Florence Company received a bank statement showing a balance

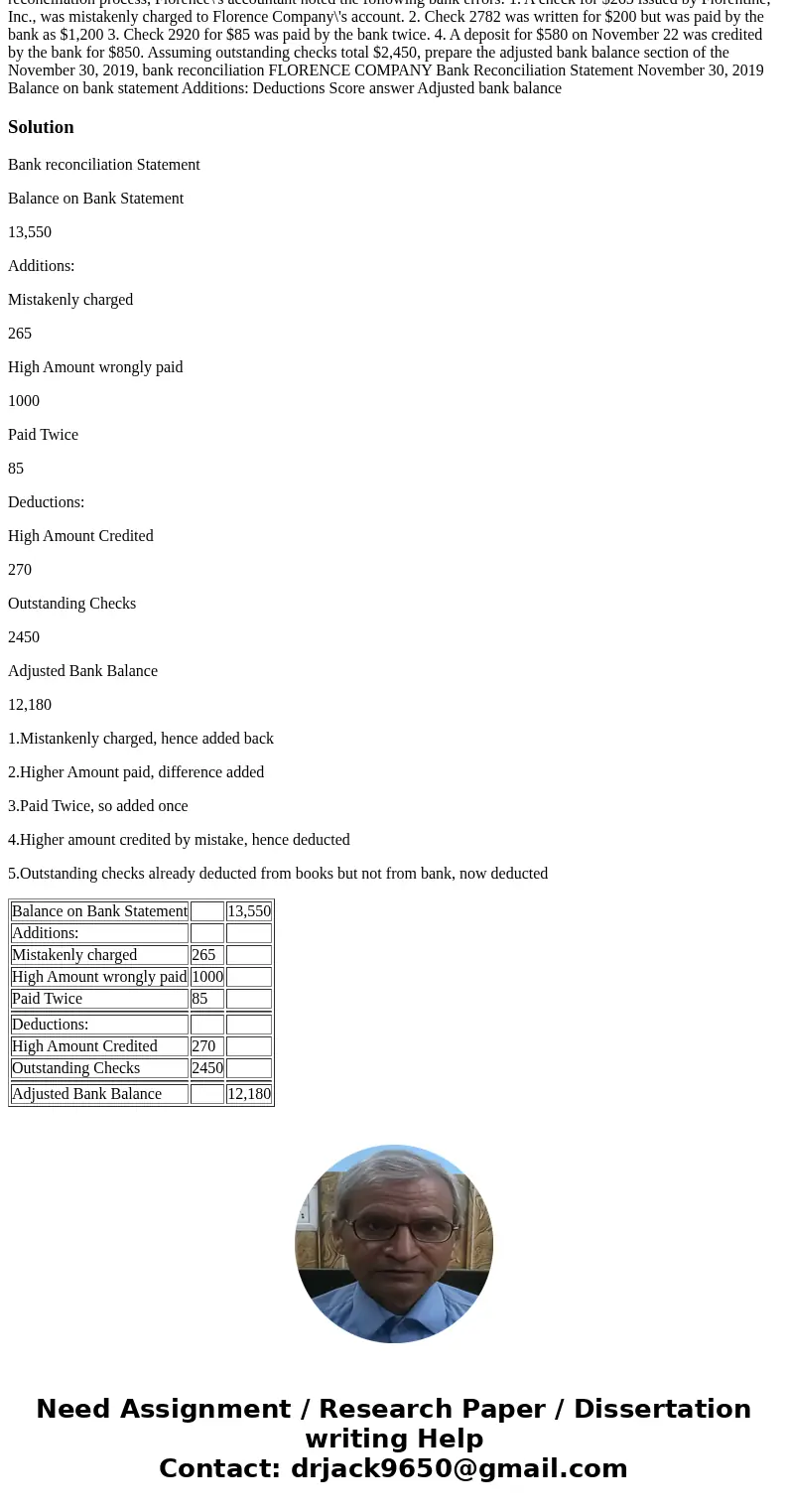

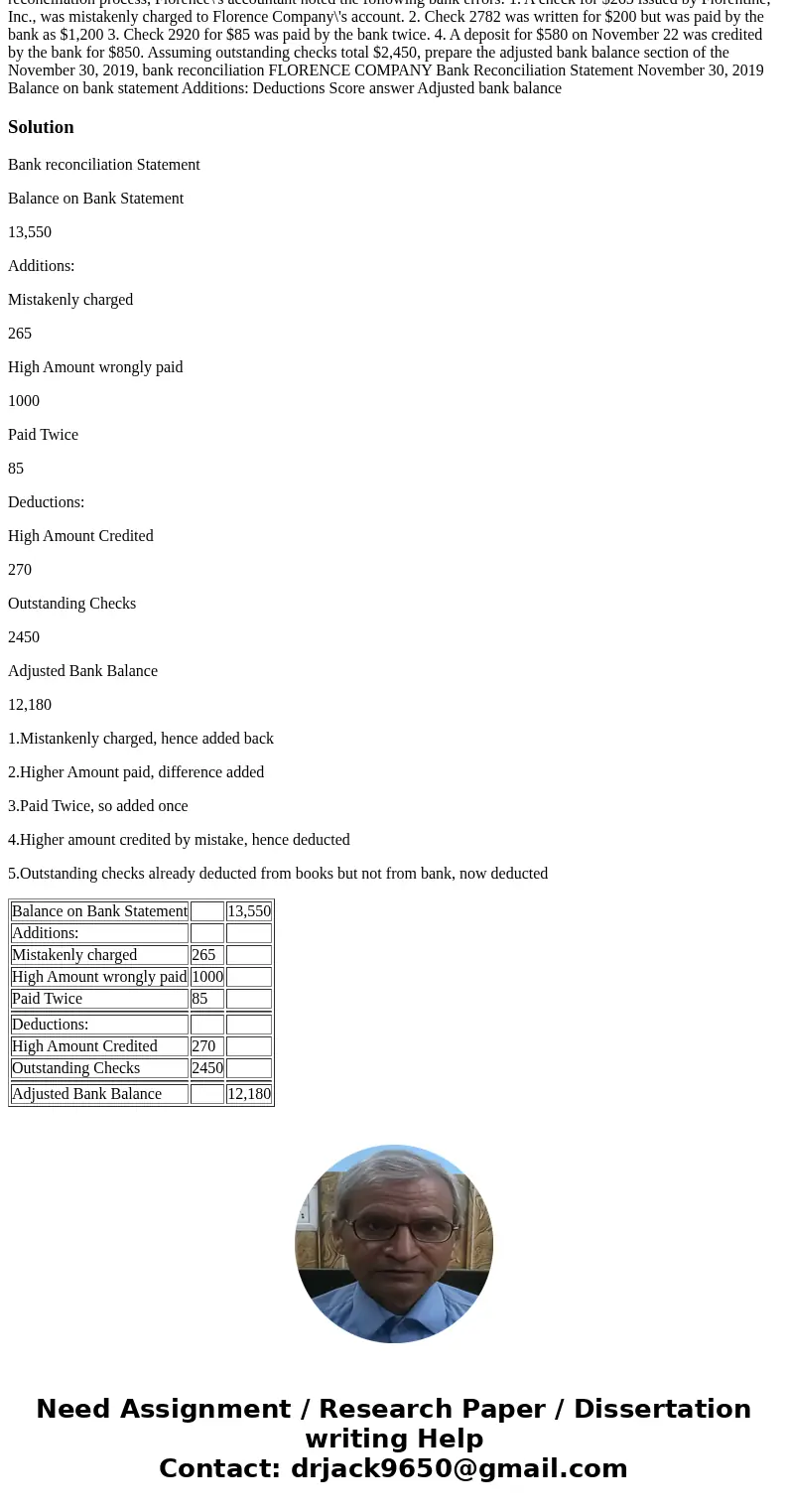

Florence Company received a bank statement showing a balance of $13,550 on November 30, 2019. During the bank reconciliation process, Florence\'s accountant noted the following bank errors: 1. A check for $265 issued by Florentine, Inc., was mistakenly charged to Florence Company\'s account. 2. Check 2782 was written for $200 but was paid by the bank as $1,200 3. Check 2920 for $85 was paid by the bank twice. 4. A deposit for $580 on November 22 was credited by the bank for $850. Assuming outstanding checks total $2,450, prepare the adjusted bank balance section of the November 30, 2019, bank reconciliation FLORENCE COMPANY Bank Reconciliation Statement November 30, 2019 Balance on bank statement Additions: Deductions Score answer Adjusted bank balance

Solution

Bank reconciliation Statement

Balance on Bank Statement

13,550

Additions:

Mistakenly charged

265

High Amount wrongly paid

1000

Paid Twice

85

Deductions:

High Amount Credited

270

Outstanding Checks

2450

Adjusted Bank Balance

12,180

1.Mistankenly charged, hence added back

2.Higher Amount paid, difference added

3.Paid Twice, so added once

4.Higher amount credited by mistake, hence deducted

5.Outstanding checks already deducted from books but not from bank, now deducted

| Balance on Bank Statement | 13,550 | |

| Additions: | ||

| Mistakenly charged | 265 | |

| High Amount wrongly paid | 1000 | |

| Paid Twice | 85 | |

| Deductions: | ||

| High Amount Credited | 270 | |

| Outstanding Checks | 2450 | |

| Adjusted Bank Balance | 12,180 |

Homework Sourse

Homework Sourse