Exercise 1020 Adcock Company issued 600000 9 20year bonds on

Exercise 10-20

Adcock Company issued $600,000, 9%, 20-year bonds on January 1, 2019, at 103. Interest is payable annually on January 1. Adcock uses straight-line amortization for bond premium or discount.

Date

Account Titles and Explanation

Debit

Credit

Jan. 1

Date

Account Titles and Explanation

Debit

Credit

Dec. 31

Date

Account Titles and Explanation

Debit

Credit

Jan. 1

Date

Account Titles and Explanation

Debit

Credit

Jan. 1, 2039

|

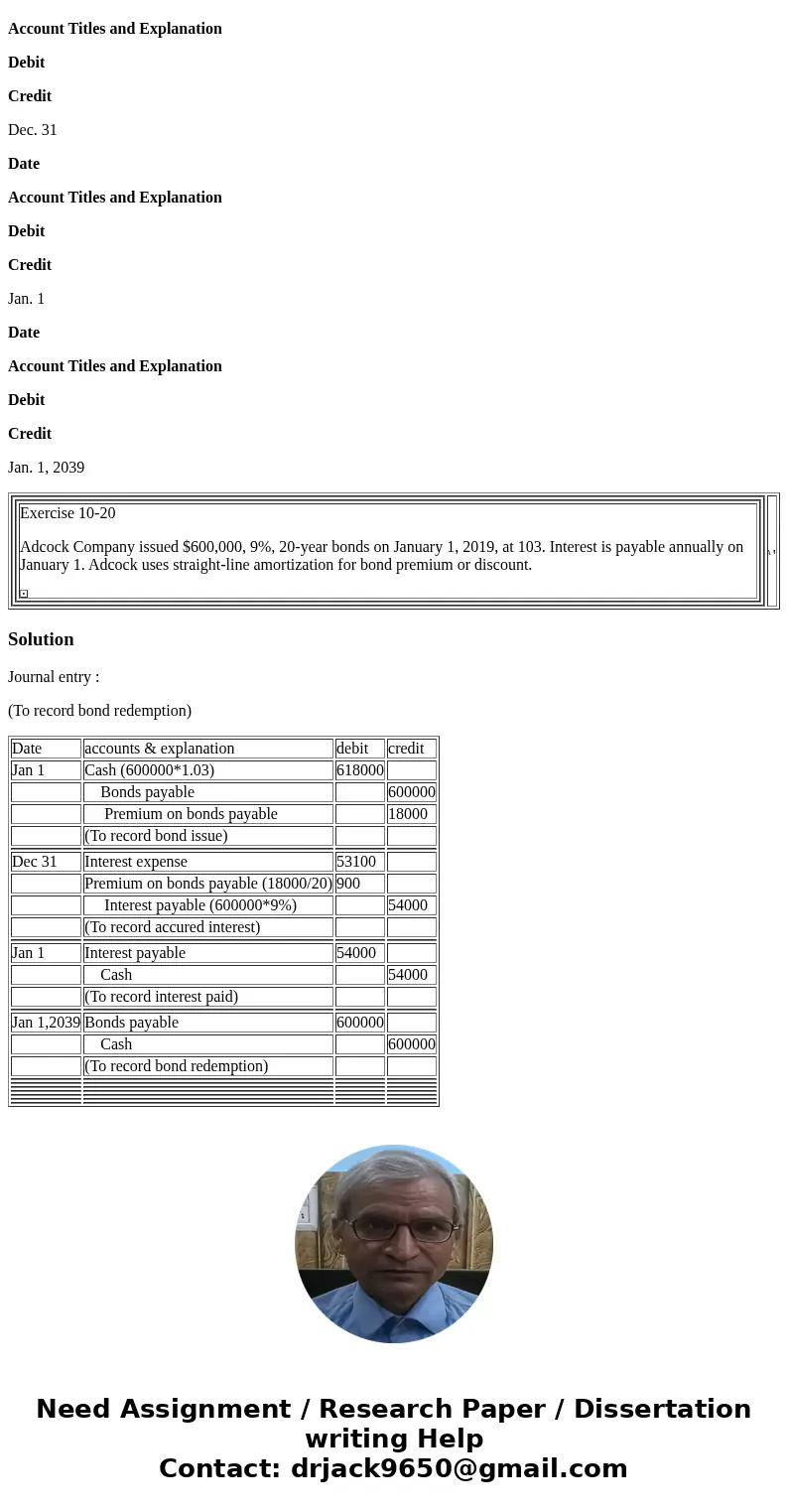

Solution

Journal entry :

(To record bond redemption)

| Date | accounts & explanation | debit | credit |

| Jan 1 | Cash (600000*1.03) | 618000 | |

| Bonds payable | 600000 | ||

| Premium on bonds payable | 18000 | ||

| (To record bond issue) | |||

| Dec 31 | Interest expense | 53100 | |

| Premium on bonds payable (18000/20) | 900 | ||

| Interest payable (600000*9%) | 54000 | ||

| (To record accured interest) | |||

| Jan 1 | Interest payable | 54000 | |

| Cash | 54000 | ||

| (To record interest paid) | |||

| Jan 1,2039 | Bonds payable | 600000 | |

| Cash | 600000 | ||

| (To record bond redemption) | |||

Homework Sourse

Homework Sourse