Tiehen Corporation uses a joborder costing system to assign

Solution

Transactions

Cash

Raw Materials

Work in Process

Finished Goods

Manufacturing overhead

PP&E (net)

=

Accounts payable

Retained Earnings

Beginning balances, April 1

$ 10,200.00

$ 4,200.00

$ 15,200.00

$ 19,200.00

$ 0.00

$ 229,200.00

=

$ 15,100.00

$ 262,900.00

1

$ 66,200.00

$ 66,200.00

2

-$ 50,200.00

$ 50,200.00

3

-$ 7,100.00

$ 7,100.00

4

-$ 95,200.00

$ 95,200.00

5

-$ 25,200.00

$ 25,200.00

6

-$ 30,200.00

-$ 30,200.00

7

$ 12,200.00

$ 12,200.00

8

$ 10,200.00

-$ 10,200.00

9

-$ 2,100.00

-$ 2,100.00

10

-$ 15,200.00

-$ 15,200.00

11

$ 57,600.00

-$ 57,600.00

12

-$ 196,200.00

$ 196,200.00

13

$ 273,000.00

$ 273,000.00

14

-$ 205,000.00

-$ 205,000.00

15

-$ 81,200.00

-$ 81,200.00

16

$ 2,900.00

$ 2,900.00

Ending balances at April 30

$ 36,200.00

$ 13,100.00

$ 22,000.00

$ 10,400.00

$ 0.00

$ 216,900.00

$ 0.00

$ 12,300.00

$ 286,300.00

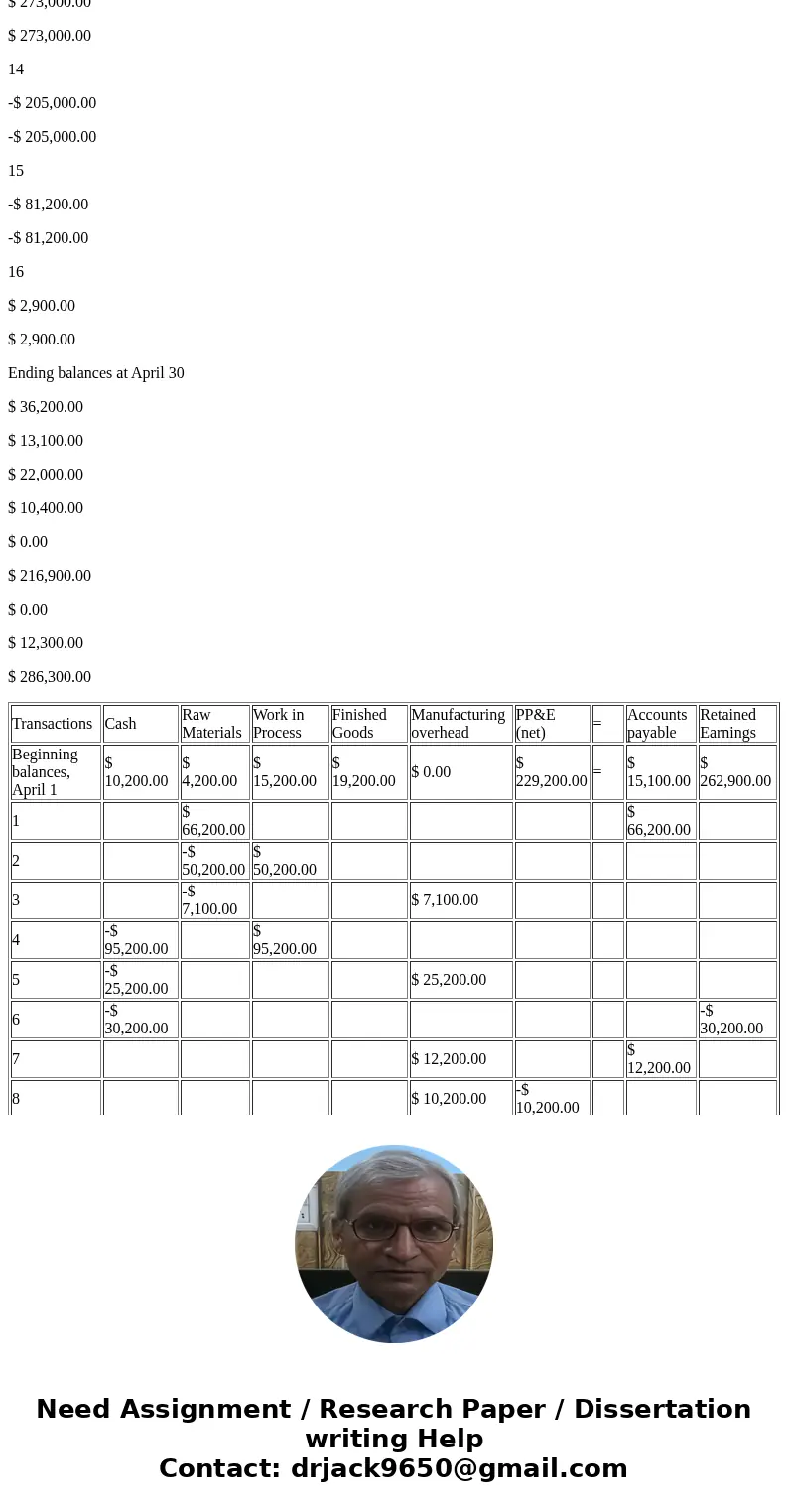

| Transactions | Cash | Raw Materials | Work in Process | Finished Goods | Manufacturing overhead | PP&E (net) | = | Accounts payable | Retained Earnings |

| Beginning balances, April 1 | $ 10,200.00 | $ 4,200.00 | $ 15,200.00 | $ 19,200.00 | $ 0.00 | $ 229,200.00 | = | $ 15,100.00 | $ 262,900.00 |

| 1 | $ 66,200.00 | $ 66,200.00 | |||||||

| 2 | -$ 50,200.00 | $ 50,200.00 | |||||||

| 3 | -$ 7,100.00 | $ 7,100.00 | |||||||

| 4 | -$ 95,200.00 | $ 95,200.00 | |||||||

| 5 | -$ 25,200.00 | $ 25,200.00 | |||||||

| 6 | -$ 30,200.00 | -$ 30,200.00 | |||||||

| 7 | $ 12,200.00 | $ 12,200.00 | |||||||

| 8 | $ 10,200.00 | -$ 10,200.00 | |||||||

| 9 | -$ 2,100.00 | -$ 2,100.00 | |||||||

| 10 | -$ 15,200.00 | -$ 15,200.00 | |||||||

| 11 | $ 57,600.00 | -$ 57,600.00 | |||||||

| 12 | -$ 196,200.00 | $ 196,200.00 | |||||||

| 13 | $ 273,000.00 | $ 273,000.00 | |||||||

| 14 | -$ 205,000.00 | -$ 205,000.00 | |||||||

| 15 | -$ 81,200.00 | -$ 81,200.00 | |||||||

| 16 | $ 2,900.00 | $ 2,900.00 | |||||||

| Ending balances at April 30 | $ 36,200.00 | $ 13,100.00 | $ 22,000.00 | $ 10,400.00 | $ 0.00 | $ 216,900.00 | $ 0.00 | $ 12,300.00 | $ 286,300.00 |

Homework Sourse

Homework Sourse