please help me The following information is provided for Ast

please help me!!!!!

The following information is provided for Astroid Antenna Corp., which manufactures two products: Lo-Gain antennas and Hi-Gain antennas for use in remote areas. (Click the icon to view the information.) Astroid Antenna plans to produce 150 Lo-Gain antennas and 360 Hi-Gain antennas. Read the requirements Requirement 1. Compute the indirect manufacturing cost per unit using direct labor hours for the singie plantwide predetermined overhead allocation rate First, computo the prodotermined ovorhead (OH) allocation rato. (Round your answor to the nearost cont.) The predetermined overhead (OH) allocation rate is $ Computo the manufacturing oost allocatod to Lo-Gain antonnas, and then computo the indiroct manufacturing cost por unit for Lo-Gain antennas. Noxt, compute the manufacturing cost allocated to Hi-Gain antonnas and the indirect cost per unit for Hi-Gain. (Round your cost per unit to the nearest cent) Lo-Gain Hi-Gain Data Table Total indirect costs allooated Number of units Indirect cost per unit Requirement 2. Compute the ABC indirect manufacturing cost per unit for each product. Bogin by selecting the formula to calculate the prodetermined ovorhead (OH) allocation rate. Then ontor the amounts to computo the allocation rato for each activity. ( Activity Cost Allocation Base 57,000 Number of setups 36,000 93,000 Machine maintenance Number of machine hours Total indirect manufacturing coats Predetermined OH Hi-Gain 1,000 30 2,100 Total 2,500 60 6,000 - alocation rate Direct labor hours Number of setups Number of machine hours 1,500 30 3,900 Machine maintonance Next, sclect the formula to alocate overhead (OH) costs. Allocated mfg Print Done - overnead costs Compute the total activity-based costs alocated to Lo-Gain antennas, and then compute the cost per unit for Lo-Gain antennas. Finally, compute the total activity-based costs allocated to Hi-Gain antennas, then compute the cost per unit for H-Gain antennas Round the cost per unit to the nearest cent.)Solution

Requirement 1

Calculation of Predetermined Overhead Rate

(A) Total Manufacturing Overheads

$ 93,000.00

(B) Total Direct Labor Hours

2,500

(A/B) Predetermined Overhead Rate

$ 37.20

Product

Lo- Gain

Hi- Gain

(A) Labor Hours

1500

1000

(B) Predetermined Overhead rate

$ 37.20

$ 37.20

(A*B) Allocated Overheads

$ 55,800.00

$ 37,200.00

Calculation of Indirect Cost per Unit

Product

Lo- Gain

Hi- Gain

Allocated Overheads

$ 55,800.00

$ 37,200.00

Number of Units

150

350

Indirect Cost Per Unit

$ 372.00

$ 106.29

Requirement 2

Calculation of Predetermined over rate

Cost [A]

Total Activity Drivers [B]

Activity rate [A/B]

