Healthcare HCA 1 Jun 2018 US10432 Rating OUTPERFORM Target P

Solution

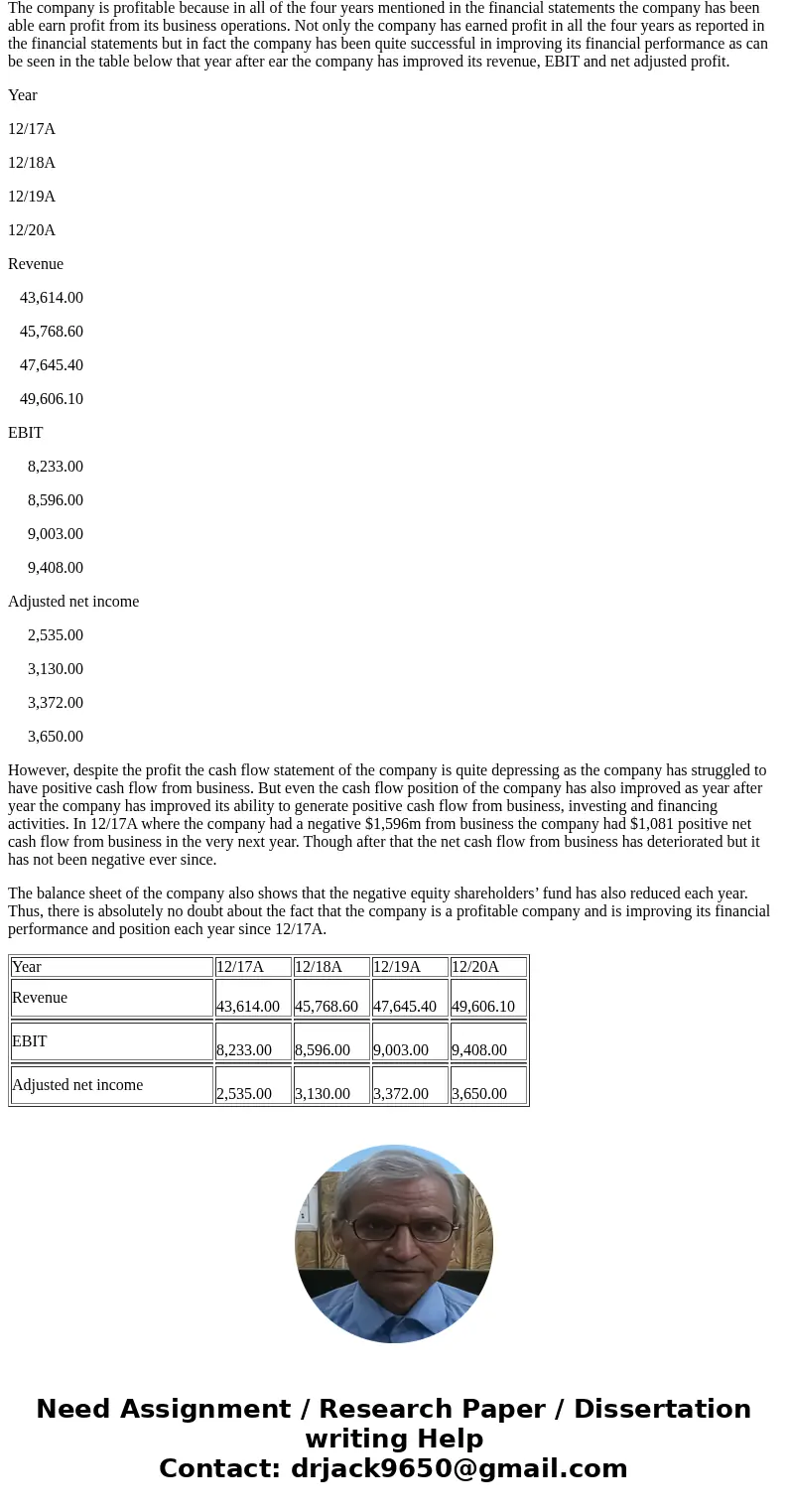

The company is profitable because in all of the four years mentioned in the financial statements the company has been able earn profit from its business operations. Not only the company has earned profit in all the four years as reported in the financial statements but in fact the company has been quite successful in improving its financial performance as can be seen in the table below that year after ear the company has improved its revenue, EBIT and net adjusted profit.

Year

12/17A

12/18A

12/19A

12/20A

Revenue

43,614.00

45,768.60

47,645.40

49,606.10

EBIT

8,233.00

8,596.00

9,003.00

9,408.00

Adjusted net income

2,535.00

3,130.00

3,372.00

3,650.00

However, despite the profit the cash flow statement of the company is quite depressing as the company has struggled to have positive cash flow from business. But even the cash flow position of the company has also improved as year after year the company has improved its ability to generate positive cash flow from business, investing and financing activities. In 12/17A where the company had a negative $1,596m from business the company had $1,081 positive net cash flow from business in the very next year. Though after that the net cash flow from business has deteriorated but it has not been negative ever since.

The balance sheet of the company also shows that the negative equity shareholders’ fund has also reduced each year. Thus, there is absolutely no doubt about the fact that the company is a profitable company and is improving its financial performance and position each year since 12/17A.

| Year | 12/17A | 12/18A | 12/19A | 12/20A |

| Revenue | 43,614.00 | 45,768.60 | 47,645.40 | 49,606.10 |

| EBIT | 8,233.00 | 8,596.00 | 9,003.00 | 9,408.00 |

| Adjusted net income | 2,535.00 | 3,130.00 | 3,372.00 | 3,650.00 |

Homework Sourse

Homework Sourse