The following transactions were selected from the records of

Solution

Answer

No.

Accounts Title & explanation

Debit

Credit

Jul-12

Cash

$ 1,200.00

Sales Revenue

$ 1,200.00

(sales made on cash)

Jul-12

Cost of Goods Sold

$ 700.00

Inventory

$ 700.00

(Inventory amount adjusted)

Jul-15

Accounts receivables

$ 5,200.00

Sales Revenue

$ 5,200.00

(Sales made on account)

Jul-15

Cost of Goods Sold

$ 3,600.00

Inventory

$ 3,600.00

(Inventory amount adjusted)

Jul-20

Accounts receivables

$ 3,100.00

Sales Revenue

$ 3,100.00

(Sales made on account)

Jul-20

Cost of Goods Sold

$ 2,000.00

Inventory

$ 2,000.00

(Inventory amount adjusted)

Jul-23

Cash

$ 5,044.00

Sales Discount

$ 156.00

Accounts receivables

$ 5,200.00

(cash received within discounting term of 10 days)

Aug-25

Cash

$ 3,100.00

Sales Discount

$ -

Inventory

$ 3,100.00

(cash received After discounting term of 10 days)

Sales

Jul-12

$ 1,200.00

Jul-15

$ 5,200.00

Jul-20

$ 3,100.00

Total Sales

$ 9,500.00

Sales Discount - Jul 23

$ (156.00)

Net Sales

$ 9,344.00

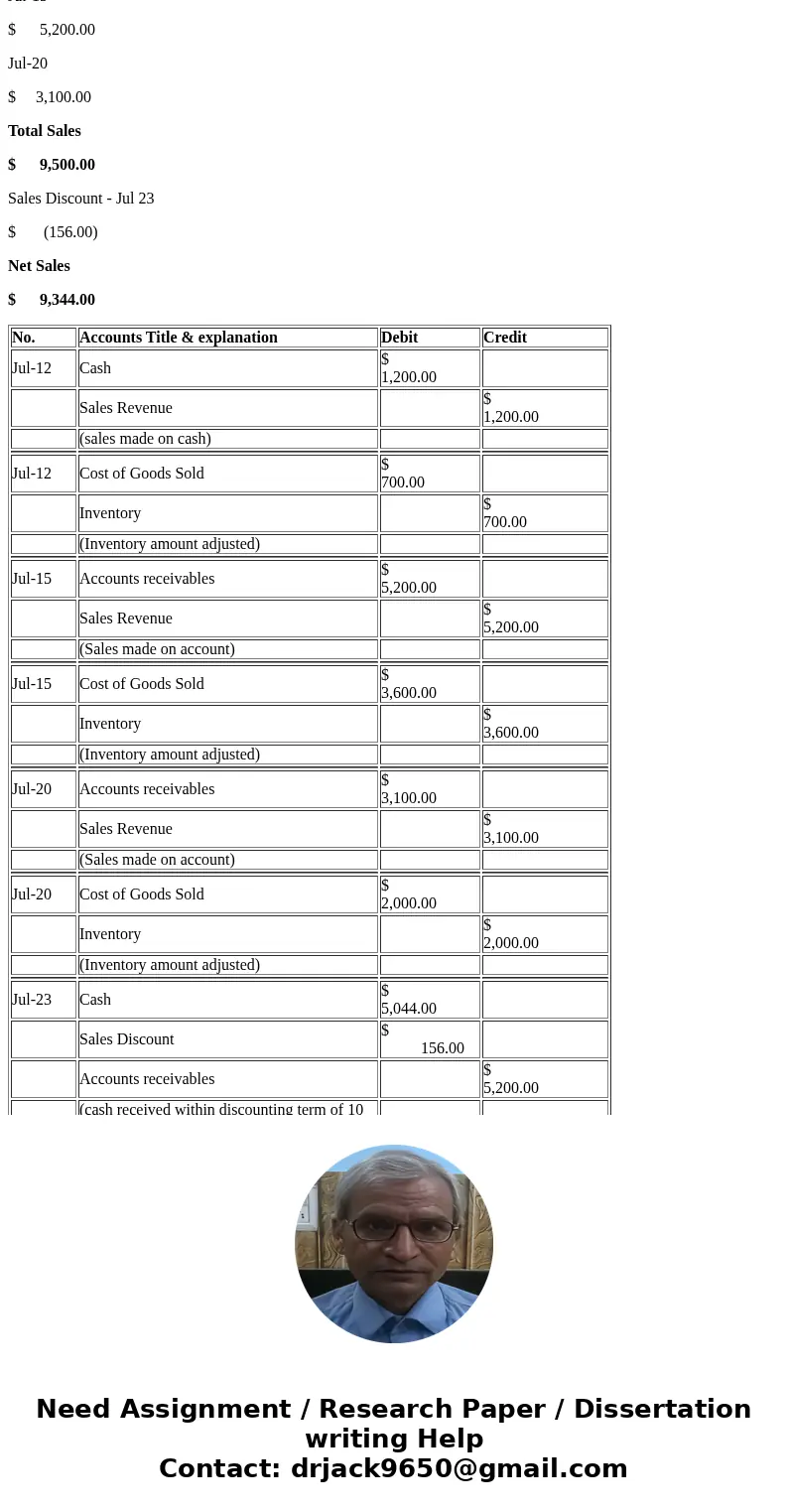

| No. | Accounts Title & explanation | Debit | Credit |

| Jul-12 | Cash | $ 1,200.00 | |

| Sales Revenue | $ 1,200.00 | ||

| (sales made on cash) | |||

| Jul-12 | Cost of Goods Sold | $ 700.00 | |

| Inventory | $ 700.00 | ||

| (Inventory amount adjusted) | |||

| Jul-15 | Accounts receivables | $ 5,200.00 | |

| Sales Revenue | $ 5,200.00 | ||

| (Sales made on account) | |||

| Jul-15 | Cost of Goods Sold | $ 3,600.00 | |

| Inventory | $ 3,600.00 | ||

| (Inventory amount adjusted) | |||

| Jul-20 | Accounts receivables | $ 3,100.00 | |

| Sales Revenue | $ 3,100.00 | ||

| (Sales made on account) | |||

| Jul-20 | Cost of Goods Sold | $ 2,000.00 | |

| Inventory | $ 2,000.00 | ||

| (Inventory amount adjusted) | |||

| Jul-23 | Cash | $ 5,044.00 | |

| Sales Discount | $ 156.00 | ||

| Accounts receivables | $ 5,200.00 | ||

| (cash received within discounting term of 10 days) | |||

| Aug-25 | Cash | $ 3,100.00 | |

| Sales Discount | $ - | ||

| Inventory | $ 3,100.00 | ||

| (cash received After discounting term of 10 days) |

Homework Sourse

Homework Sourse