1 On January 1 2016 Ott Co sold goods to Flynn Company Flynn

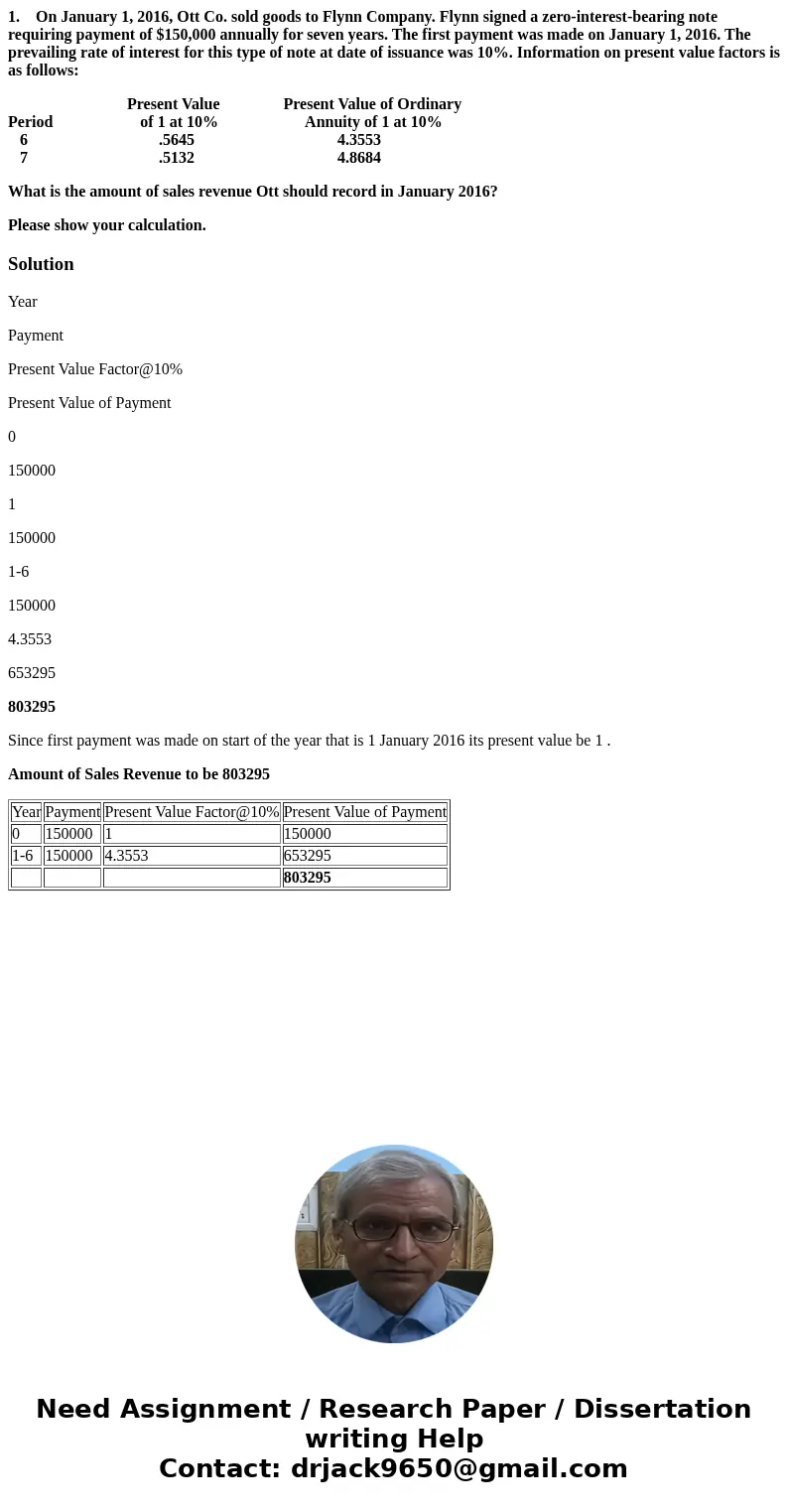

1. On January 1, 2016, Ott Co. sold goods to Flynn Company. Flynn signed a zero-interest-bearing note requiring payment of $150,000 annually for seven years. The first payment was made on January 1, 2016. The prevailing rate of interest for this type of note at date of issuance was 10%. Information on present value factors is as follows:

Present Value Present Value of Ordinary

Period of 1 at 10% Annuity of 1 at 10%

6 .5645 4.3553

7 .5132 4.8684

What is the amount of sales revenue Ott should record in January 2016?

Please show your calculation.

Solution

Year

Payment

Present Value Factor@10%

Present Value of Payment

0

150000

1

150000

1-6

150000

4.3553

653295

803295

Since first payment was made on start of the year that is 1 January 2016 its present value be 1 .

Amount of Sales Revenue to be 803295

| Year | Payment | Present Value Factor@10% | Present Value of Payment |

| 0 | 150000 | 1 | 150000 |

| 1-6 | 150000 | 4.3553 | 653295 |

| 803295 |

Homework Sourse

Homework Sourse