Frankum Company has issued three different bonds during 2017

Frankum Company has issued three different bonds during 2017. Interest is payable annually on each of these bonds.

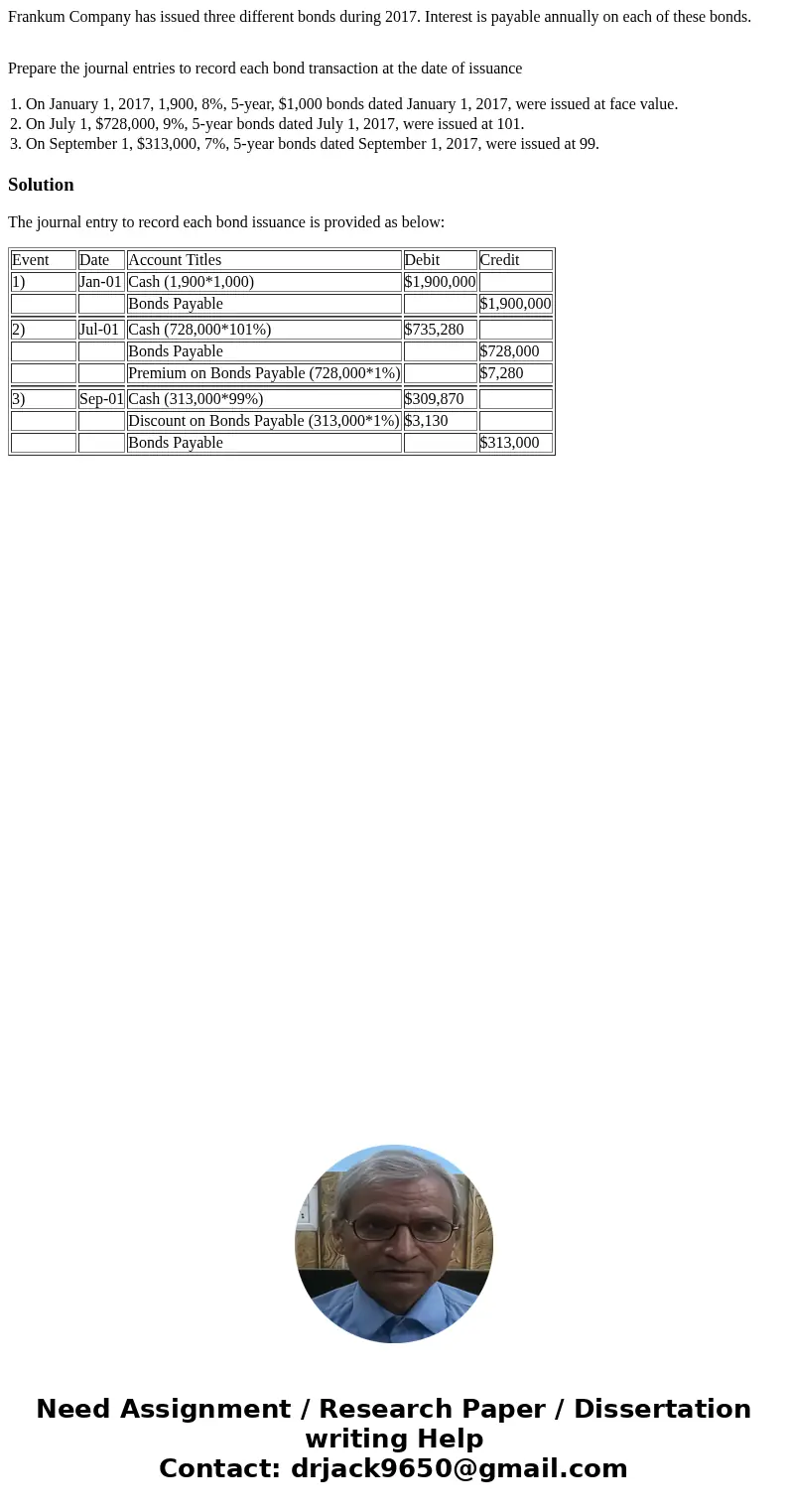

Prepare the journal entries to record each bond transaction at the date of issuance

| 1. | On January 1, 2017, 1,900, 8%, 5-year, $1,000 bonds dated January 1, 2017, were issued at face value. | |

| 2. | On July 1, $728,000, 9%, 5-year bonds dated July 1, 2017, were issued at 101. | |

| 3. | On September 1, $313,000, 7%, 5-year bonds dated September 1, 2017, were issued at 99. |

Solution

The journal entry to record each bond issuance is provided as below:

| Event | Date | Account Titles | Debit | Credit |

| 1) | Jan-01 | Cash (1,900*1,000) | $1,900,000 | |

| Bonds Payable | $1,900,000 | |||

| 2) | Jul-01 | Cash (728,000*101%) | $735,280 | |

| Bonds Payable | $728,000 | |||

| Premium on Bonds Payable (728,000*1%) | $7,280 | |||

| 3) | Sep-01 | Cash (313,000*99%) | $309,870 | |

| Discount on Bonds Payable (313,000*1%) | $3,130 | |||

| Bonds Payable | $313,000 |

Homework Sourse

Homework Sourse