Bowen Company produces products P Q and R from a joint produ

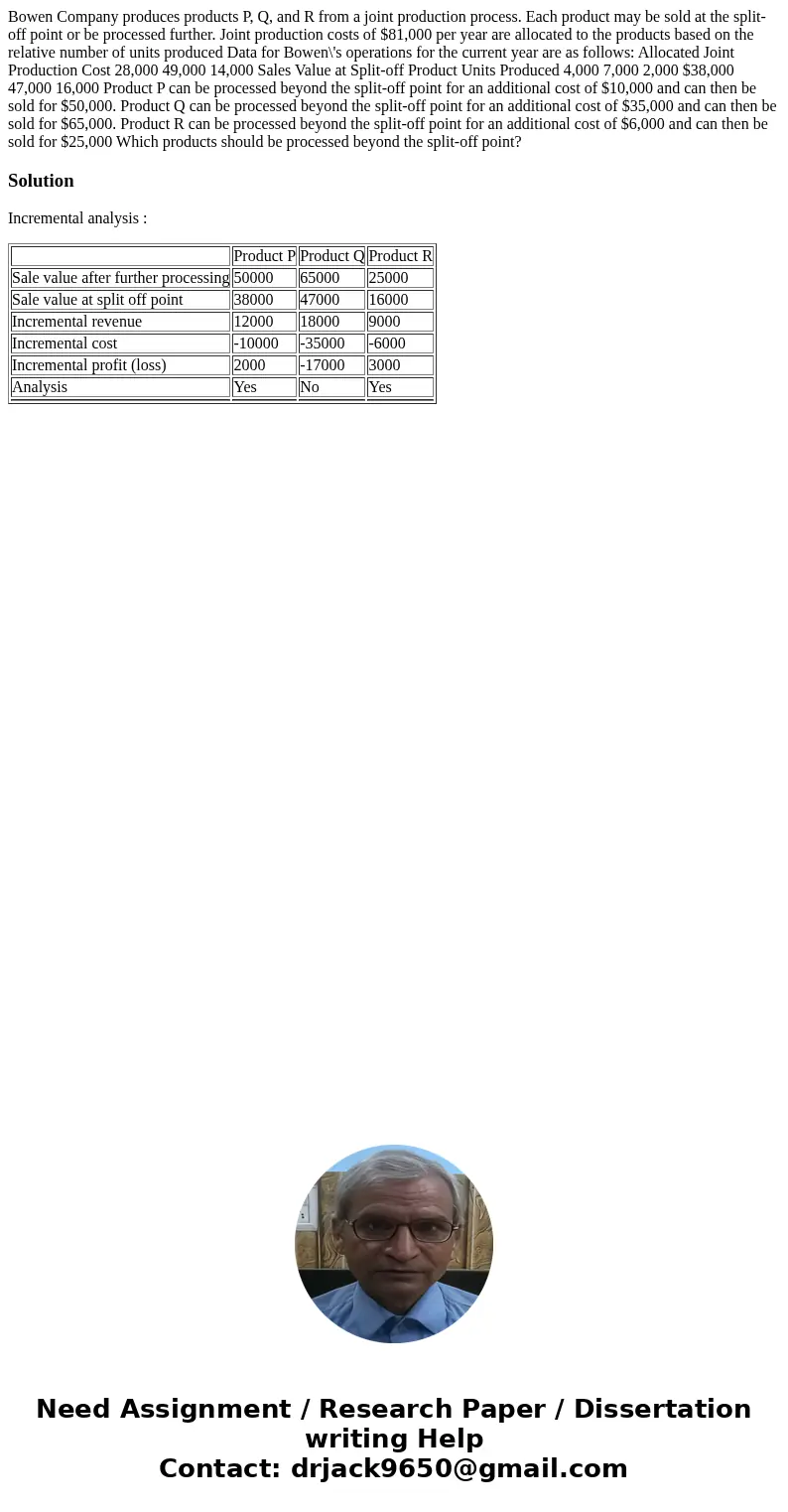

Bowen Company produces products P, Q, and R from a joint production process. Each product may be sold at the split-off point or be processed further. Joint production costs of $81,000 per year are allocated to the products based on the relative number of units produced Data for Bowen\'s operations for the current year are as follows: Allocated Joint Production Cost 28,000 49,000 14,000 Sales Value at Split-off Product Units Produced 4,000 7,000 2,000 $38,000 47,000 16,000 Product P can be processed beyond the split-off point for an additional cost of $10,000 and can then be sold for $50,000. Product Q can be processed beyond the split-off point for an additional cost of $35,000 and can then be sold for $65,000. Product R can be processed beyond the split-off point for an additional cost of $6,000 and can then be sold for $25,000 Which products should be processed beyond the split-off point?

Solution

Incremental analysis :

| Product P | Product Q | Product R | |

| Sale value after further processing | 50000 | 65000 | 25000 |

| Sale value at split off point | 38000 | 47000 | 16000 |

| Incremental revenue | 12000 | 18000 | 9000 |

| Incremental cost | -10000 | -35000 | -6000 |

| Incremental profit (loss) | 2000 | -17000 | 3000 |

| Analysis | Yes | No | Yes |

Homework Sourse

Homework Sourse