Exercise 58A Allocating costs with different cost drivers LO

Solution

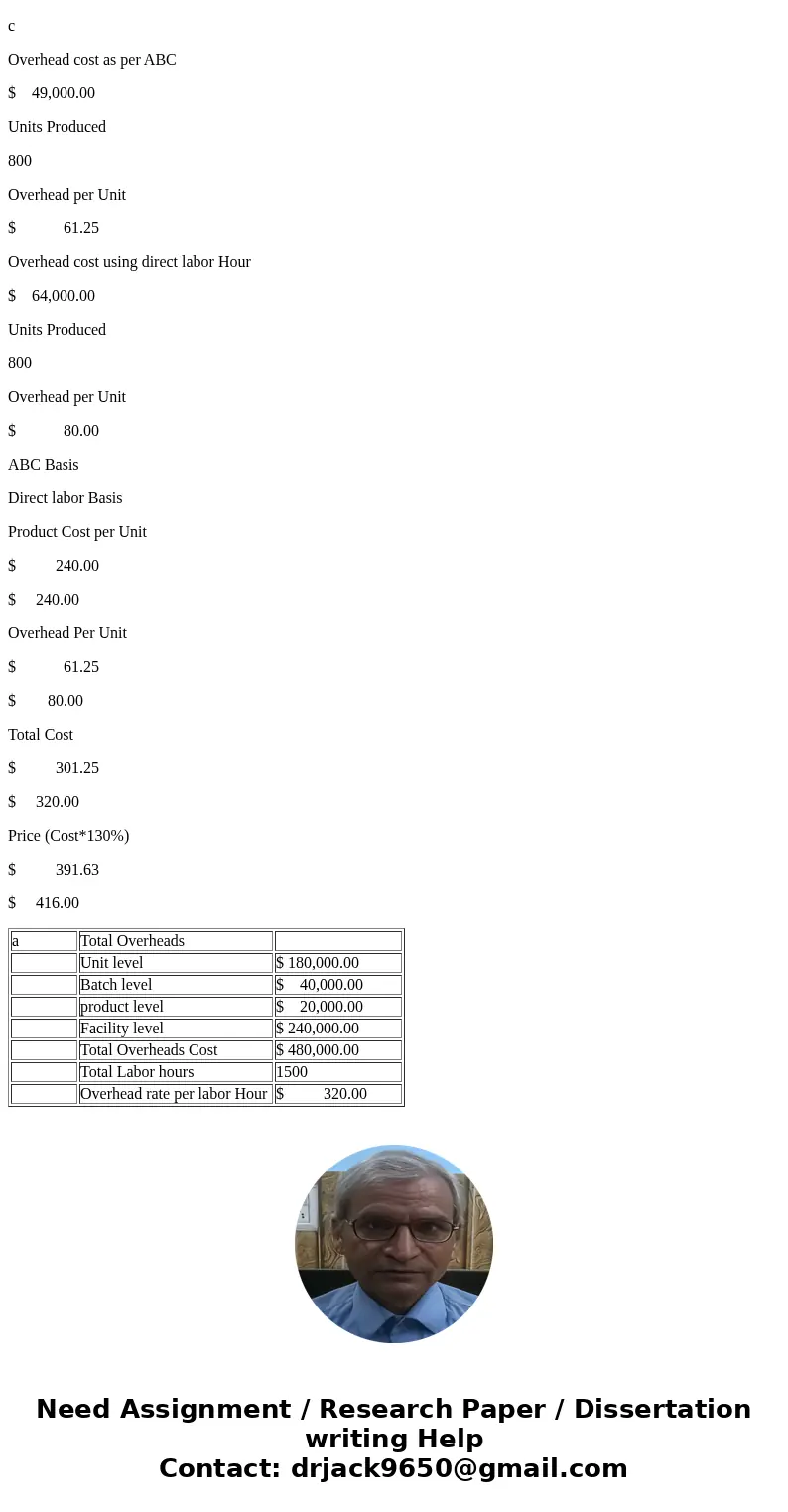

a

Total Overheads

Unit level

$ 180,000.00

Batch level

$ 40,000.00

product level

$ 20,000.00

Facility level

$ 240,000.00

Total Overheads Cost

$ 480,000.00

Total Labor hours

1500

Overhead rate per labor Hour

$ 320.00

Allocation to Cutting Shears

Labor hours

200

Overhead rate per labor Hour

$ 320.00

Overhead Allocated

$ 64,000.00

b

Predetermined overhead rate as per activity based costing

Activity

Activity amount

Allocation basis

Total Activity Pool

Predetermined Overhead rate per Activity

Unit level

$ 180,000.00

Labor hours

1500

$ 120.00

per Labor hour

Batch level

$ 40,000.00

Setups

40

$ 1,000.00

per setup

product level

$ 20,000.00

Percentage of use

100%

$ 200.00

per %

Facility level

$ 240,000.00

no of units

12000

$ 20.00

per unit

Cost Allocation to Cutting Shears

Activity

Activity level

rate per Activity

Overhead allocated

Unit level

200

$ 120.00

$ 24,000.00

Batch level

6

$ 1,000.00

$ 6,000.00

product level

15%

$ 200.00

$ 3,000.00

Facility level

800

$ 20.00

$ 16,000.00

Total Overheads Allocated

$ 49,000.00

c

Overhead cost as per ABC

$ 49,000.00

Units Produced

800

Overhead per Unit

$ 61.25

Overhead cost using direct labor Hour

$ 64,000.00

Units Produced

800

Overhead per Unit

$ 80.00

ABC Basis

Direct labor Basis

Product Cost per Unit

$ 240.00

$ 240.00

Overhead Per Unit

$ 61.25

$ 80.00

Total Cost

$ 301.25

$ 320.00

Price (Cost*130%)

$ 391.63

$ 416.00

| a | Total Overheads | |

| Unit level | $ 180,000.00 | |

| Batch level | $ 40,000.00 | |

| product level | $ 20,000.00 | |

| Facility level | $ 240,000.00 | |

| Total Overheads Cost | $ 480,000.00 | |

| Total Labor hours | 1500 | |

| Overhead rate per labor Hour | $ 320.00 |

Homework Sourse

Homework Sourse