1000 points Harris Company manufactures and sells a single p

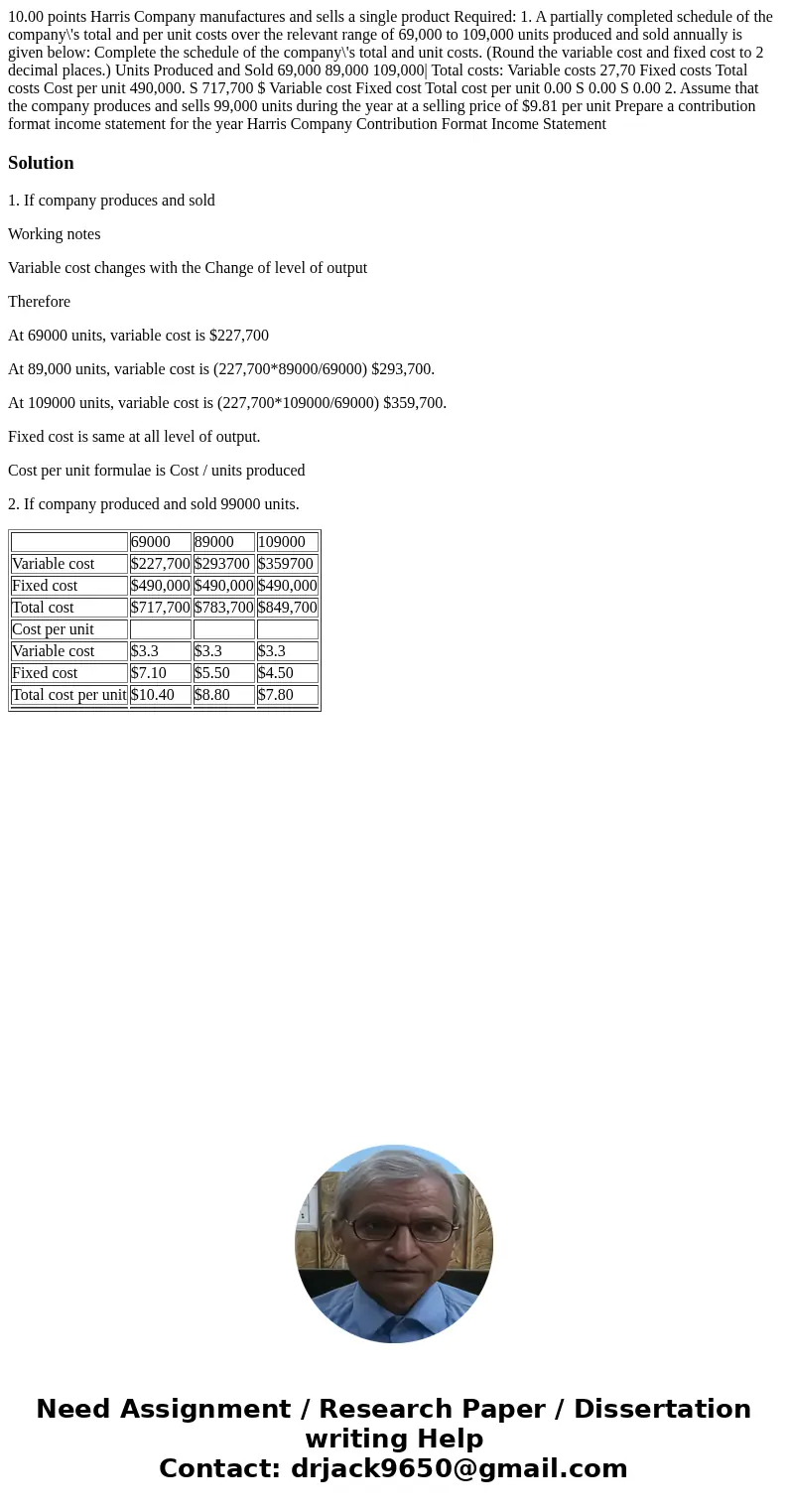

10.00 points Harris Company manufactures and sells a single product Required: 1. A partially completed schedule of the company\'s total and per unit costs over the relevant range of 69,000 to 109,000 units produced and sold annually is given below: Complete the schedule of the company\'s total and unit costs. (Round the variable cost and fixed cost to 2 decimal places.) Units Produced and Sold 69,000 89,000 109,000| Total costs: Variable costs 27,70 Fixed costs Total costs Cost per unit 490,000. S 717,700 $ Variable cost Fixed cost Total cost per unit 0.00 S 0.00 S 0.00 2. Assume that the company produces and sells 99,000 units during the year at a selling price of $9.81 per unit Prepare a contribution format income statement for the year Harris Company Contribution Format Income Statement

Solution

1. If company produces and sold

Working notes

Variable cost changes with the Change of level of output

Therefore

At 69000 units, variable cost is $227,700

At 89,000 units, variable cost is (227,700*89000/69000) $293,700.

At 109000 units, variable cost is (227,700*109000/69000) $359,700.

Fixed cost is same at all level of output.

Cost per unit formulae is Cost / units produced

2. If company produced and sold 99000 units.

| 69000 | 89000 | 109000 | |

| Variable cost | $227,700 | $293700 | $359700 |

| Fixed cost | $490,000 | $490,000 | $490,000 |

| Total cost | $717,700 | $783,700 | $849,700 |

| Cost per unit | |||

| Variable cost | $3.3 | $3.3 | $3.3 |

| Fixed cost | $7.10 | $5.50 | $4.50 |

| Total cost per unit | $10.40 | $8.80 | $7.80 |

Homework Sourse

Homework Sourse