Chrome CengageNOWv2 Online teaching and learning resource fr

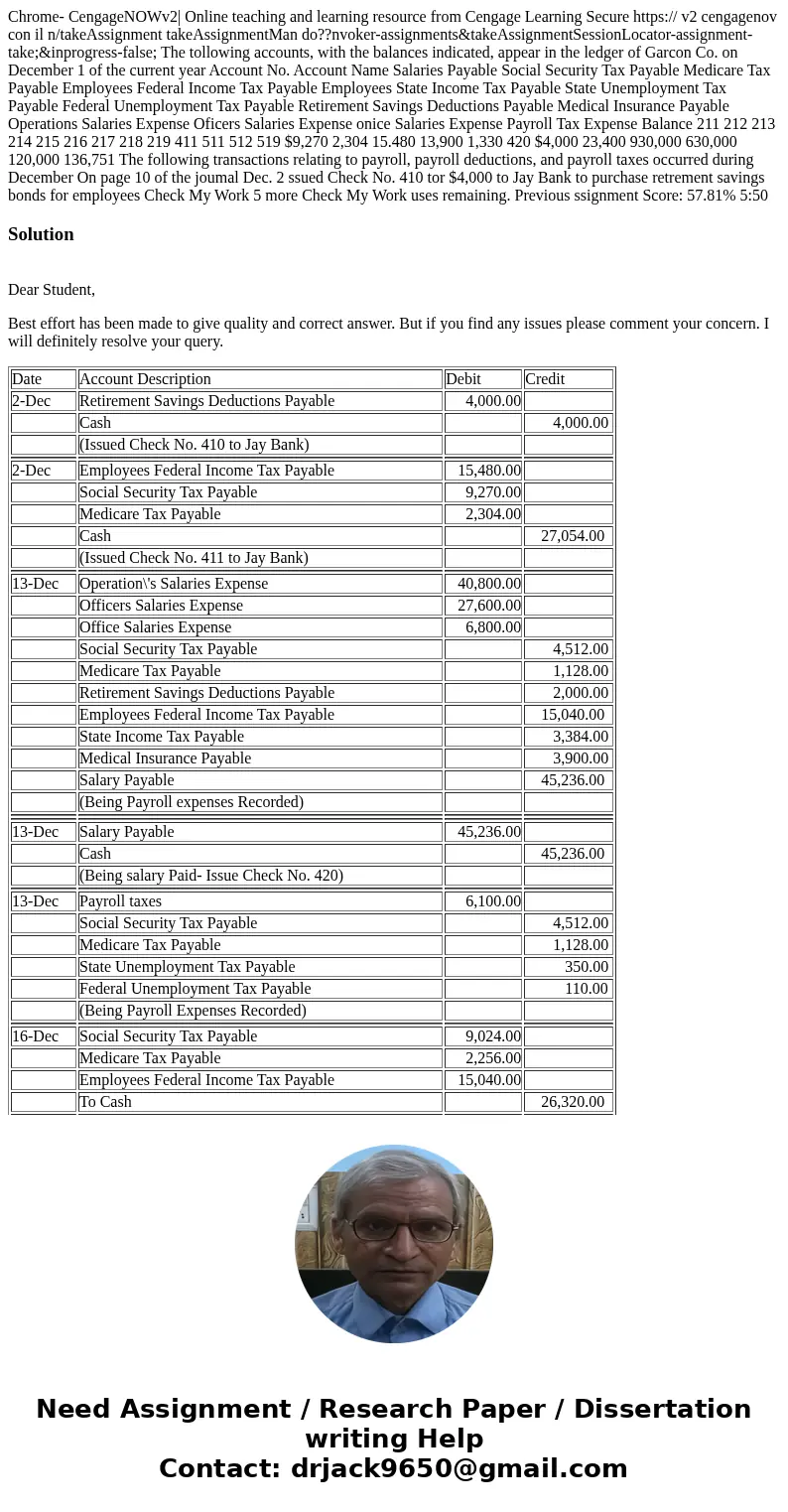

Chrome- CengageNOWv2| Online teaching and learning resource from Cengage Learning Secure https:// v2 cengagenov con il n/takeAssignment takeAssignmentMan do??nvoker-assignments&takeAssignmentSessionLocator-assignment-take;&inprogress-false; The tollowing accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year Account No. Account Name Salaries Payable Social Security Tax Payable Medicare Tax Payable Employees Federal Income Tax Payable Employees State Income Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable Retirement Savings Deductions Payable Medical Insurance Payable Operations Salaries Expense Oficers Salaries Expense onice Salaries Expense Payroll Tax Expense Balance 211 212 213 214 215 216 217 218 219 411 511 512 519 $9,270 2,304 15.480 13,900 1,330 420 $4,000 23,400 930,000 630,000 120,000 136,751 The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December On page 10 of the joumal Dec. 2 ssued Check No. 410 tor $4,000 to Jay Bank to purchase retrement savings bonds for employees Check My Work 5 more Check My Work uses remaining. Previous ssignment Score: 57.81% 5:50

