Exercise 67 Flint Corporation reports the following for the

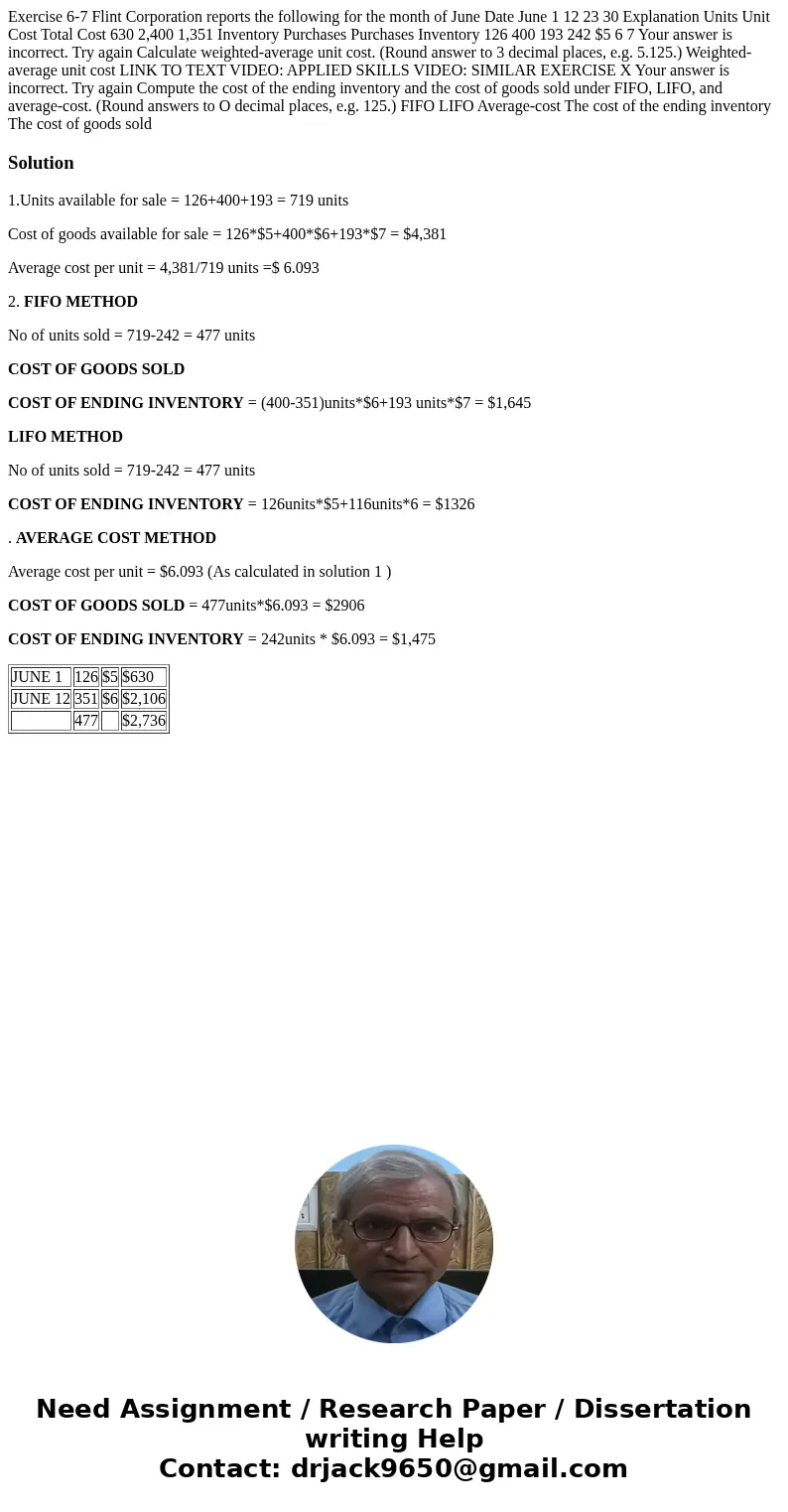

Exercise 6-7 Flint Corporation reports the following for the month of June Date June 1 12 23 30 Explanation Units Unit Cost Total Cost 630 2,400 1,351 Inventory Purchases Purchases Inventory 126 400 193 242 $5 6 7 Your answer is incorrect. Try again Calculate weighted-average unit cost. (Round answer to 3 decimal places, e.g. 5.125.) Weighted-average unit cost LINK TO TEXT VIDEO: APPLIED SKILLS VIDEO: SIMILAR EXERCISE X Your answer is incorrect. Try again Compute the cost of the ending inventory and the cost of goods sold under FIFO, LIFO, and average-cost. (Round answers to O decimal places, e.g. 125.) FIFO LIFO Average-cost The cost of the ending inventory The cost of goods sold

Solution

1.Units available for sale = 126+400+193 = 719 units

Cost of goods available for sale = 126*$5+400*$6+193*$7 = $4,381

Average cost per unit = 4,381/719 units =$ 6.093

2. FIFO METHOD

No of units sold = 719-242 = 477 units

COST OF GOODS SOLD

COST OF ENDING INVENTORY = (400-351)units*$6+193 units*$7 = $1,645

LIFO METHOD

No of units sold = 719-242 = 477 units

COST OF ENDING INVENTORY = 126units*$5+116units*6 = $1326

. AVERAGE COST METHOD

Average cost per unit = $6.093 (As calculated in solution 1 )

COST OF GOODS SOLD = 477units*$6.093 = $2906

COST OF ENDING INVENTORY = 242units * $6.093 = $1,475

| JUNE 1 | 126 | $5 | $630 |

| JUNE 12 | 351 | $6 | $2,106 |

| 477 | $2,736 |

Homework Sourse

Homework Sourse