In 2017 Michael has 90000 in salary from his fulltime job an

In 2017 Michael has $90,000 in salary from his full-time job and net self-employment income of $40,000 from his sole proprietorship. What is his self-employment tax? How much of it can he deduct in arriving at his AGI? Show and label calculations.

Solution

Here, Michael is a sole proprietor and therefore he is required to pay Self Employment (SE)tax @15.3% of his net earnings(after available deduction) as it exceeds $400.

This 15.3% includes 12.4% towards social security tax and 2.9% towards Medicare tax.

As per IRS, Half of 15.3% that is 7.65% is considered to be employer portion and hence available for deduction from net income for computing SE tax.

Therefore 92.35%( 100 - 7.65 ) earnings are considered for computing SE tax.

SE tax = $40000 * 92.35% * 15.3%

= $5652

While computing Adjusted Gross Income (AGI), he can deduct half of SE tax paid by him.

Therfore deduction available = $5652 / 2

= $2826

Tax Deductible portion for Form 1040 (5652 / 2 )

That is deduction available for arriving at Adjusted Gross Income

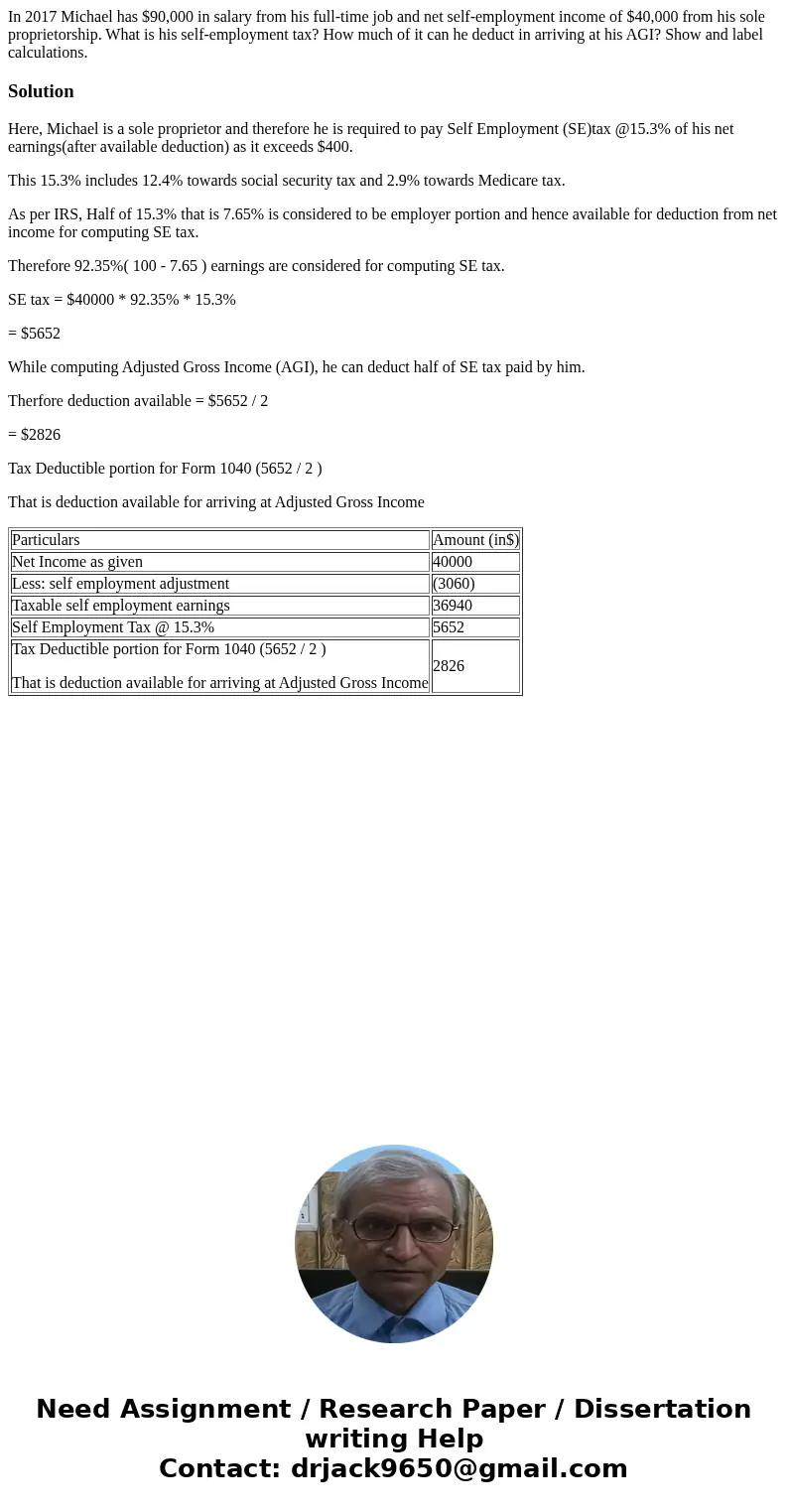

| Particulars | Amount (in$) |

| Net Income as given | 40000 |

| Less: self employment adjustment | (3060) |

| Taxable self employment earnings | 36940 |

| Self Employment Tax @ 15.3% | 5652 |

| Tax Deductible portion for Form 1040 (5652 / 2 ) That is deduction available for arriving at Adjusted Gross Income | 2826 |

Homework Sourse

Homework Sourse