For fiscal year 2014 calculate use two decimal points a The

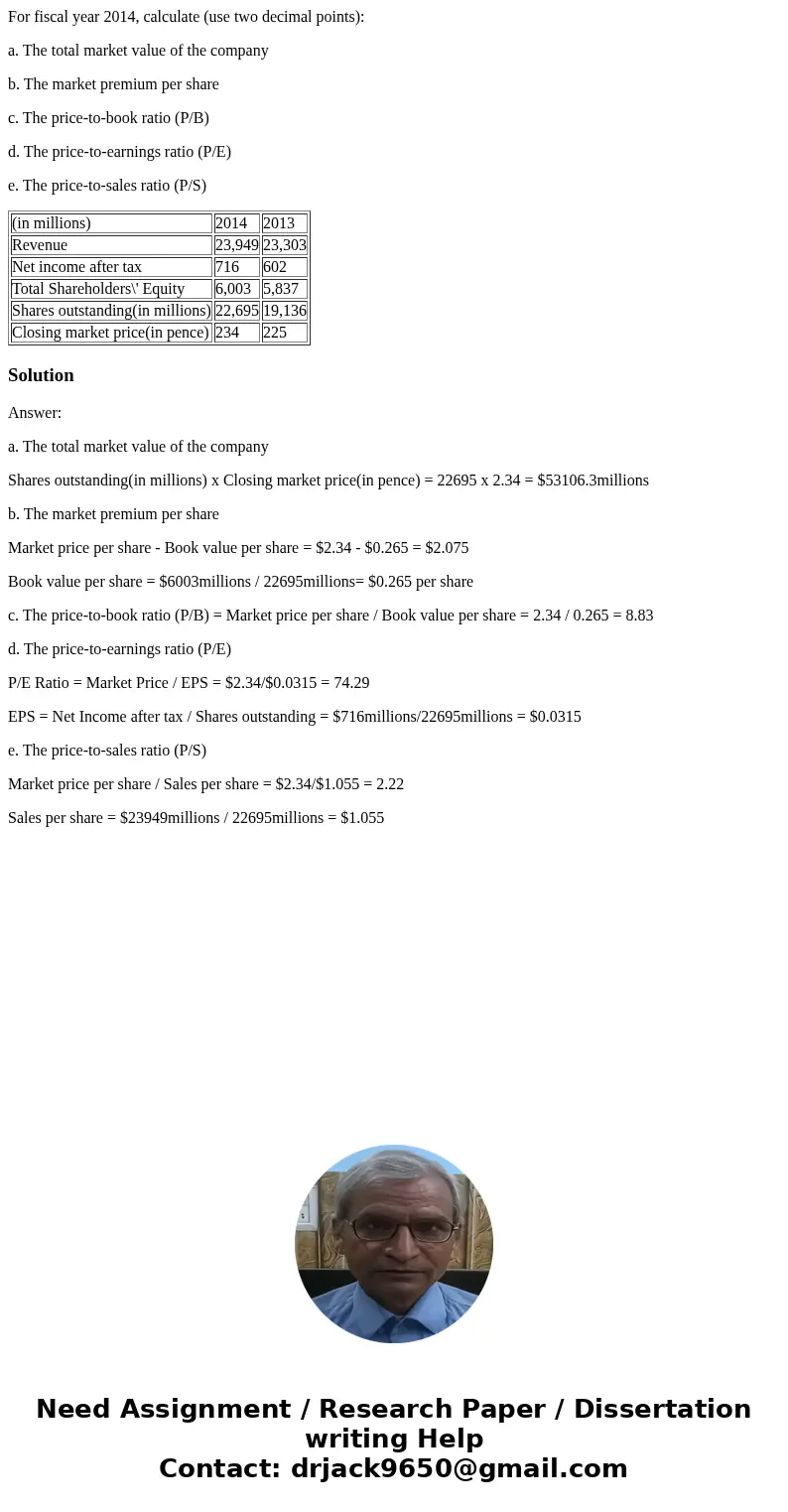

For fiscal year 2014, calculate (use two decimal points):

a. The total market value of the company

b. The market premium per share

c. The price-to-book ratio (P/B)

d. The price-to-earnings ratio (P/E)

e. The price-to-sales ratio (P/S)

| (in millions) | 2014 | 2013 |

| Revenue | 23,949 | 23,303 |

| Net income after tax | 716 | 602 |

| Total Shareholders\' Equity | 6,003 | 5,837 |

| Shares outstanding(in millions) | 22,695 | 19,136 |

| Closing market price(in pence) | 234 | 225 |

Solution

Answer:

a. The total market value of the company

Shares outstanding(in millions) x Closing market price(in pence) = 22695 x 2.34 = $53106.3millions

b. The market premium per share

Market price per share - Book value per share = $2.34 - $0.265 = $2.075

Book value per share = $6003millions / 22695millions= $0.265 per share

c. The price-to-book ratio (P/B) = Market price per share / Book value per share = 2.34 / 0.265 = 8.83

d. The price-to-earnings ratio (P/E)

P/E Ratio = Market Price / EPS = $2.34/$0.0315 = 74.29

EPS = Net Income after tax / Shares outstanding = $716millions/22695millions = $0.0315

e. The price-to-sales ratio (P/S)

Market price per share / Sales per share = $2.34/$1.055 = 2.22

Sales per share = $23949millions / 22695millions = $1.055

Homework Sourse

Homework Sourse