10 12 13 CCA Recapture Reduced alowace Terminal loss Capital

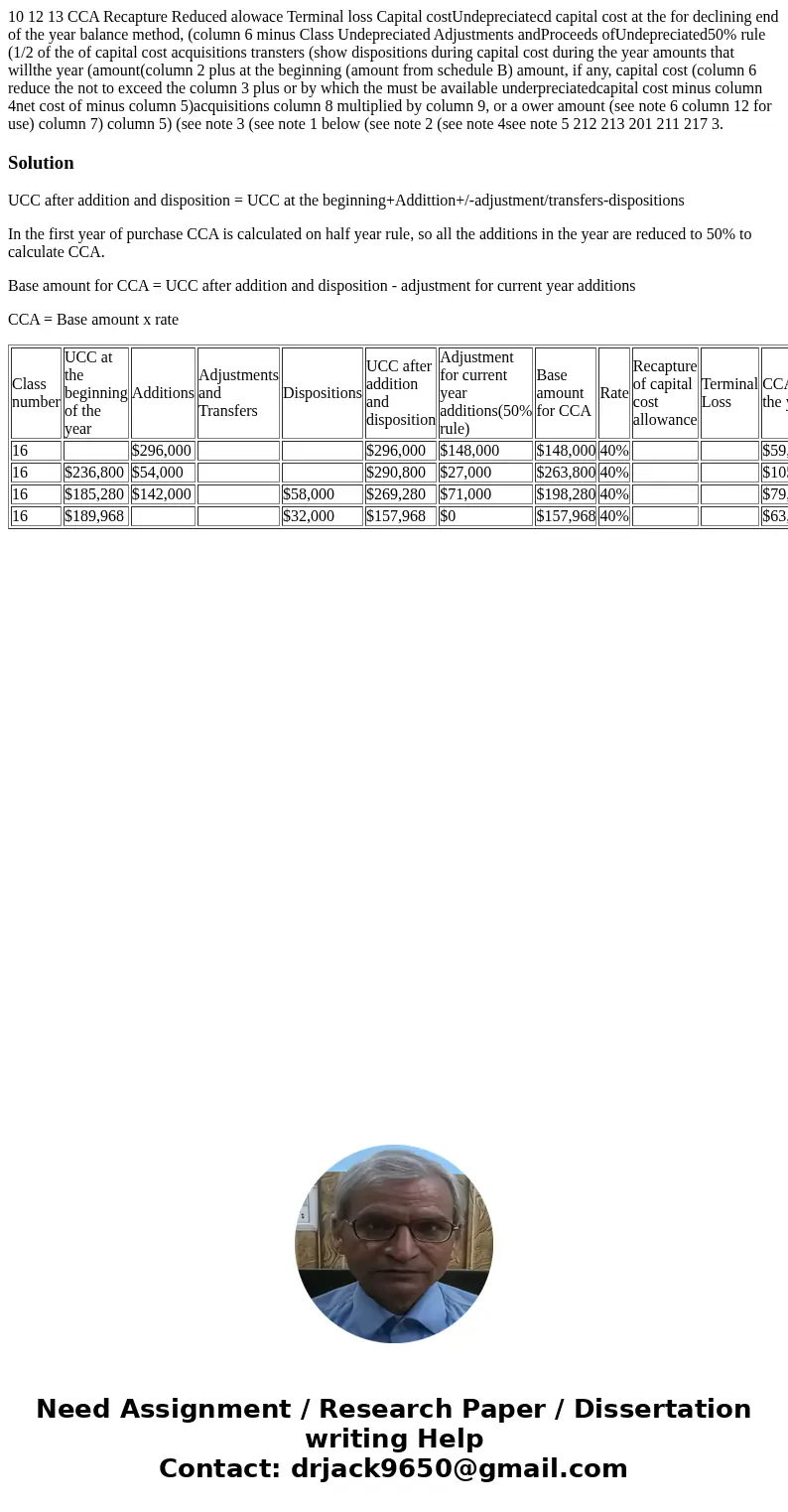

10 12 13 CCA Recapture Reduced alowace Terminal loss Capital costUndepreciatecd capital cost at the for declining end of the year balance method, (column 6 minus Class Undepreciated Adjustments andProceeds ofUndepreciated50% rule (1/2 of the of capital cost acquisitions transters (show dispositions during capital cost during the year amounts that willthe year (amount(column 2 plus at the beginning (amount from schedule B) amount, if any, capital cost (column 6 reduce the not to exceed the column 3 plus or by which the must be available underpreciatedcapital cost minus column 4net cost of minus column 5)acquisitions column 8 multiplied by column 9, or a ower amount (see note 6 column 12 for use) column 7) column 5) (see note 3 (see note 1 below (see note 2 (see note 4see note 5 212 213 201 211 217 3.

Solution

UCC after addition and disposition = UCC at the beginning+Addittion+/-adjustment/transfers-dispositions

In the first year of purchase CCA is calculated on half year rule, so all the additions in the year are reduced to 50% to calculate CCA.

Base amount for CCA = UCC after addition and disposition - adjustment for current year additions

CCA = Base amount x rate

| Class number | UCC at the beginning of the year | Additions | Adjustments and Transfers | Dispositions | UCC after addition and disposition | Adjustment for current year additions(50% rule) | Base amount for CCA | Rate | Recapture of capital cost allowance | Terminal Loss | CCA for the year | UCC at the end of the year |

| 16 | $296,000 | $296,000 | $148,000 | $148,000 | 40% | $59,200 | $236,800 | |||||

| 16 | $236,800 | $54,000 | $290,800 | $27,000 | $263,800 | 40% | $105,520 | $185,280 | ||||

| 16 | $185,280 | $142,000 | $58,000 | $269,280 | $71,000 | $198,280 | 40% | $79,312 | $189,968 | |||

| 16 | $189,968 | $32,000 | $157,968 | $0 | $157,968 | 40% | $63,187 | $94,781 |

Homework Sourse

Homework Sourse