Chuck Wagon Grills Inc makes a single producta handmade spec

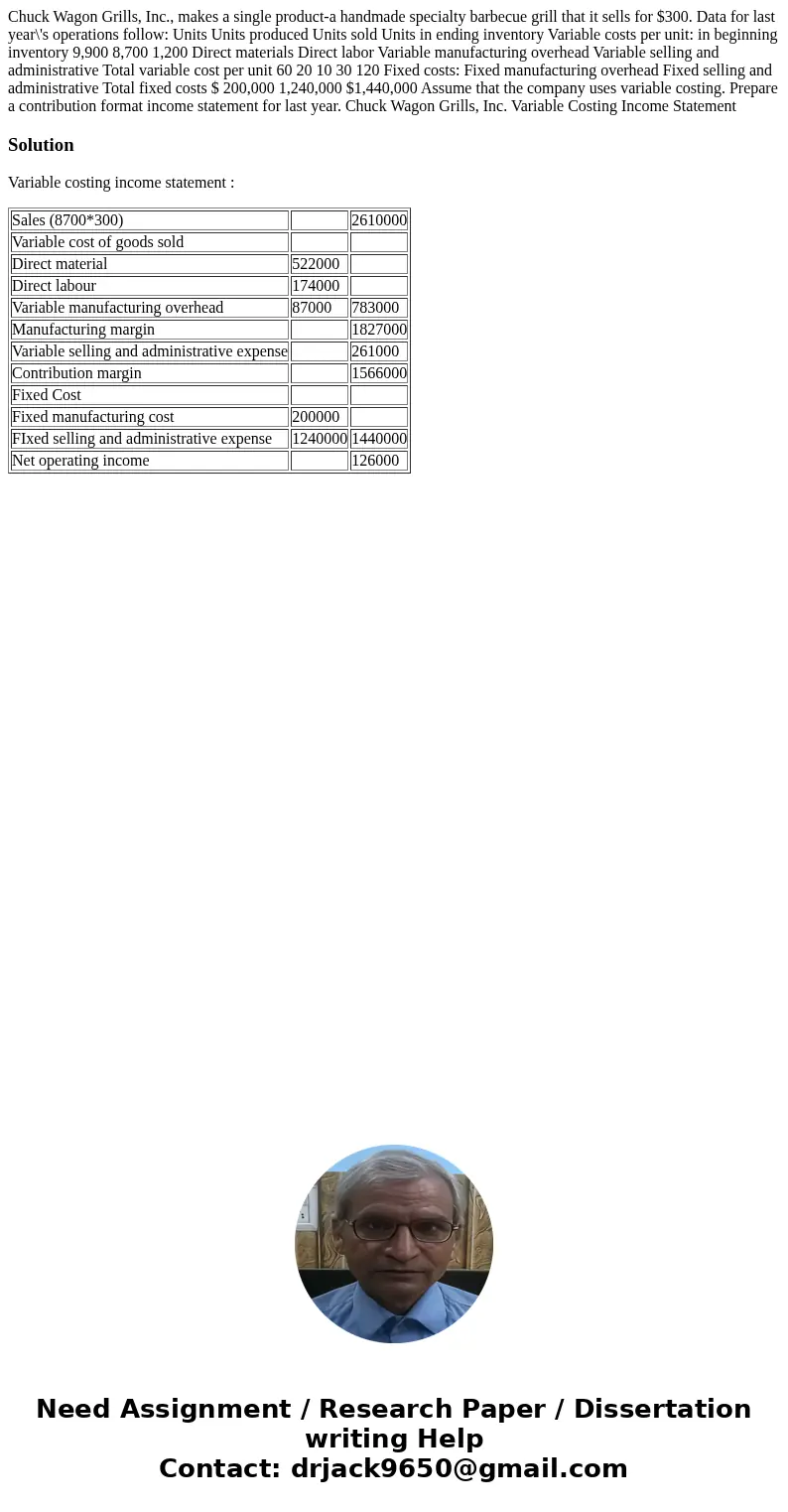

Chuck Wagon Grills, Inc., makes a single product-a handmade specialty barbecue grill that it sells for $300. Data for last year\'s operations follow: Units Units produced Units sold Units in ending inventory Variable costs per unit: in beginning inventory 9,900 8,700 1,200 Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Total variable cost per unit 60 20 10 30 120 Fixed costs: Fixed manufacturing overhead Fixed selling and administrative Total fixed costs $ 200,000 1,240,000 $1,440,000 Assume that the company uses variable costing. Prepare a contribution format income statement for last year. Chuck Wagon Grills, Inc. Variable Costing Income Statement

Solution

Variable costing income statement :

| Sales (8700*300) | 2610000 | |

| Variable cost of goods sold | ||

| Direct material | 522000 | |

| Direct labour | 174000 | |

| Variable manufacturing overhead | 87000 | 783000 |

| Manufacturing margin | 1827000 | |

| Variable selling and administrative expense | 261000 | |

| Contribution margin | 1566000 | |

| Fixed Cost | ||

| Fixed manufacturing cost | 200000 | |

| FIxed selling and administrative expense | 1240000 | 1440000 |

| Net operating income | 126000 |

Homework Sourse

Homework Sourse