P171A SolutionAnswer Transaction Statement of Cash Flows Act

P17-1A

Solution

Answer-

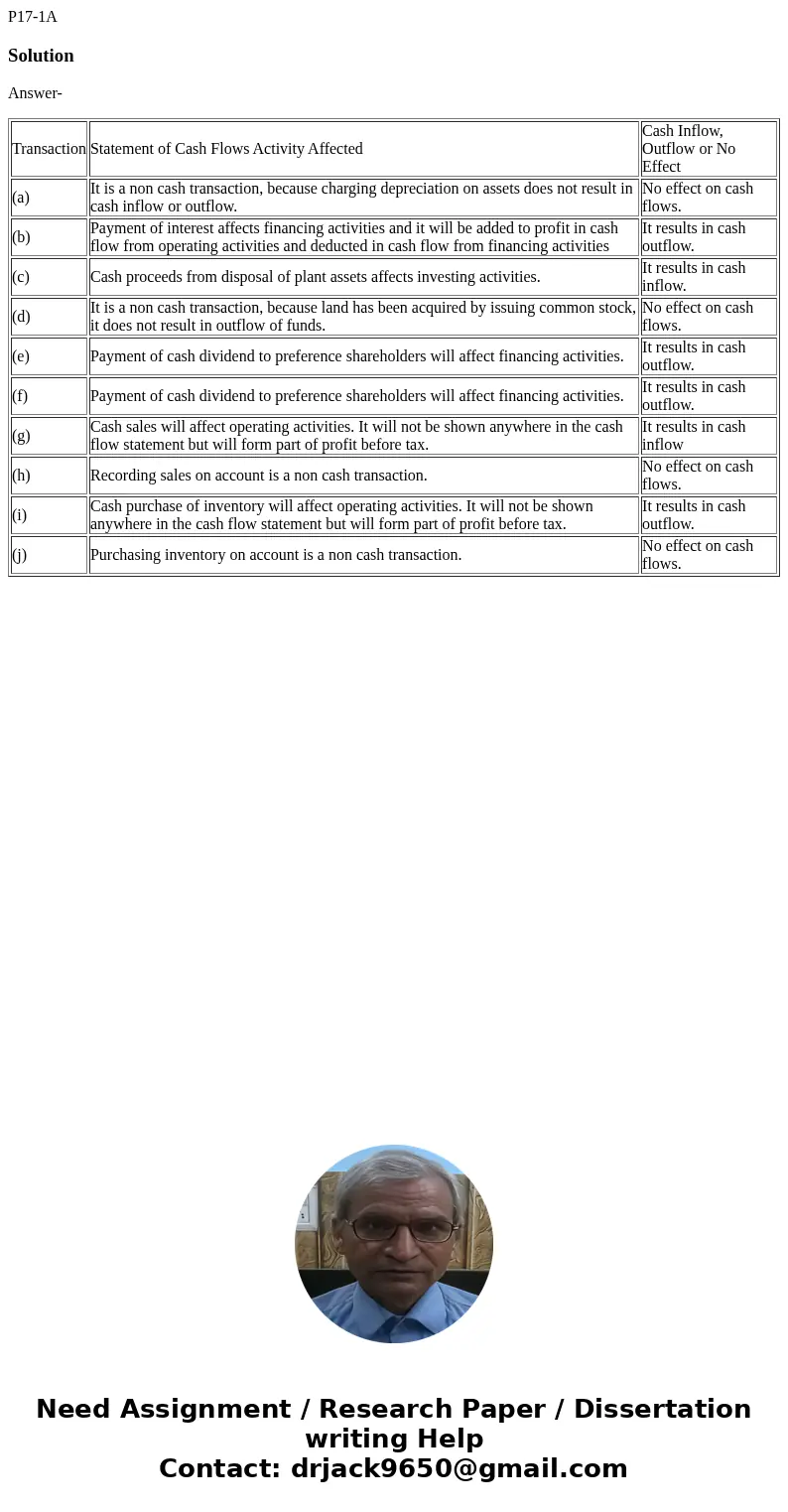

| Transaction | Statement of Cash Flows Activity Affected | Cash Inflow, Outflow or No Effect |

| (a) | It is a non cash transaction, because charging depreciation on assets does not result in cash inflow or outflow. | No effect on cash flows. |

| (b) | Payment of interest affects financing activities and it will be added to profit in cash flow from operating activities and deducted in cash flow from financing activities | It results in cash outflow. |

| (c) | Cash proceeds from disposal of plant assets affects investing activities. | It results in cash inflow. |

| (d) | It is a non cash transaction, because land has been acquired by issuing common stock, it does not result in outflow of funds. | No effect on cash flows. |

| (e) | Payment of cash dividend to preference shareholders will affect financing activities. | It results in cash outflow. |

| (f) | Payment of cash dividend to preference shareholders will affect financing activities. | It results in cash outflow. |

| (g) | Cash sales will affect operating activities. It will not be shown anywhere in the cash flow statement but will form part of profit before tax. | It results in cash inflow |

| (h) | Recording sales on account is a non cash transaction. | No effect on cash flows. |

| (i) | Cash purchase of inventory will affect operating activities. It will not be shown anywhere in the cash flow statement but will form part of profit before tax. | It results in cash outflow. |

| (j) | Purchasing inventory on account is a non cash transaction. | No effect on cash flows. |

Homework Sourse

Homework Sourse