Nancy Tai has recently opened a revolving charge account wit

Nancy Tai has recently opened a revolving charge account with MasterCard. Her credit limit is $1,000, but she has not charged that much since opening the account. Nancy hasn’t had the time to review her monthly statements promptly as she should, but over the upcoming weekend she plans to catch up on her work. She has been putting it off because she can’t tell how much interest she paid or the unpaid balance in November. She spilled watercolor paint on that portion of the statement. In reviewing November’s statement she notices that her beginning balance was $600 and that she made a $200 payment on November 10. She also charged purchases of $80 on November 5, $100 on November 15, and $50 on November 30. She paid $5.27 in interest the month before. She does remember, though, seeing the letters APR and the number 16%. Also, the back of her statement indicates that interest was charged using the average daily balance method, including current purchases, which considers the day of a charge or credit. 1) Find the unpaid balance on November 30 before the interest is charged. _________________________________________________________________________________________ 5) Assuming a 30-day period in November find the average daily balance. _________________________________________________________________________________________ 6) Calculate the interest for November. _________________________________________________________________________________________ 7) What was the unpaid balance for November after interest is charged? _________________________________________________________________________________________

Nancy Tai has recently opened a revolving charge account with MasterCard. Her credit limit is $1,000, but she has not charged that much since opening the account. Nancy hasn’t had the time to review her monthly statements promptly as she should, but over the upcoming weekend she plans to catch up on her work. She has been putting it off because she can’t tell how much interest she paid or the unpaid balance in November. She spilled watercolor paint on that portion of the statement. In reviewing November’s statement she notices that her beginning balance was $600 and that she made a $200 payment on November 10. She also charged purchases of $80 on November 5, $100 on November 15, and $50 on November 30. She paid $5.27 in interest the month before. She does remember, though, seeing the letters APR and the number 16%. Also, the back of her statement indicates that interest was charged using the average daily balance method, including current purchases, which considers the day of a charge or credit. 1) Find the unpaid balance on November 30 before the interest is charged. _________________________________________________________________________________________ 5) Assuming a 30-day period in November find the average daily balance. _________________________________________________________________________________________ 6) Calculate the interest for November. _________________________________________________________________________________________ 7) What was the unpaid balance for November after interest is charged? _________________________________________________________________________________________

Nancy Tai has recently opened a revolving charge account with MasterCard. Her credit limit is $1,000, but she has not charged that much since opening the account. Nancy hasn’t had the time to review her monthly statements promptly as she should, but over the upcoming weekend she plans to catch up on her work. She has been putting it off because she can’t tell how much interest she paid or the unpaid balance in November. She spilled watercolor paint on that portion of the statement. In reviewing November’s statement she notices that her beginning balance was $600 and that she made a $200 payment on November 10. She also charged purchases of $80 on November 5, $100 on November 15, and $50 on November 30. She paid $5.27 in interest the month before. She does remember, though, seeing the letters APR and the number 16%. Also, the back of her statement indicates that interest was charged using the average daily balance method, including current purchases, which considers the day of a charge or credit. 1) Find the unpaid balance on November 30 before the interest is charged. _________________________________________________________________________________________ 5) Assuming a 30-day period in November find the average daily balance. _________________________________________________________________________________________ 6) Calculate the interest for November. _________________________________________________________________________________________ 7) What was the unpaid balance for November after interest is charged? _________________________________________________________________________________________

