P1 The following information pertains to the payrolls of A C

P1. The following information pertains to the payrolls of A Company for the month of July 2017: ployee Wage earned State/local Wage earned in July 2017 Em Federal Income By 6/30/2017 Tax ncome laxes $ l 10,000 $900 250 50 $18,000 Jane Tom Bill 60,000 6,000 10,000 1,100 $2,500 1,200 300 Actual state unemployment tax rate is 4%, while the federal unemployment tax rate is 0.08%. The taxable income limit for social security tax is $118,000/person, year, while the taxable income limit for SUTA and FUTA is $7,000/ person, year. Instructions: Prepare the necessary journal entries for July payrolls of A Company if salaries and wages are paid in cash after withholding all payroll taxes and dues.

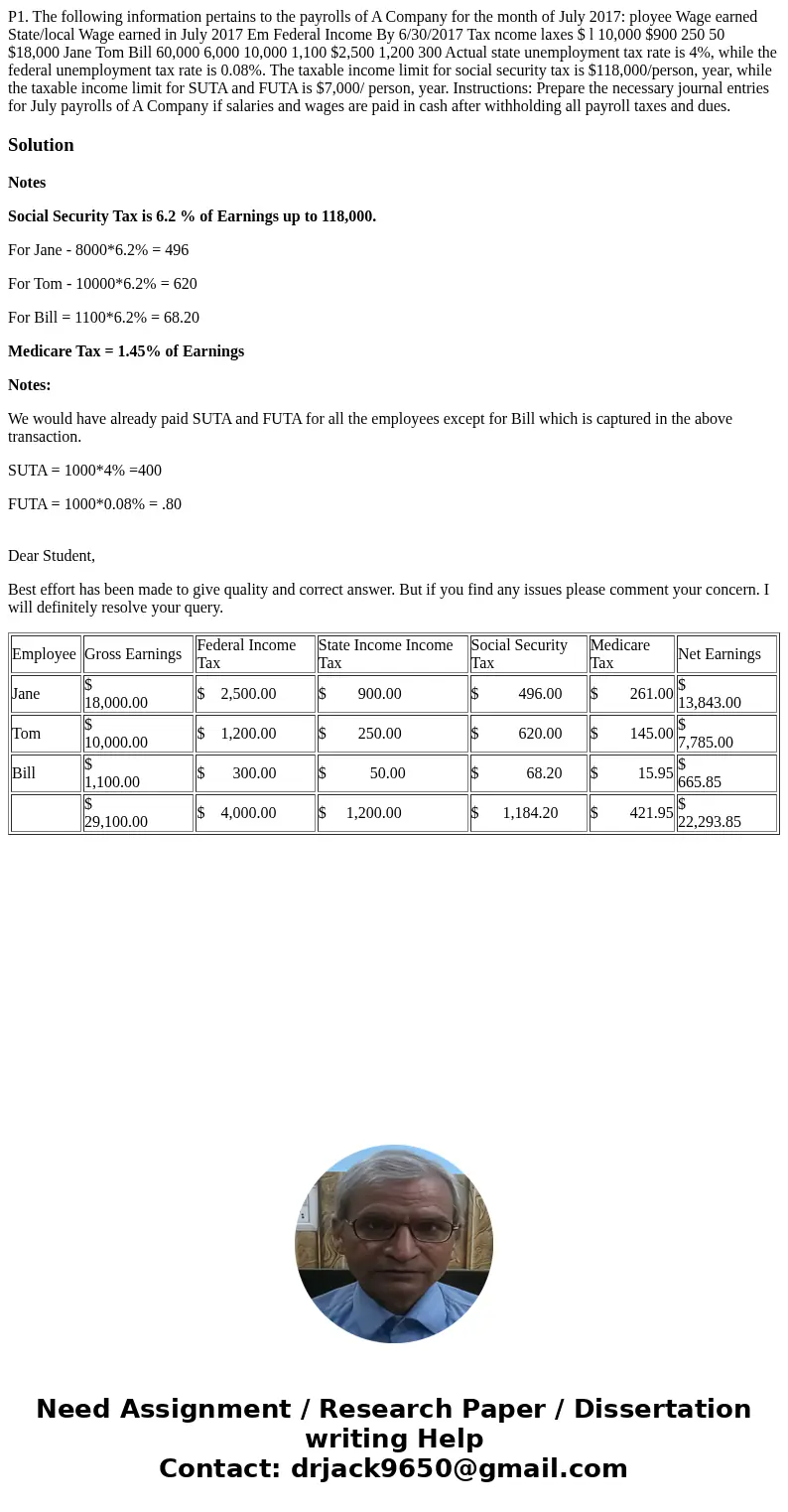

Solution

Notes

Social Security Tax is 6.2 % of Earnings up to 118,000.

For Jane - 8000*6.2% = 496

For Tom - 10000*6.2% = 620

For Bill = 1100*6.2% = 68.20

Medicare Tax = 1.45% of Earnings

Notes:

We would have already paid SUTA and FUTA for all the employees except for Bill which is captured in the above transaction.

SUTA = 1000*4% =400

FUTA = 1000*0.08% = .80

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

| Employee | Gross Earnings | Federal Income Tax | State Income Income Tax | Social Security Tax | Medicare Tax | Net Earnings |

| Jane | $ 18,000.00 | $ 2,500.00 | $ 900.00 | $ 496.00 | $ 261.00 | $ 13,843.00 |

| Tom | $ 10,000.00 | $ 1,200.00 | $ 250.00 | $ 620.00 | $ 145.00 | $ 7,785.00 |

| Bill | $ 1,100.00 | $ 300.00 | $ 50.00 | $ 68.20 | $ 15.95 | $ 665.85 |

| $ 29,100.00 | $ 4,000.00 | $ 1,200.00 | $ 1,184.20 | $ 421.95 | $ 22,293.85 |

Homework Sourse

Homework Sourse