400 + 1700) |

Homework Sourse

Homework Sourse