Solution

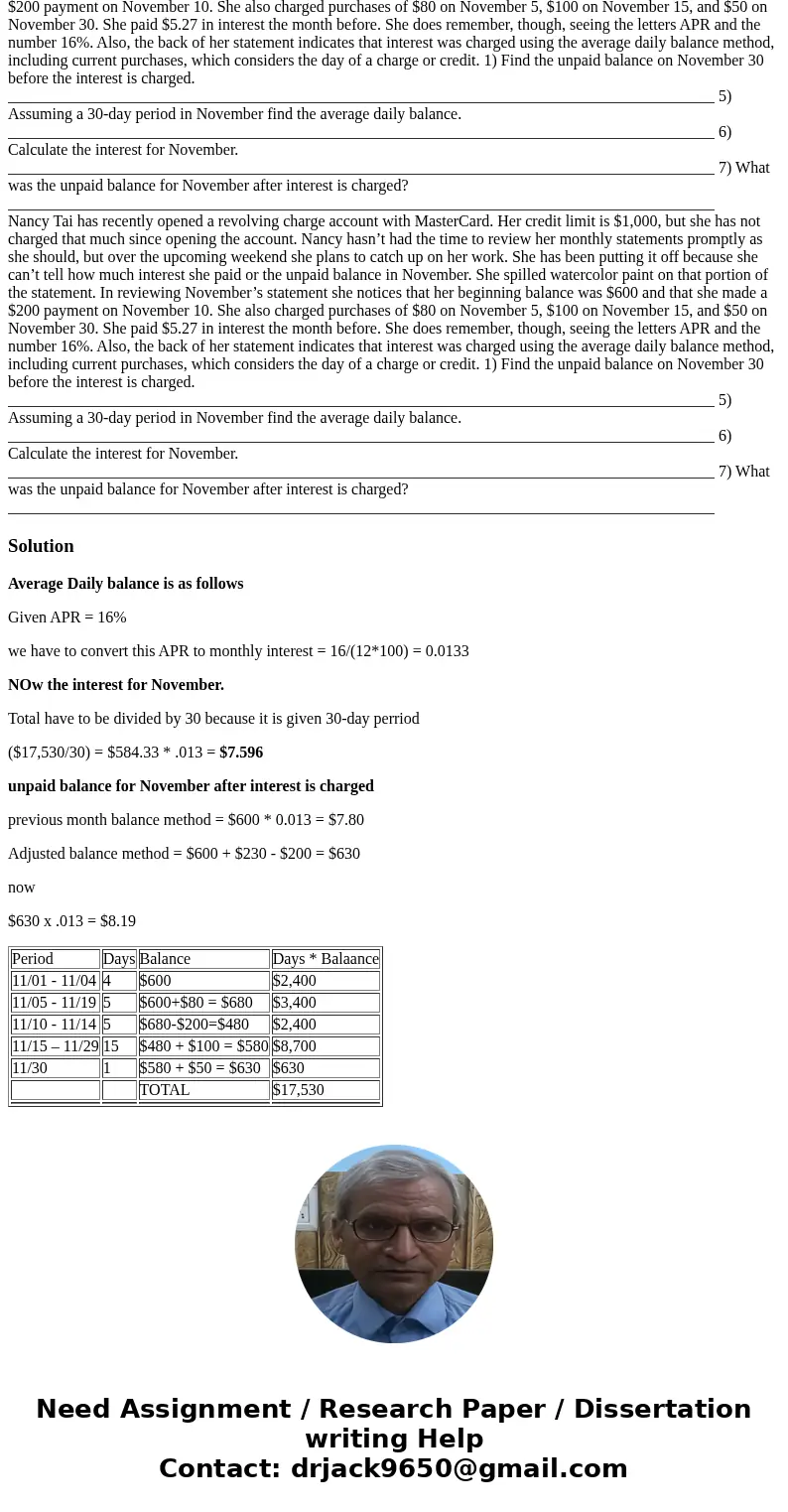

Average Daily balance is as follows

Given APR = 16%

we have to convert this APR to monthly interest = 16/(12*100) = 0.0133

NOw the interest for November.

Total have to be divided by 30 because it is given 30-day perriod

($17,530/30) = $584.33 * .013 = $7.596

unpaid balance for November after interest is charged

previous month balance method = $600 * 0.013 = $7.80

Adjusted balance method = $600 + $230 - $200 = $630

now

$630 x .013 = $8.19

| Period | Days | Balance | Days * Balaance |

| 11/01 - 11/04 | 4 | $600 | $2,400 |

| 11/05 - 11/19 | 5 | $600+$80 = $680 | $3,400 |

| 11/10 - 11/14 | 5 | $680-$200=$480 | $2,400 |

| 11/15 – 11/29 | 15 | $480 + $100 = $580 | $8,700 |

| 11/30 | 1 | $580 + $50 = $630 | $630 |

| TOTAL | $17,530 | ||

Homework Sourse

Homework Sourse