Problem 117A Part Level Submission On January 1 2019 Larkspu

Problem 11-7A (Part Level Submission) On January 1, 2019, Larkspur, Inc. had the following stockholders\' equity accounts.

Common Stock ($10 par value, 78,300 shares issued and outstanding) $783,000

Paid-in Capital in Excess of Par Value-Common Stock 199,000

Retained Earnings 593,000

During the year, the following transactions occurred.

Jan. 15 Declared a $1.10 cash dividend per share to stockholders of record on January 31, payable

February 15. Feb. 15 Paid the dividend declared in January.

Apr. 15 Declared a 5% stock dividend to stockholders of record on April 30, distributable

May 15. On April 15, the market price of the stock was $16 per share. May 15 Issued the shares for the stock dividend.

July 1 Announced a 2-for-1 stock split. The market price per share prior to the announcement was $14. (The new par value is $5.)

Dec. 1 Declared a $0.50 per share cash dividend to stockholders of record on December 15, payable January 10, 2020.

Dec. 31 Determined that net income for the year was $225,000.

a)Journalize the transactions and the closing entries for net income and dividends.

FYI

| Jan. 15 | Cash Dividends | (78,300 × $1.10) | $86,130 |

| Apr. 15 | Stock Dividends | (3,915 × $16) | $62,640 |

| Common Stock Dividends Distributable | (3,915 × $10) | $39,150 | |

| Paid-in Capital in Excess of Par-Common Stock | (3,915 × $6) | $23,490 | |

| July 1 | Memo - two-for-one stock split increases number of shares to 164,430 | ||

