Need to answer 1002 1004 1005 101 first pic shows the proble

Need to answer 10.02, 10.04, 10.05- 10.1 (first pic shows the problem, rest of the pics are further info that may be needed)

8 Cash Budget Assume actual cash receipts and disbursements will follow the pattern below: (Note: Receivables and Payables of 12/31/x1 will have a cash impact in 20x2.) 1. 22.00% of sales for the year are made in November and December. Since our customers have 60 day terms those funds will be collected be collected in January and February. 2. 80.00% of material purchases will be paid during the year, the remaining portion will be paid in Januay or February. 3. All other manufacturing and operating costs are paid for when incurred 4. The budgeted depreciation expense is equal to 0.6% of the fixed manufacturing, selling and administrative expenses. 5. Minimum Cash Balance needed for 20x2, $165,000 l See The Light Projected Cash Budget For the Year Ending December 31, 20x2 Round dollars to two places, $#### Beginning Cash Balance Cash Inflows: Sales Collections: Account Receivable (Sales last year not collected) Sales made and collected in 20x2 Cash Available 10.02 1,587,300.00 10.03 10.04 Cash Outflows: Accounts Payable (Purchases last year) Purchases made and paid for in 20x2 10.05 Other Manufacturing Costs Direct Labor Total Manufacturing Overhead Selling and Administrative Less: Depreciation 10.06 10.07 10.08 10.09 10.10 Total Cash Outflows Budgeted Cash Balance before financing Needed Minimum Balance Amount to be borrowed (if any) Budgeted Cash BalanceSolution

