3 Dersch Co purchased a machine on January 1 2014 for 150000

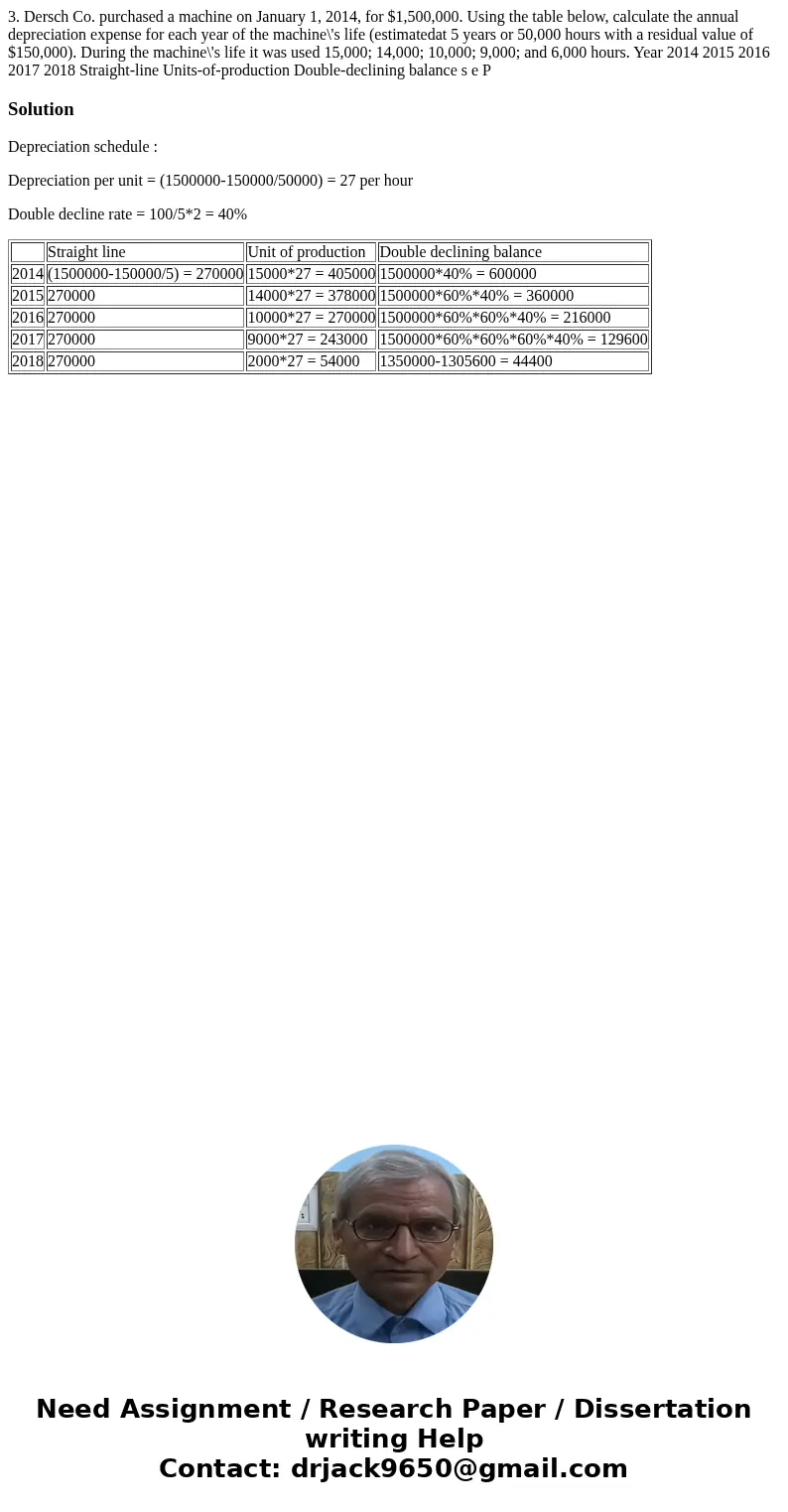

3. Dersch Co. purchased a machine on January 1, 2014, for $1,500,000. Using the table below, calculate the annual depreciation expense for each year of the machine\'s life (estimatedat 5 years or 50,000 hours with a residual value of $150,000). During the machine\'s life it was used 15,000; 14,000; 10,000; 9,000; and 6,000 hours. Year 2014 2015 2016 2017 2018 Straight-line Units-of-production Double-declining balance s e P

Solution

Depreciation schedule :

Depreciation per unit = (1500000-150000/50000) = 27 per hour

Double decline rate = 100/5*2 = 40%

| Straight line | Unit of production | Double declining balance | |

| 2014 | (1500000-150000/5) = 270000 | 15000*27 = 405000 | 1500000*40% = 600000 |

| 2015 | 270000 | 14000*27 = 378000 | 1500000*60%*40% = 360000 |

| 2016 | 270000 | 10000*27 = 270000 | 1500000*60%*60%*40% = 216000 |

| 2017 | 270000 | 9000*27 = 243000 | 1500000*60%*60%*60%*40% = 129600 |

| 2018 | 270000 | 2000*27 = 54000 | 1350000-1305600 = 44400 |

Homework Sourse

Homework Sourse