On June 5 2017 Brown Inc a calendar year taxpayer receives c

On June 5, 2017, Brown, Inc., a calendar year taxpayer, receives cash of $883,500 from the county upon condemnation of its warehouse building (adjusted basis of $618,450 and fair market value of $883,500).

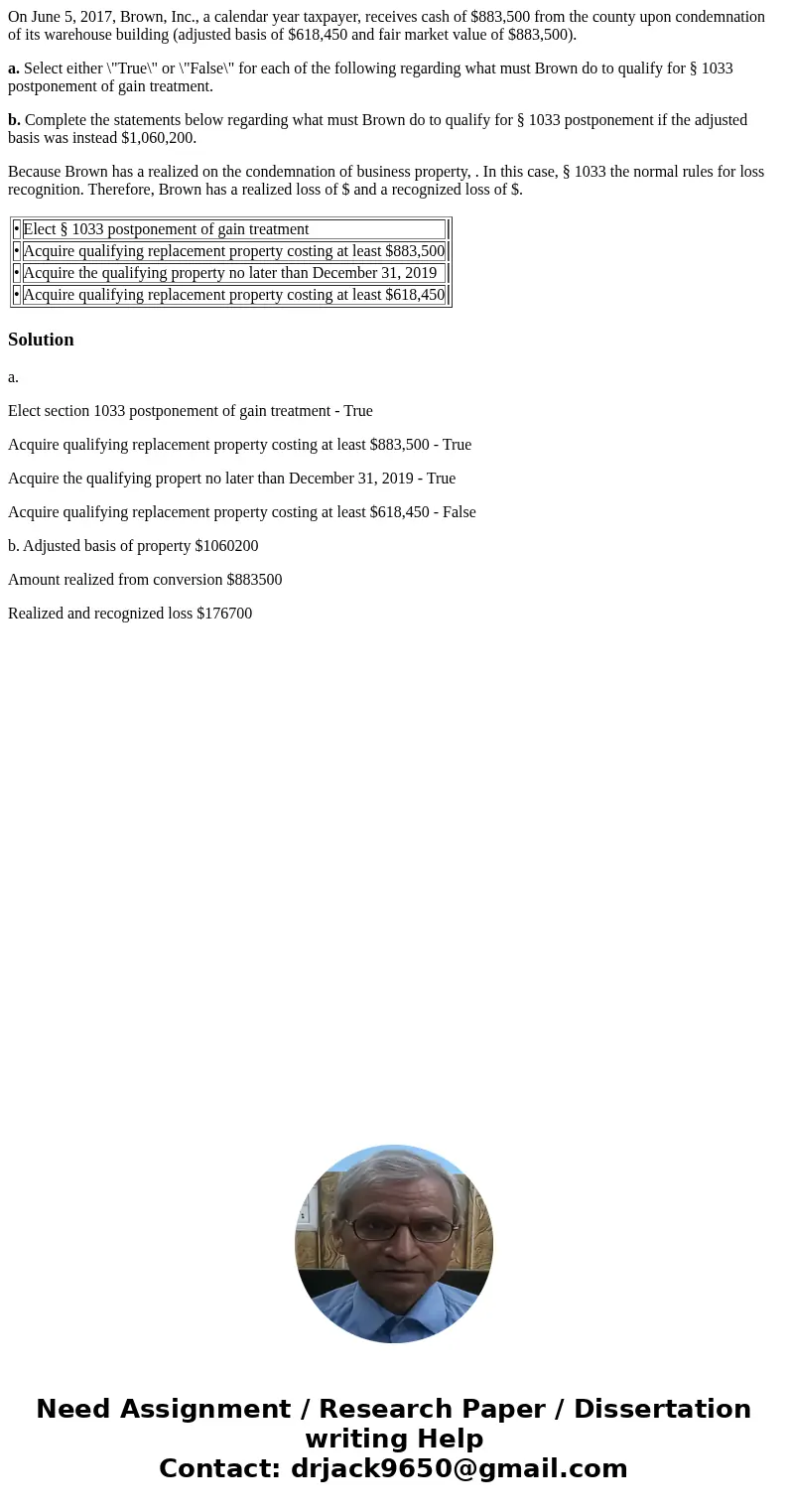

a. Select either \"True\" or \"False\" for each of the following regarding what must Brown do to qualify for § 1033 postponement of gain treatment.

b. Complete the statements below regarding what must Brown do to qualify for § 1033 postponement if the adjusted basis was instead $1,060,200.

Because Brown has a realized on the condemnation of business property, . In this case, § 1033 the normal rules for loss recognition. Therefore, Brown has a realized loss of $ and a recognized loss of $.

|

Solution

a.

Elect section 1033 postponement of gain treatment - True

Acquire qualifying replacement property costing at least $883,500 - True

Acquire the qualifying propert no later than December 31, 2019 - True

Acquire qualifying replacement property costing at least $618,450 - False

b. Adjusted basis of property $1060200

Amount realized from conversion $883500

Realized and recognized loss $176700

Homework Sourse

Homework Sourse