Exercise 1811 Wiemers Corporations comnarative halance sheet

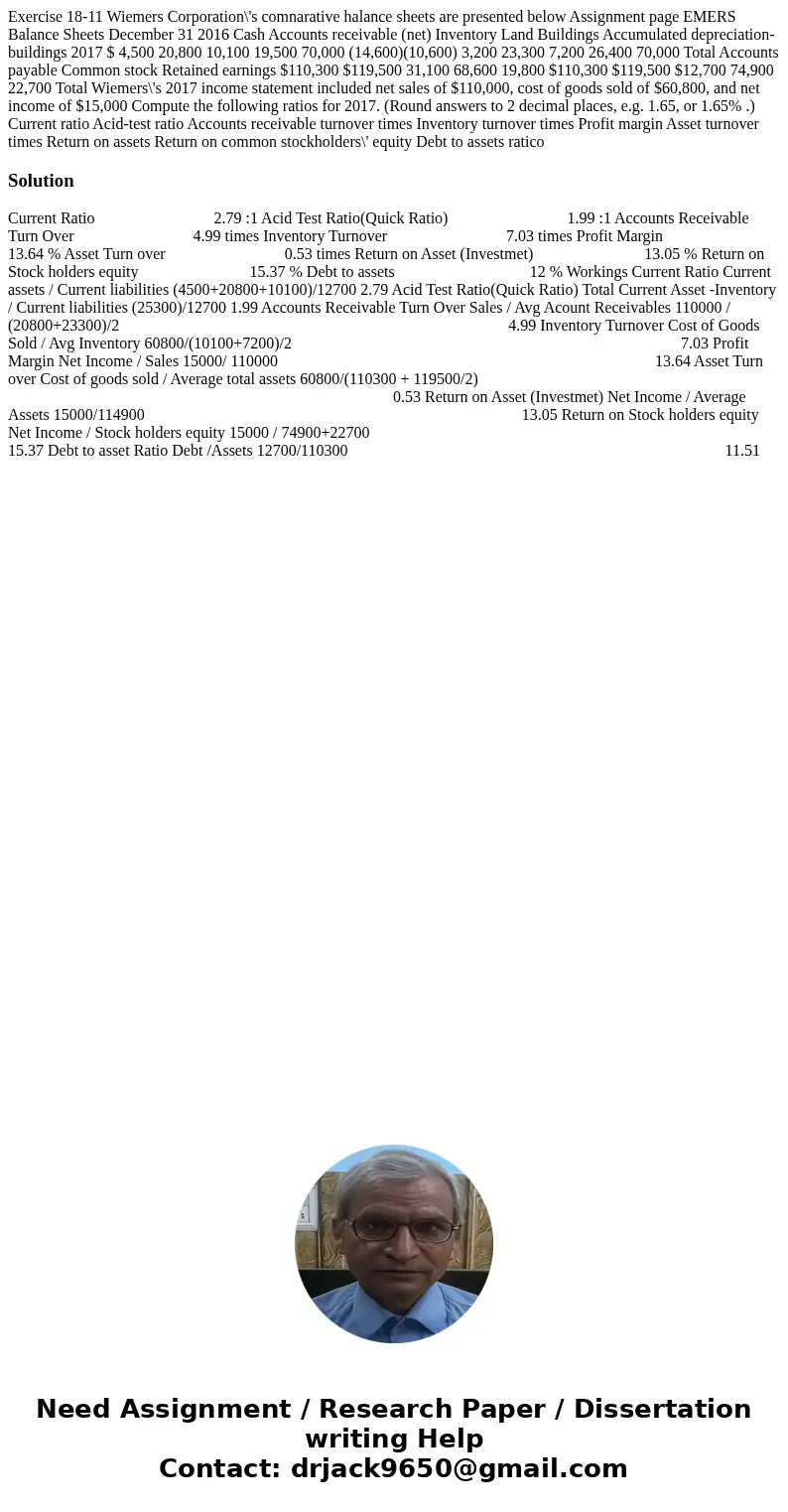

Exercise 18-11 Wiemers Corporation\'s comnarative halance sheets are presented below Assignment page EMERS Balance Sheets December 31 2016 Cash Accounts receivable (net) Inventory Land Buildings Accumulated depreciation-buildings 2017 $ 4,500 20,800 10,100 19,500 70,000 (14,600)(10,600) 3,200 23,300 7,200 26,400 70,000 Total Accounts payable Common stock Retained earnings $110,300 $119,500 31,100 68,600 19,800 $110,300 $119,500 $12,700 74,900 22,700 Total Wiemers\'s 2017 income statement included net sales of $110,000, cost of goods sold of $60,800, and net income of $15,000 Compute the following ratios for 2017. (Round answers to 2 decimal places, e.g. 1.65, or 1.65% .) Current ratio Acid-test ratio Accounts receivable turnover times Inventory turnover times Profit margin Asset turnover times Return on assets Return on common stockholders\' equity Debt to assets ratico

Solution

Current Ratio 2.79 :1 Acid Test Ratio(Quick Ratio) 1.99 :1 Accounts Receivable Turn Over 4.99 times Inventory Turnover 7.03 times Profit Margin 13.64 % Asset Turn over 0.53 times Return on Asset (Investmet) 13.05 % Return on Stock holders equity 15.37 % Debt to assets 12 % Workings Current Ratio Current assets / Current liabilities (4500+20800+10100)/12700 2.79 Acid Test Ratio(Quick Ratio) Total Current Asset -Inventory / Current liabilities (25300)/12700 1.99 Accounts Receivable Turn Over Sales / Avg Acount Receivables 110000 / (20800+23300)/2 4.99 Inventory Turnover Cost of Goods Sold / Avg Inventory 60800/(10100+7200)/2 7.03 Profit Margin Net Income / Sales 15000/ 110000 13.64 Asset Turn over Cost of goods sold / Average total assets 60800/(110300 + 119500/2) 0.53 Return on Asset (Investmet) Net Income / Average Assets 15000/114900 13.05 Return on Stock holders equity Net Income / Stock holders equity 15000 / 74900+22700 15.37 Debt to asset Ratio Debt /Assets 12700/110300 11.51

Homework Sourse

Homework Sourse