As the operations manager for Valley Kayaks as described in

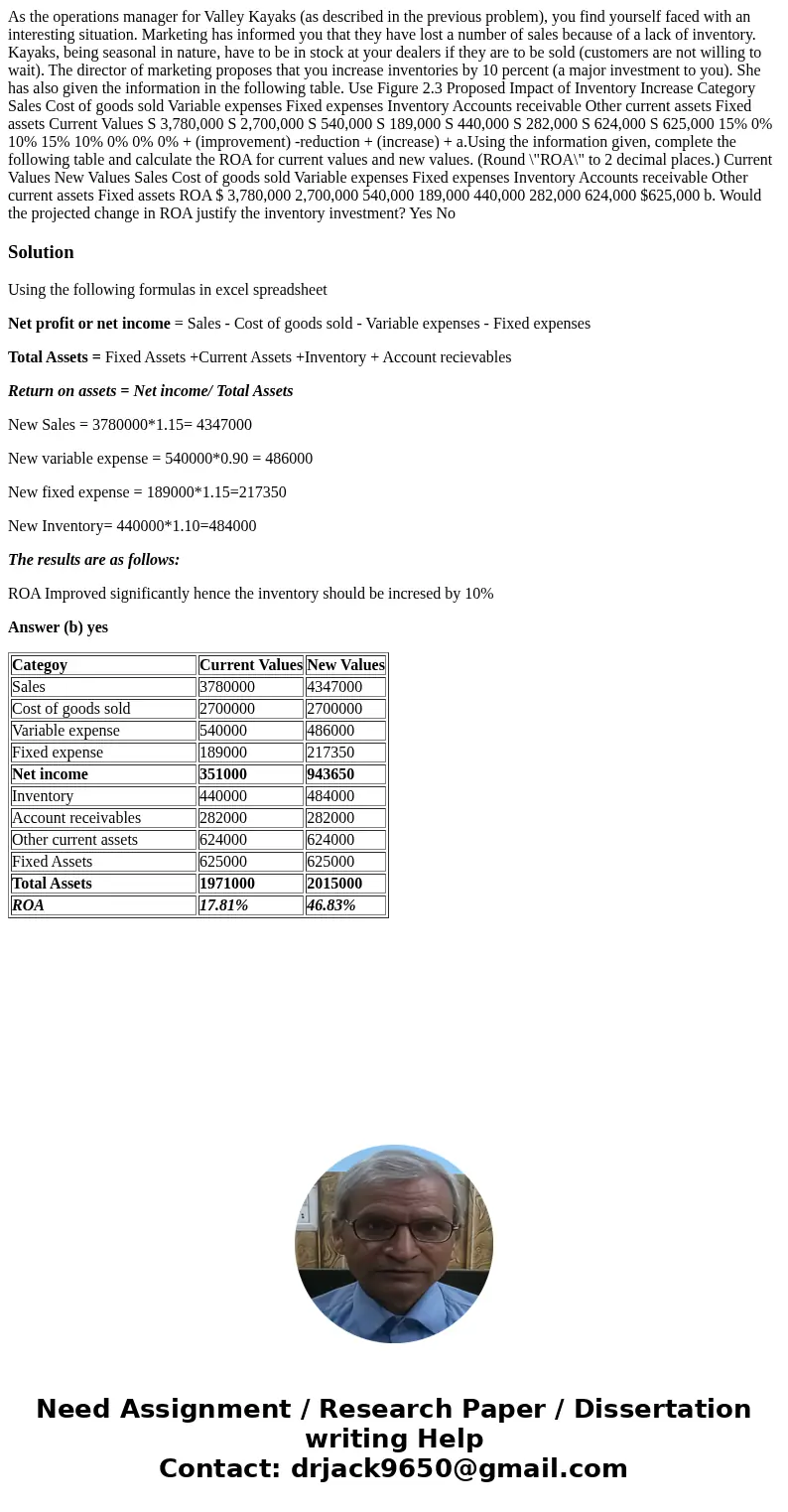

As the operations manager for Valley Kayaks (as described in the previous problem), you find yourself faced with an interesting situation. Marketing has informed you that they have lost a number of sales because of a lack of inventory. Kayaks, being seasonal in nature, have to be in stock at your dealers if they are to be sold (customers are not willing to wait). The director of marketing proposes that you increase inventories by 10 percent (a major investment to you). She has also given the information in the following table. Use Figure 2.3 Proposed Impact of Inventory Increase Category Sales Cost of goods sold Variable expenses Fixed expenses Inventory Accounts receivable Other current assets Fixed assets Current Values S 3,780,000 S 2,700,000 S 540,000 S 189,000 S 440,000 S 282,000 S 624,000 S 625,000 15% 0% 10% 15% 10% 0% 0% 0% + (improvement) -reduction + (increase) + a.Using the information given, complete the following table and calculate the ROA for current values and new values. (Round \"ROA\" to 2 decimal places.) Current Values New Values Sales Cost of goods sold Variable expenses Fixed expenses Inventory Accounts receivable Other current assets Fixed assets ROA $ 3,780,000 2,700,000 540,000 189,000 440,000 282,000 624,000 $625,000 b. Would the projected change in ROA justify the inventory investment? Yes No

Solution

Using the following formulas in excel spreadsheet

Net profit or net income = Sales - Cost of goods sold - Variable expenses - Fixed expenses

Total Assets = Fixed Assets +Current Assets +Inventory + Account recievables

Return on assets = Net income/ Total Assets

New Sales = 3780000*1.15= 4347000

New variable expense = 540000*0.90 = 486000

New fixed expense = 189000*1.15=217350

New Inventory= 440000*1.10=484000

The results are as follows:

ROA Improved significantly hence the inventory should be incresed by 10%

Answer (b) yes

| Categoy | Current Values | New Values |

| Sales | 3780000 | 4347000 |

| Cost of goods sold | 2700000 | 2700000 |

| Variable expense | 540000 | 486000 |

| Fixed expense | 189000 | 217350 |

| Net income | 351000 | 943650 |

| Inventory | 440000 | 484000 |

| Account receivables | 282000 | 282000 |

| Other current assets | 624000 | 624000 |

| Fixed Assets | 625000 | 625000 |

| Total Assets | 1971000 | 2015000 |

| ROA | 17.81% | 46.83% |

Homework Sourse

Homework Sourse