Solution

Dear Student,

Best effort has been made to give quality and correct answer. But if you find any issues please comment your concern. I will definitely resolve your query.

| Date | Account Description | Debit | Credit |

| 2-Dec | Retirement Savings Deductions Payable | 4,000.00 | |

| Cash | 4,000.00 | ||

| (Issued Check No. 410 to Jay Bank) | |||

| 2-Dec | Employees Federal Income Tax Payable | 15,480.00 | |

| Social Security Tax Payable | 9,270.00 | ||

| Medicare Tax Payable | 2,304.00 | ||

| Cash | 27,054.00 | ||

| (Issued Check No. 411 to Jay Bank) | |||

| 13-Dec | Operation\'s Salaries Expense | 40,800.00 | |

| Officers Salaries Expense | 27,600.00 | ||

| Office Salaries Expense | 6,800.00 | ||

| Social Security Tax Payable | 4,512.00 | ||

| Medicare Tax Payable | 1,128.00 | ||

| Retirement Savings Deductions Payable | 2,000.00 | ||

| Employees Federal Income Tax Payable | 15,040.00 | ||

| State Income Tax Payable | 3,384.00 | ||

| Medical Insurance Payable | 3,900.00 | ||

| Salary Payable | 45,236.00 | ||

| (Being Payroll expenses Recorded) | |||

| 13-Dec | Salary Payable | 45,236.00 | |

| Cash | 45,236.00 | ||

| (Being salary Paid- Issue Check No. 420) | |||

| 13-Dec | Payroll taxes | 6,100.00 | |

| Social Security Tax Payable | 4,512.00 | ||

| Medicare Tax Payable | 1,128.00 | ||

| State Unemployment Tax Payable | 350.00 | ||

| Federal Unemployment Tax Payable | 110.00 | ||

| (Being Payroll Expenses Recorded) | |||

| 16-Dec | Social Security Tax Payable | 9,024.00 | |

| Medicare Tax Payable | 2,256.00 | ||

| Employees Federal Income Tax Payable | 15,040.00 | ||

| To Cash | 26,320.00 | ||

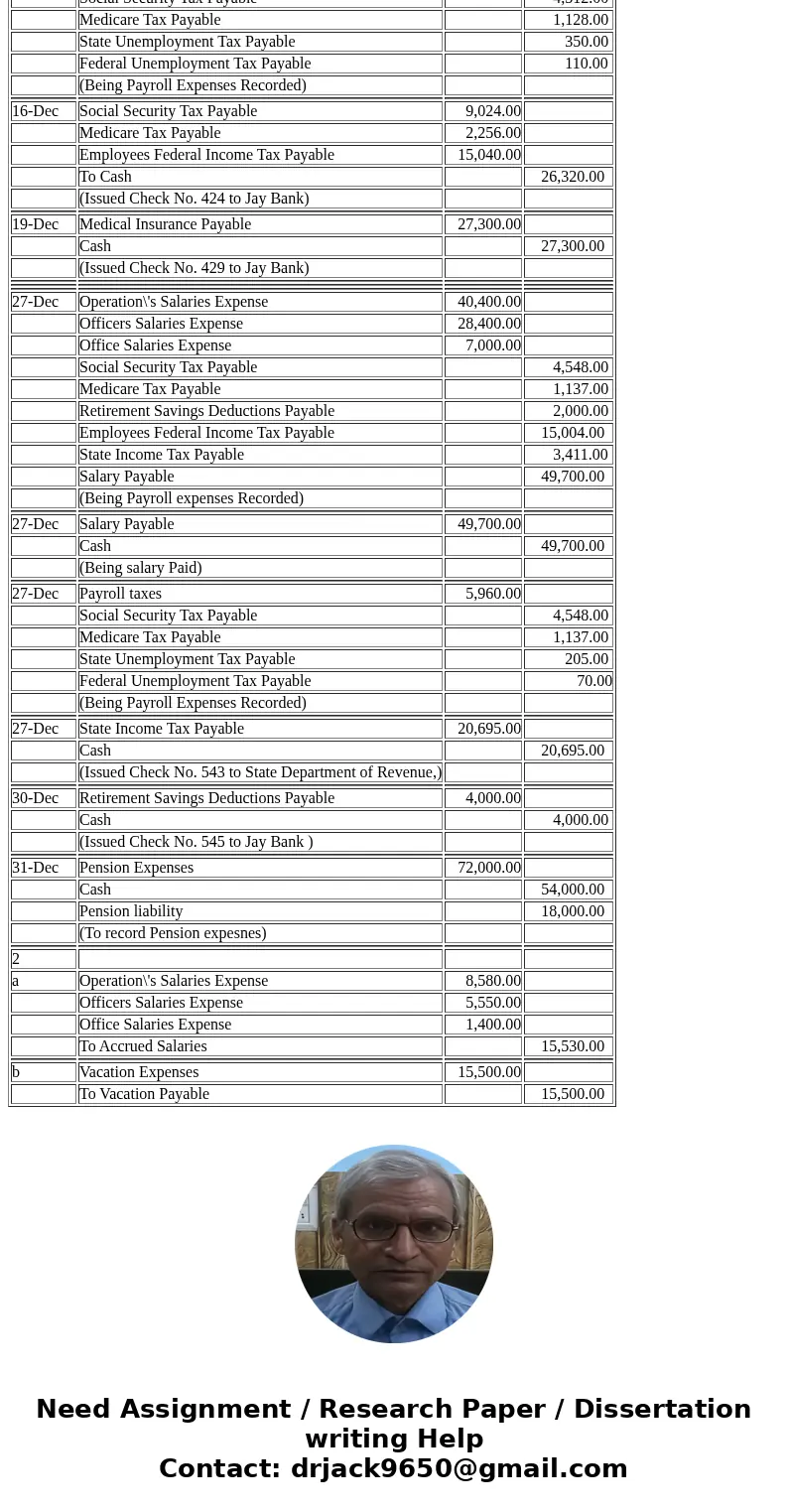