| = (82,215 × 2) and reduces par value to $5 per share. | |||

| Dec. 1 | Cash Dividends | (164,430 × $0.50) | $82,215 |

| Dec. 31 | Retained Earnings | ($39,150 + $82,215) | $168,345 |

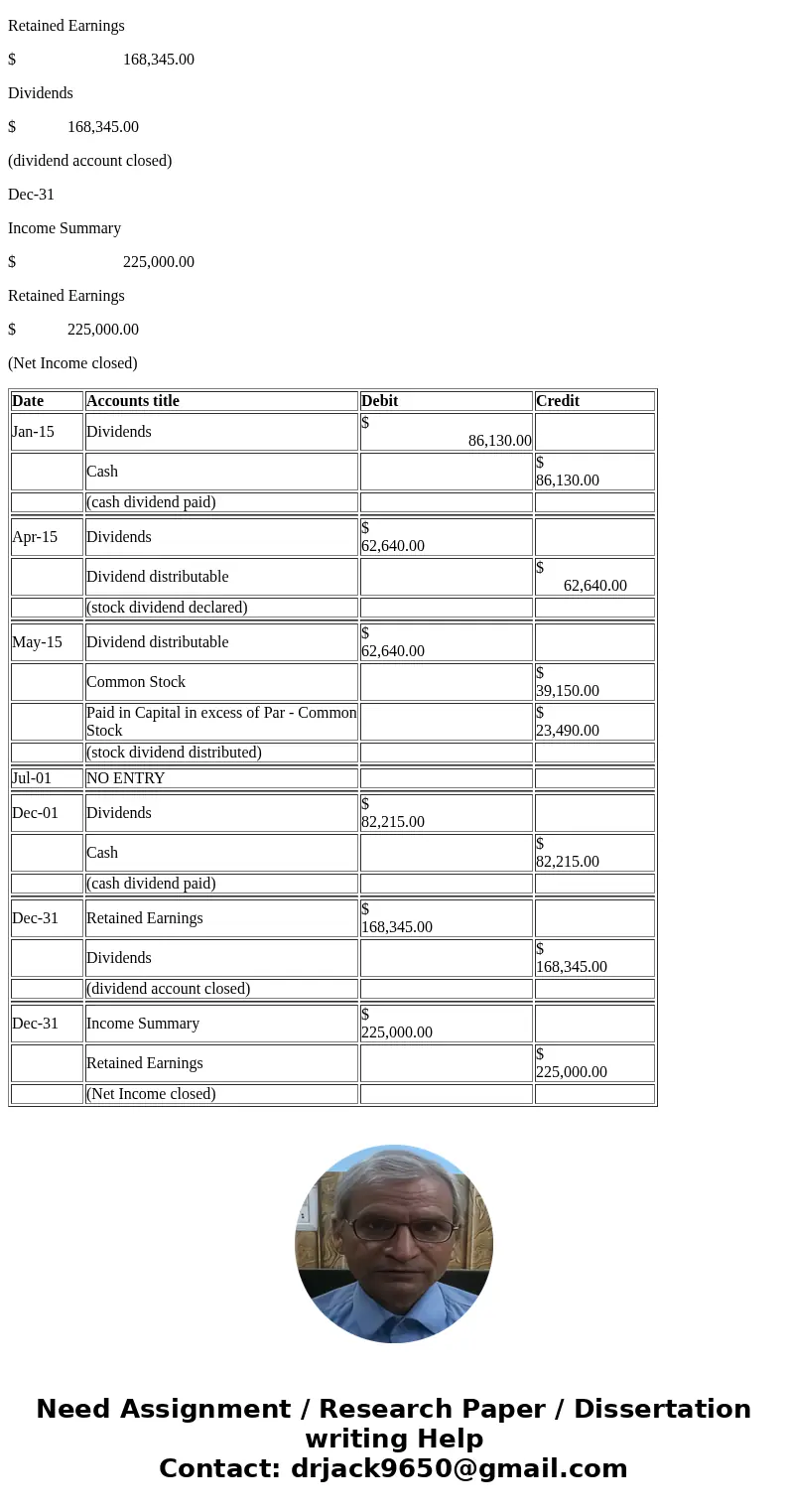

Solution

Answers

Date

Accounts title

Debit

Credit

Jan-15

Dividends

$ 86,130.00

Cash

$ 86,130.00

(cash dividend paid)

Apr-15

Dividends

$ 62,640.00

Dividend distributable

$ 62,640.00

(stock dividend declared)

May-15

Dividend distributable

$ 62,640.00

Common Stock

$ 39,150.00

Paid in Capital in excess of Par - Common Stock

$ 23,490.00

(stock dividend distributed)

Jul-01

NO ENTRY

Dec-01

Dividends

$ 82,215.00

Cash

$ 82,215.00

(cash dividend paid)

Dec-31

Retained Earnings

$ 168,345.00

Dividends

$ 168,345.00

(dividend account closed)

Dec-31

Income Summary

$ 225,000.00

Retained Earnings

$ 225,000.00

(Net Income closed)

| Date | Accounts title | Debit | Credit |

| Jan-15 | Dividends | $ 86,130.00 | |

| Cash | $ 86,130.00 | ||

| (cash dividend paid) | |||

| Apr-15 | Dividends | $ 62,640.00 | |

| Dividend distributable | $ 62,640.00 | ||

| (stock dividend declared) | |||

| May-15 | Dividend distributable | $ 62,640.00 | |

| Common Stock | $ 39,150.00 | ||

| Paid in Capital in excess of Par - Common Stock | $ 23,490.00 | ||

| (stock dividend distributed) | |||

| Jul-01 | NO ENTRY | ||

| Dec-01 | Dividends | $ 82,215.00 | |

| Cash | $ 82,215.00 | ||

| (cash dividend paid) | |||

| Dec-31 | Retained Earnings | $ 168,345.00 | |

| Dividends | $ 168,345.00 | ||

| (dividend account closed) | |||

| Dec-31 | Income Summary | $ 225,000.00 | |

| Retained Earnings | $ 225,000.00 | ||

| (Net Income closed) |

Homework Sourse

Homework Sourse