Setups

$ 57,000.00

60

$ 950.00

per Setup

Machine Maintenance

$ 36,000.00

6000

$ 6.00

Per Machine Hour

Total

$ 93,000.00

Allocation of Overheads

Cost pool

(A) Activity rate

(B) Activity Quantity Lo-gain

(A*B) Cost allocation Lo-Gain

(C ) Activity Quantity Hi-gain

(A*C) Cost allocation Hi-Gain

Setups

$ 950.00

30

$ 28,500.00

30

$ 28,500.00

Machine Maintenance

$ 6.00

3900

$ 23,400.00

2100

$ 12,600.00

Total Overhead allocated

$ 51,900.00

$ 41,100.00

Calculation of Indirect Cost per Unit

Product

Lo- Gain

Hi- Gain

Setups

$ 28,500.00

$ 28,500.00

Maintenance Cost

$ 23,400.00

$ 12,600.00

Total Activity based Cost

$ 51,900.00

$ 41,100.00

Number of Units

150

350

Indirect Cost Per Unit

$ 346.00

$ 117.43

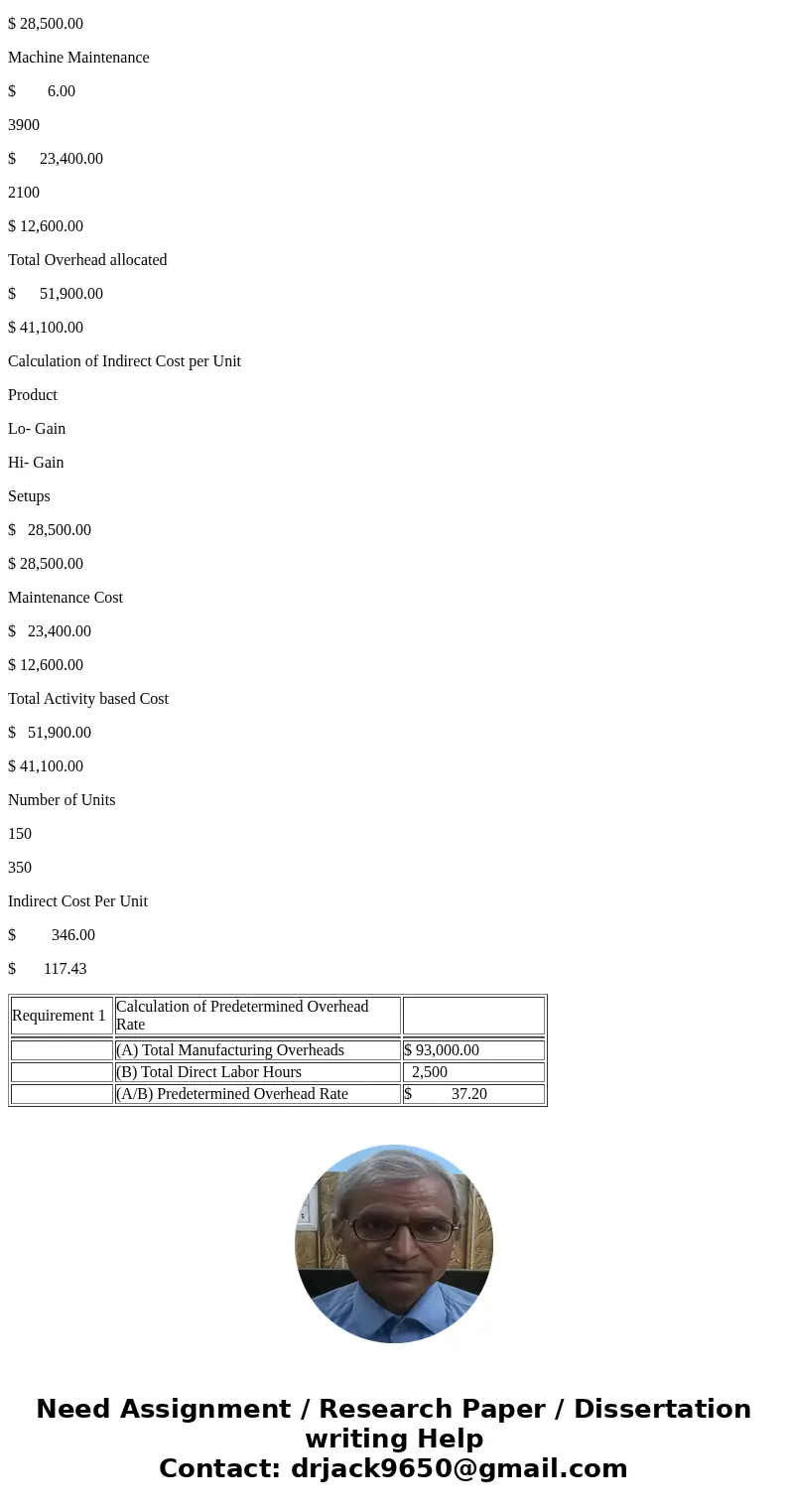

| Requirement 1 | Calculation of Predetermined Overhead Rate | |

| (A) Total Manufacturing Overheads | $ 93,000.00 | |

| (B) Total Direct Labor Hours | 2,500 | |

| (A/B) Predetermined Overhead Rate | $ 37.20 |

Homework Sourse

Homework Sourse