| (Issued Check No. 424 to Jay Bank) | |||

| 19-Dec | Medical Insurance Payable | 27,300.00 | |

| Cash | 27,300.00 | ||

| (Issued Check No. 429 to Jay Bank) | |||

| 27-Dec | Operation\'s Salaries Expense | 40,400.00 | |

| Officers Salaries Expense | 28,400.00 | ||

| Office Salaries Expense | 7,000.00 | ||

| Social Security Tax Payable | 4,548.00 | ||

| Medicare Tax Payable | 1,137.00 | ||

| Retirement Savings Deductions Payable | 2,000.00 | ||

| Employees Federal Income Tax Payable | 15,004.00 | ||

| State Income Tax Payable | 3,411.00 | ||

| Salary Payable | 49,700.00 | ||

| (Being Payroll expenses Recorded) | |||

| 27-Dec | Salary Payable | 49,700.00 | |

| Cash | 49,700.00 | ||

| (Being salary Paid) | |||

| 27-Dec | Payroll taxes | 5,960.00 | |

| Social Security Tax Payable | 4,548.00 | ||

| Medicare Tax Payable | 1,137.00 | ||

| State Unemployment Tax Payable | 205.00 | ||

| Federal Unemployment Tax Payable | 70.00 | ||

| (Being Payroll Expenses Recorded) | |||

| 27-Dec | State Income Tax Payable | 20,695.00 | |

| Cash | 20,695.00 | ||

| (Issued Check No. 543 to State Department of Revenue,) | |||

| 30-Dec | Retirement Savings Deductions Payable | 4,000.00 | |

| Cash | 4,000.00 | ||

| (Issued Check No. 545 to Jay Bank ) | |||

| 31-Dec | Pension Expenses | 72,000.00 | |

| Cash | 54,000.00 | ||

| Pension liability | 18,000.00 | ||

| (To record Pension expesnes) | |||

| 2 | |||

| a | Operation\'s Salaries Expense | 8,580.00 | |

| Officers Salaries Expense | 5,550.00 | ||

| Office Salaries Expense | 1,400.00 | ||

| To Accrued Salaries | 15,530.00 | ||

| b | Vacation Expenses | 15,500.00 | |

| To Vacation Payable | 15,500.00 |

Homework Sourse

Homework Sourse