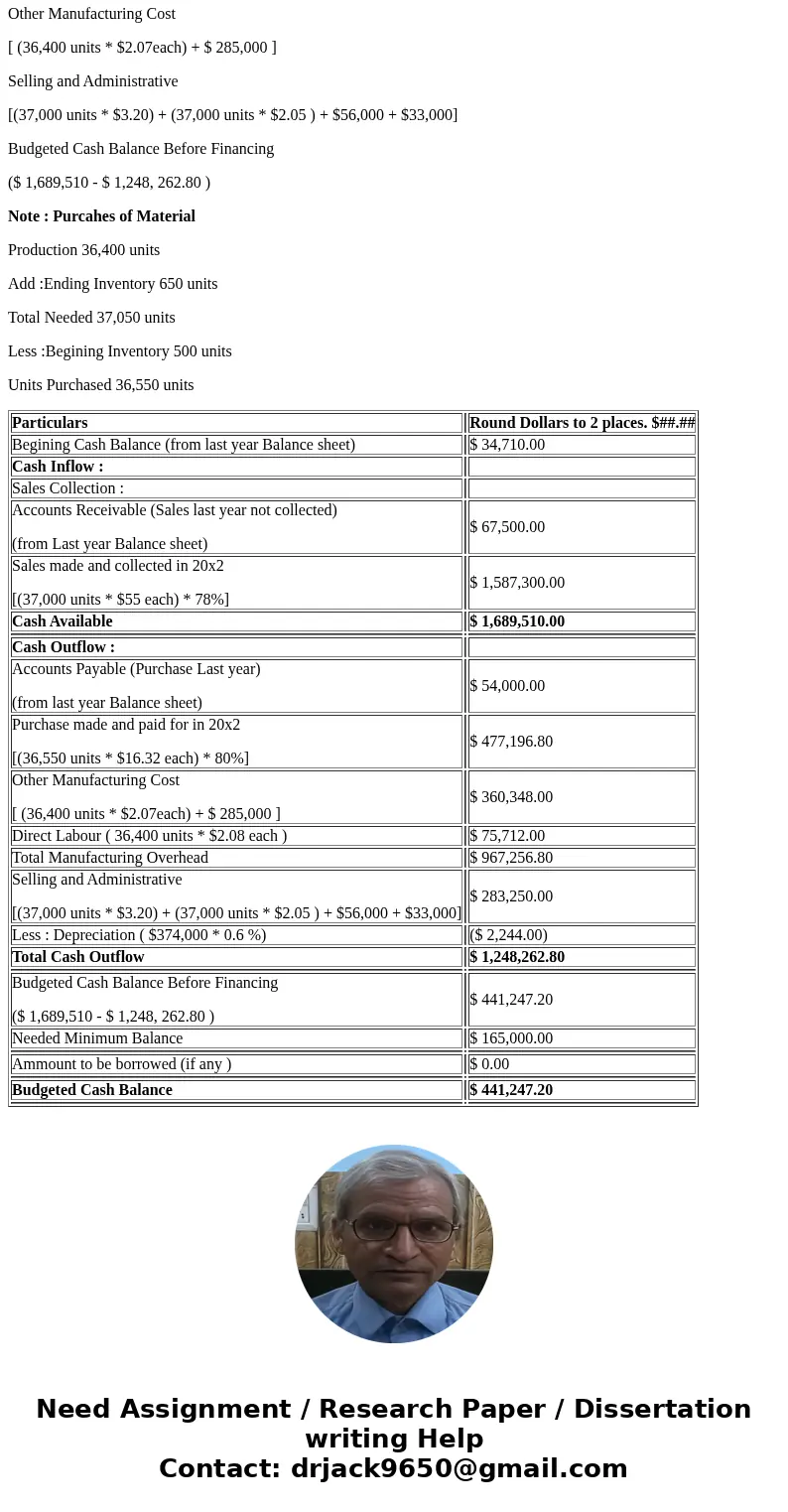

PROJECTED CASH BUDGET FOR THE YEAR ENDING DECEMBER 31, 20X2

Begining Cash Balance (from last year Balance sheet)

Accounts Receivable (Sales last year not collected)

(from Last year Balance sheet)

Sales made and collected in 20x2

[(37,000 units * $55 each) * 78%]

Accounts Payable (Purchase Last year)

(from last year Balance sheet)

Purchase made and paid for in 20x2

[(36,550 units * $16.32 each) * 80%]

Other Manufacturing Cost

[ (36,400 units * $2.07each) + $ 285,000 ]

Selling and Administrative

[(37,000 units * $3.20) + (37,000 units * $2.05 ) + $56,000 + $33,000]

Budgeted Cash Balance Before Financing

($ 1,689,510 - $ 1,248, 262.80 )

Note : Purcahes of Material

Production 36,400 units

Add :Ending Inventory 650 units

Total Needed 37,050 units

Less :Begining Inventory 500 units

Units Purchased 36,550 units

| Particulars | Round Dollars to 2 places. $##.## | |

| Begining Cash Balance (from last year Balance sheet) | $ 34,710.00 | |

| Cash Inflow : | ||

| Sales Collection : | ||

| Accounts Receivable (Sales last year not collected) (from Last year Balance sheet) | $ 67,500.00 | |

| Sales made and collected in 20x2 [(37,000 units * $55 each) * 78%] | $ 1,587,300.00 | |

| Cash Available | $ 1,689,510.00 | |

| Cash Outflow : | ||

| Accounts Payable (Purchase Last year) (from last year Balance sheet) | $ 54,000.00 | |

| Purchase made and paid for in 20x2 [(36,550 units * $16.32 each) * 80%] | $ 477,196.80 | |

| Other Manufacturing Cost [ (36,400 units * $2.07each) + $ 285,000 ] | $ 360,348.00 | |

| Direct Labour ( 36,400 units * $2.08 each ) | $ 75,712.00 | |

| Total Manufacturing Overhead | $ 967,256.80 | |

| Selling and Administrative [(37,000 units * $3.20) + (37,000 units * $2.05 ) + $56,000 + $33,000] | $ 283,250.00 | |

| Less : Depreciation ( $374,000 * 0.6 %) | ($ 2,244.00) | |

| Total Cash Outflow | $ 1,248,262.80 | |

| Budgeted Cash Balance Before Financing ($ 1,689,510 - $ 1,248, 262.80 ) | $ 441,247.20 | |

| Needed Minimum Balance | $ 165,000.00 | |

| Ammount to be borrowed (if any ) | $ 0.00 | |

| Budgeted Cash Balance | $ 441,247.20 | |

Homework Sourse

Homework Sourse