The adjustments columns of the worksheet for Becker Company

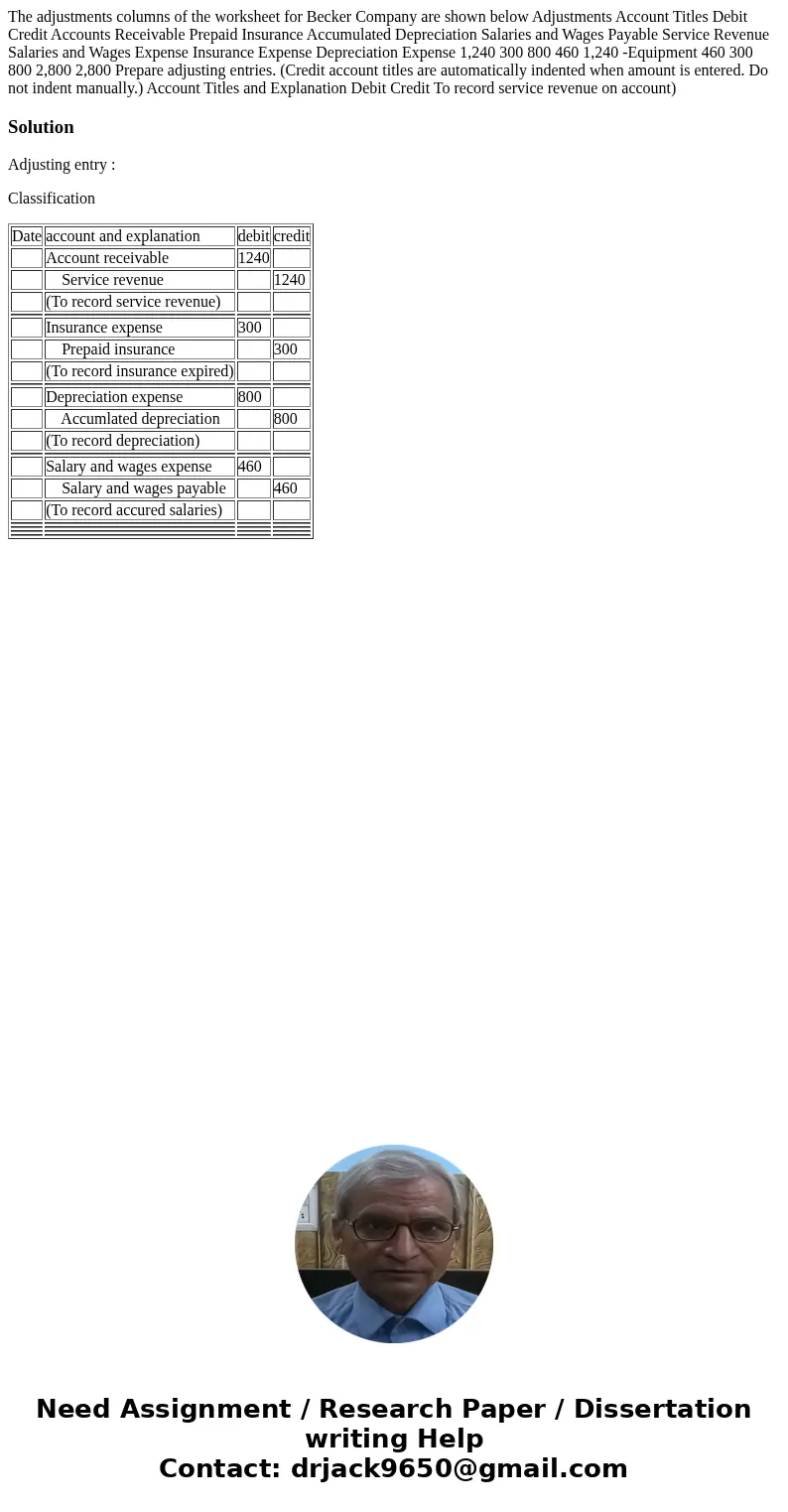

The adjustments columns of the worksheet for Becker Company are shown below Adjustments Account Titles Debit Credit Accounts Receivable Prepaid Insurance Accumulated Depreciation Salaries and Wages Payable Service Revenue Salaries and Wages Expense Insurance Expense Depreciation Expense 1,240 300 800 460 1,240 -Equipment 460 300 800 2,800 2,800 Prepare adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit To record service revenue on account)

Solution

Adjusting entry :

Classification

| Date | account and explanation | debit | credit |

| Account receivable | 1240 | ||

| Service revenue | 1240 | ||

| (To record service revenue) | |||

| Insurance expense | 300 | ||

| Prepaid insurance | 300 | ||

| (To record insurance expired) | |||

| Depreciation expense | 800 | ||

| Accumlated depreciation | 800 | ||

| (To record depreciation) | |||

| Salary and wages expense | 460 | ||

| Salary and wages payable | 460 | ||

| (To record accured salaries) | |||

Homework Sourse

Homework Sourse