Class time TTH 9 NPV 55 points Your company is undertaking a

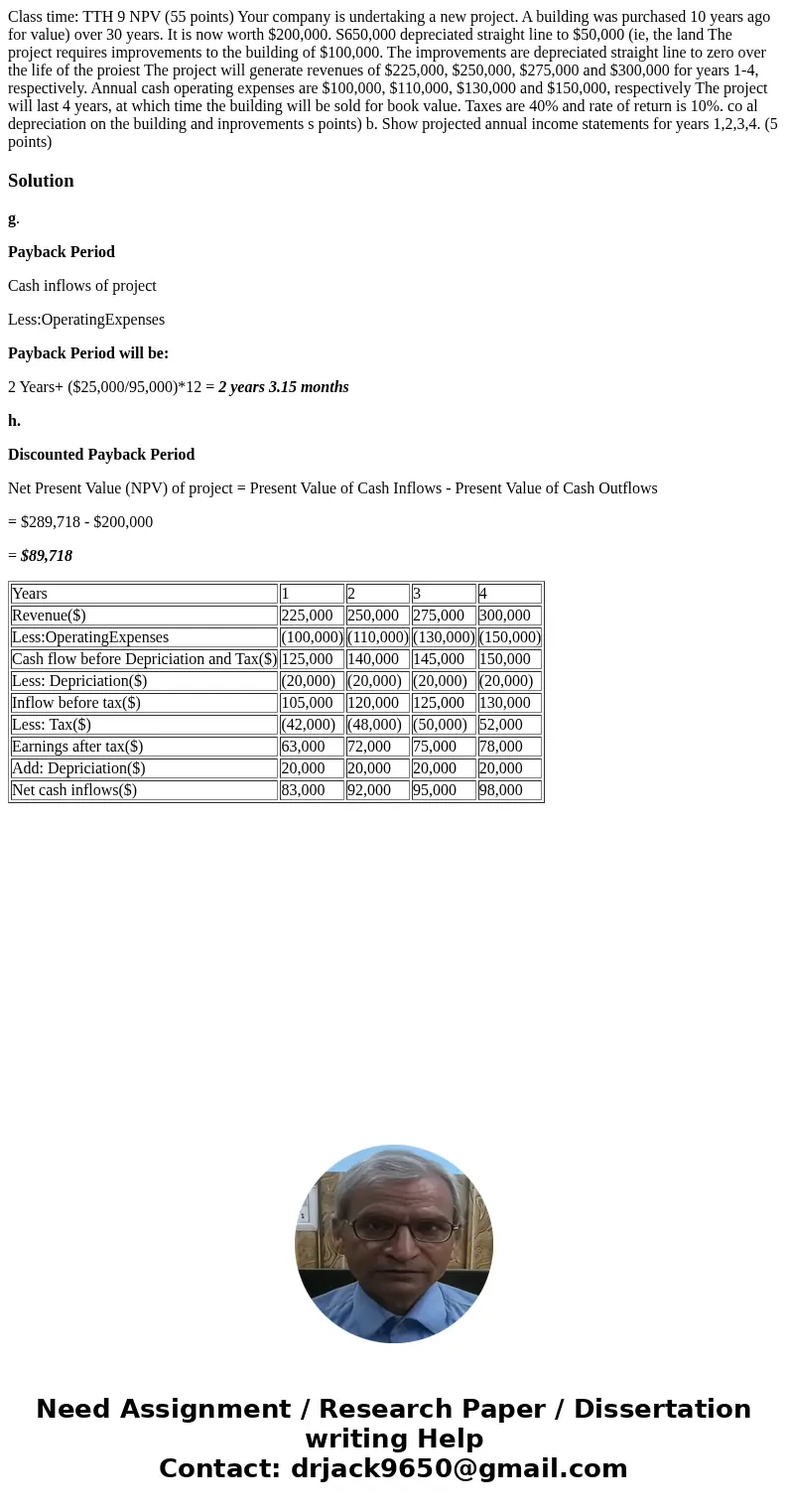

Class time: TTH 9 NPV (55 points) Your company is undertaking a new project. A building was purchased 10 years ago for value) over 30 years. It is now worth $200,000. S650,000 depreciated straight line to $50,000 (ie, the land The project requires improvements to the building of $100,000. The improvements are depreciated straight line to zero over the life of the proiest The project will generate revenues of $225,000, $250,000, $275,000 and $300,000 for years 1-4, respectively. Annual cash operating expenses are $100,000, $110,000, $130,000 and $150,000, respectively The project will last 4 years, at which time the building will be sold for book value. Taxes are 40% and rate of return is 10%. co al depreciation on the building and inprovements s points) b. Show projected annual income statements for years 1,2,3,4. (5 points)

Solution

g.

Payback Period

Cash inflows of project

Less:OperatingExpenses

Payback Period will be:

2 Years+ ($25,000/95,000)*12 = 2 years 3.15 months

h.

Discounted Payback Period

Net Present Value (NPV) of project = Present Value of Cash Inflows - Present Value of Cash Outflows

= $289,718 - $200,000

= $89,718

| Years | 1 | 2 | 3 | 4 |

| Revenue($) | 225,000 | 250,000 | 275,000 | 300,000 |

| Less:OperatingExpenses | (100,000) | (110,000) | (130,000) | (150,000) |

| Cash flow before Depriciation and Tax($) | 125,000 | 140,000 | 145,000 | 150,000 |

| Less: Depriciation($) | (20,000) | (20,000) | (20,000) | (20,000) |

| Inflow before tax($) | 105,000 | 120,000 | 125,000 | 130,000 |

| Less: Tax($) | (42,000) | (48,000) | (50,000) | 52,000 |

| Earnings after tax($) | 63,000 | 72,000 | 75,000 | 78,000 |

| Add: Depriciation($) | 20,000 | 20,000 | 20,000 | 20,000 |

| Net cash inflows($) | 83,000 | 92,000 | 95,000 | 98,000 |

Homework Sourse

Homework Sourse