Dividends Per Share Windborn Company has 15000 shares of cum

Solution

15000 shares of cumulative preferred 1% stock,$100 and 50,000 shares of $10 par common stock

In year 1

15000 shares@$100 = $1,500,000, 1% stock , 15,000 preferred dividend

Total dividend = $37,500

Common stock dividend = Total dividend - Preference dividend

= $37,500 - $15,000

= $ 22,500

Preferred dividend per share = $15,000/15000 shares

= $1 shares

Common stock dividend per share = $22,500/50,000 shares

= $0.45 per share

2nd year

Preferred dividend = $15,000

Total dividend = $7,500

Therefore, $7,500 carried forward to the next year

Preferred dividend per share = $7,500/15000 shares

= 0.5 per share

Common stock dividend per share = 0

3rd year

Preferred dividend = $15,000 + $7,500

= $ 22,500

Common stock dividend = $45,000 - $22,500

= $22,500

Preferred dividend per share = $22,500/15,000 share

= $1.5 per share

Common stock dividend per share = $22,500/50,000 shares

= $0.45per share

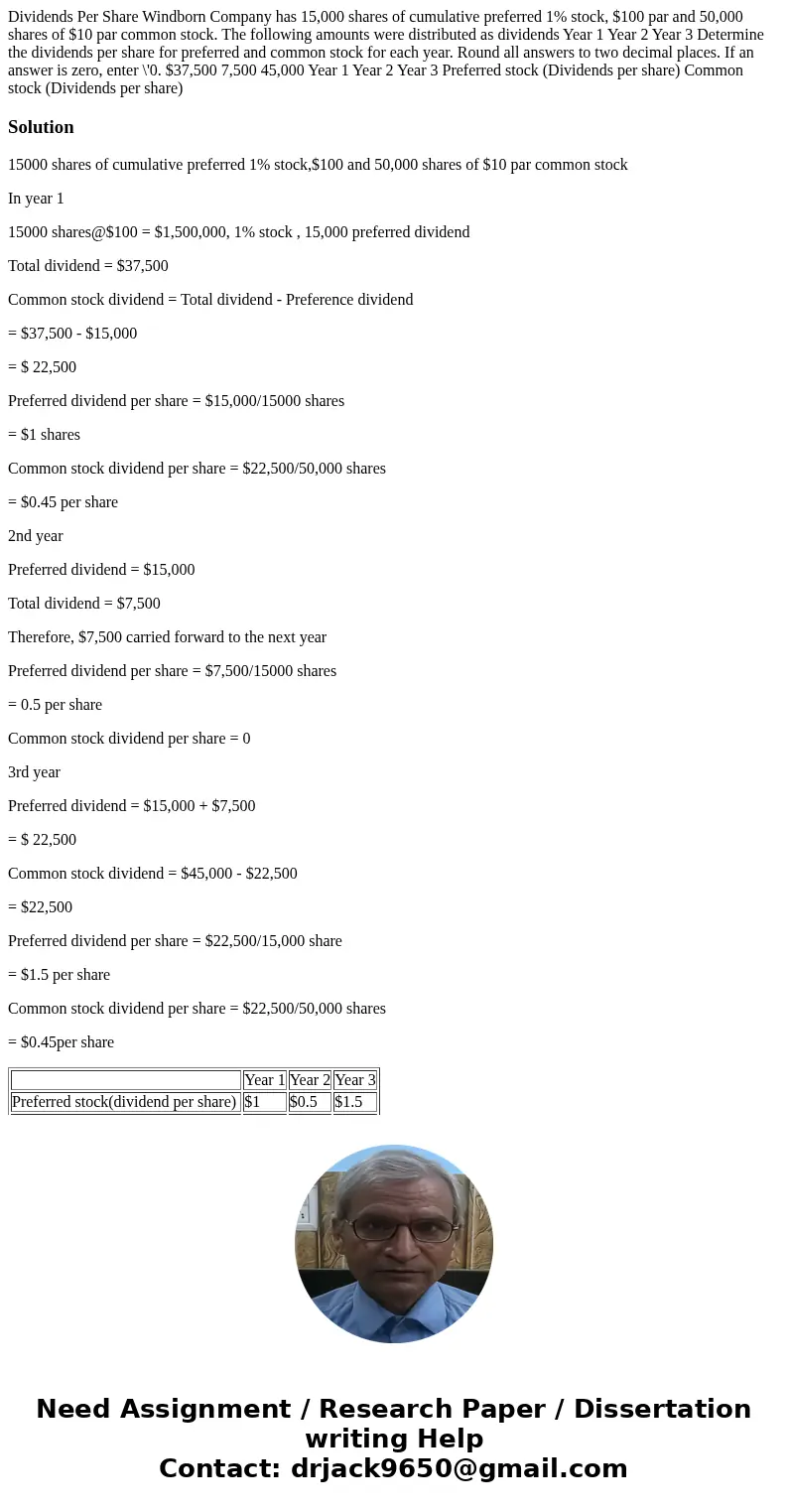

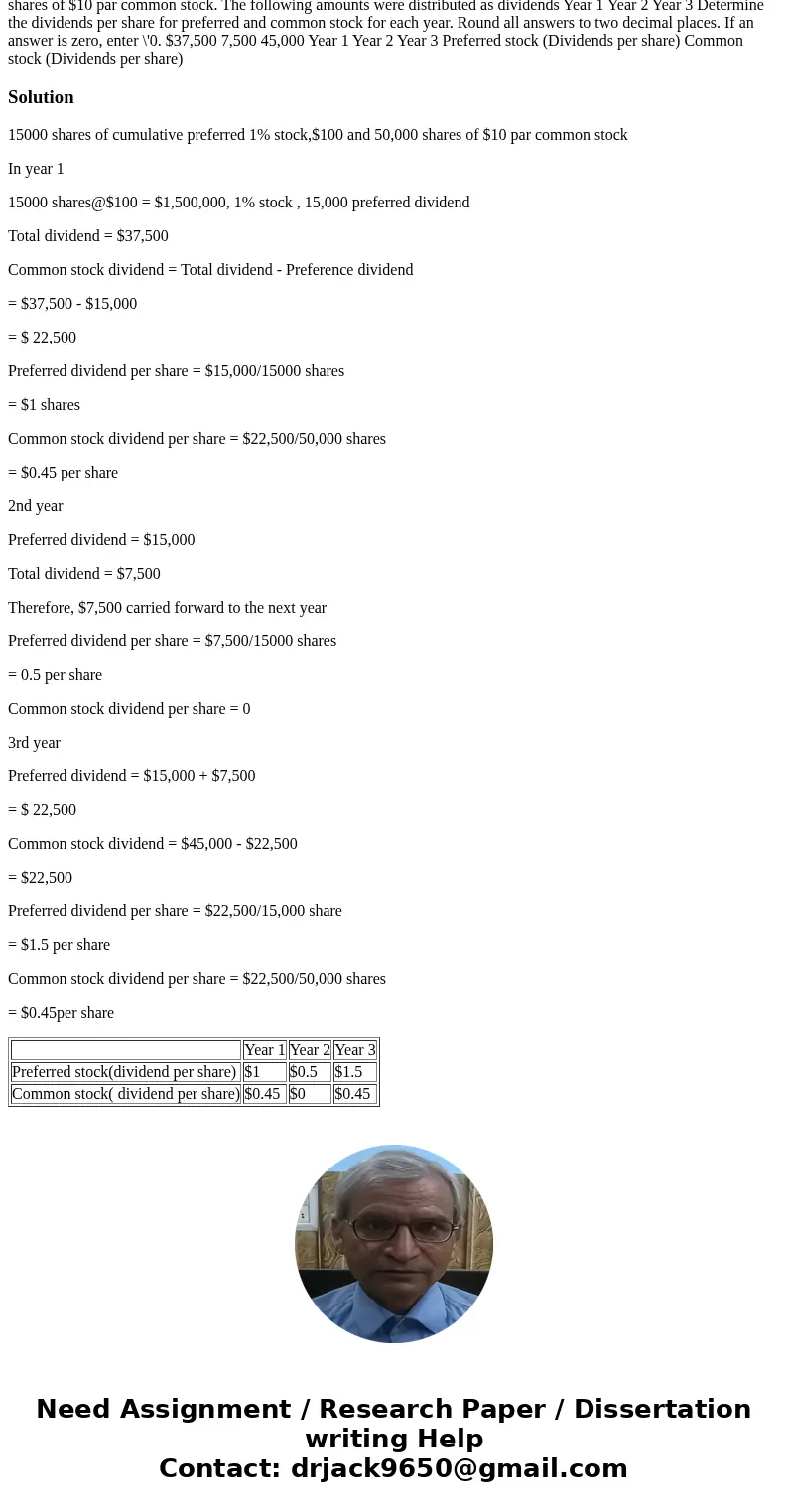

| Year 1 | Year 2 | Year 3 | |

| Preferred stock(dividend per share) | $1 | $0.5 | $1.5 |

| Common stock( dividend per share) | $0.45 | $0 | $0.45 |

Homework Sourse

Homework Sourse