Financial data for Joel de Paris Inc for last year follow So

| Financial data for Joel de Paris, Inc., for last year follow: |

Solution

Requirement – 1, company’s margin, turnover, and return on investment (ROI) for last year

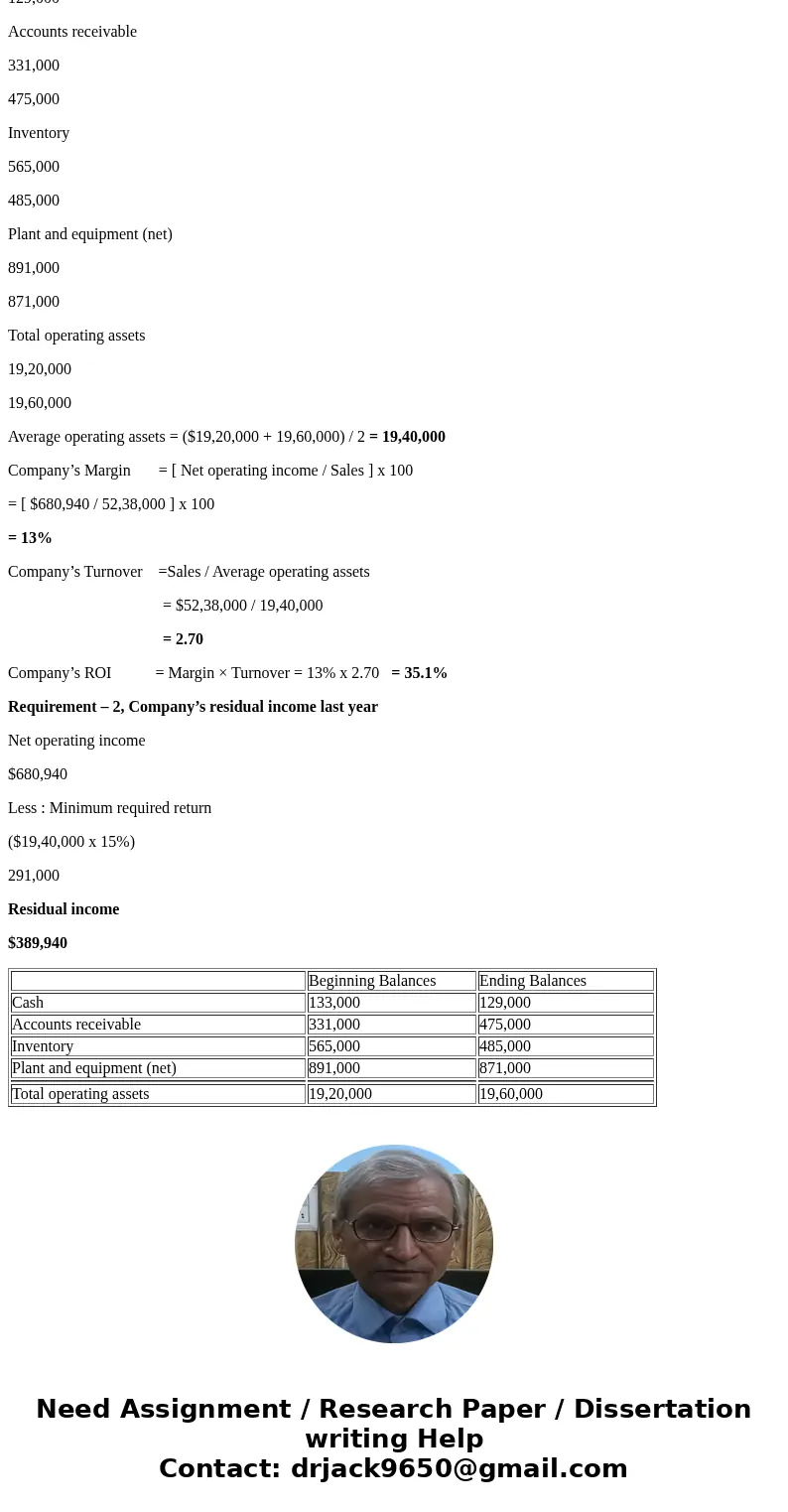

Beginning Balances

Ending Balances

Cash

133,000

129,000

Accounts receivable

331,000

475,000

Inventory

565,000

485,000

Plant and equipment (net)

891,000

871,000

Total operating assets

19,20,000

19,60,000

Average operating assets = ($19,20,000 + 19,60,000) / 2 = 19,40,000

Company’s Margin = [ Net operating income / Sales ] x 100

= [ $680,940 / 52,38,000 ] x 100

= 13%

Company’s Turnover =Sales / Average operating assets

= $52,38,000 / 19,40,000

= 2.70

Company’s ROI = Margin × Turnover = 13% x 2.70 = 35.1%

Requirement – 2, Company’s residual income last year

Net operating income

$680,940

Less : Minimum required return

($19,40,000 x 15%)

291,000

Residual income

$389,940

| Beginning Balances | Ending Balances | |

| Cash | 133,000 | 129,000 |

| Accounts receivable | 331,000 | 475,000 |

| Inventory | 565,000 | 485,000 |

| Plant and equipment (net) | 891,000 | 871,000 |

| Total operating assets | 19,20,000 | 19,60,000 |

Homework Sourse

Homework Sourse