View History Bookmarks Window Help 47D Tue 158 AM a edugenwi

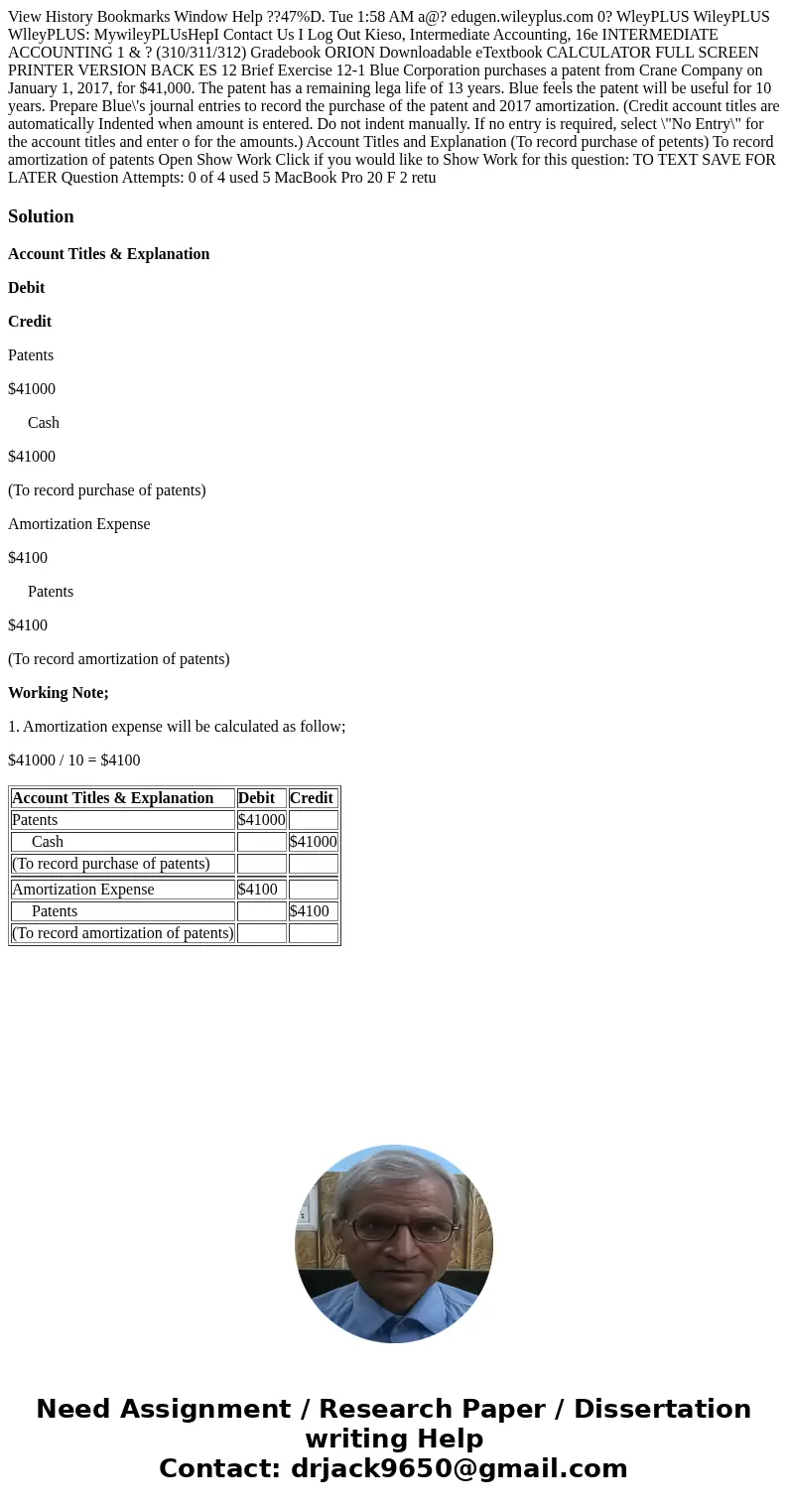

View History Bookmarks Window Help ??47%D. Tue 1:58 AM a@? edugen.wileyplus.com 0? WleyPLUS WileyPLUS WlleyPLUS: MywileyPLUsHepI Contact Us I Log Out Kieso, Intermediate Accounting, 16e INTERMEDIATE ACCOUNTING 1 & ? (310/311/312) Gradebook ORION Downloadable eTextbook CALCULATOR FULL SCREEN PRINTER VERSION BACK ES 12 Brief Exercise 12-1 Blue Corporation purchases a patent from Crane Company on January 1, 2017, for $41,000. The patent has a remaining lega life of 13 years. Blue feels the patent will be useful for 10 years. Prepare Blue\'s journal entries to record the purchase of the patent and 2017 amortization. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select \"No Entry\" for the account titles and enter o for the amounts.) Account Titles and Explanation (To record purchase of petents) To record amortization of patents Open Show Work Click if you would like to Show Work for this question: TO TEXT SAVE FOR LATER Question Attempts: 0 of 4 used 5 MacBook Pro 20 F 2 retu

Solution

Account Titles & Explanation

Debit

Credit

Patents

$41000

Cash

$41000

(To record purchase of patents)

Amortization Expense

$4100

Patents

$4100

(To record amortization of patents)

Working Note;

1. Amortization expense will be calculated as follow;

$41000 / 10 = $4100

| Account Titles & Explanation | Debit | Credit |

| Patents | $41000 | |

| Cash | $41000 | |

| (To record purchase of patents) | ||

| Amortization Expense | $4100 | |

| Patents | $4100 | |

| (To record amortization of patents) |

Homework Sourse

Homework Sourse